1-year anniversaries for Crypto.com and Meta Platforms, plus the Fed's preferred inflation measure, America's fast food chains, and the week in review

The Sandbox Daily (10.28.2022)

Welcome, Sandbox friends.

Today’s Daily discusses the unceremonious one-year anniversaries of specific events from Crypto.com and Meta Platforms, the September Personal Consumption Expenditures (PCE) report, America’s fast food chains, and a brief recap to snapshot the week in markets.

And yes, Elon Musk finally owns Twitter, closing the $44 billion transaction to take $TWTR private. Chief Twit.

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 +3.17% | Dow +2.59% | S&P 500 +2.46% | Russell 2000 +2.25%

FIXED INCOME: Barclays Agg Bond -0.25% | High Yield +0.77% | 2yr UST 4.416% | 10yr UST 4.014%

COMMODITIES: Brent Crude -0.72% to $96.03/barrel. Gold -1.25% to $1,647.7/oz.

BITCOIN: +1.70% to $20,639

US DOLLAR INDEX: +0.11% to 110.679

CBOE EQUITY PUT/CALL RATIO: 0.85

VIX: -5.99% to 25.75

Unceremonious one-year anniversaries

Matt Damon’s infamous “fortune favors the brave” Crypto.com commercial premiered one year ago today on October 28, 2021, and its timing couldn’t have been worse.

Bitcoin is down -65.42% since the commercial rolled out (then $60,608, today $20,639), and the company reportedly slashed about 40% of its workforce this summer. Ouch!!

October 28, 2021 was also the same day that Facebook (FB) announced it would rebrand itself and change its corporate name to Meta Platforms (META) to align / pivot its ambitions to development of the metaverse.

Unfortunately, Meta reported a revenue decline of -4% YoY just this week, a decline and first ever drop in its daily average users (as reported in February), and perhaps worst of all, announced 2022 total expenses to be in the range of $85 billion to $87 billion and 2023 total expenses to be between $96 billion and $101 billion. The market rejected each of these developments vociferously and, as a result, the company has shed roughly $700 billion of market capitalization with the stock down -68.9% over the last year. Another ouch!!

Source: Finance in Bold, CNBC

Core PCE inflation picks up while consumers show resilience

The Personal Consumption Expenditures price index (PCE), an economic gauge that the Federal Reserve follows closely, showed that inflation stayed strong in September but mostly within expectations, rising +0.3% from the previous month and is up +6.2% YoY. Excluding the more volatile food and energy categories, Core PCE increased +0.5% MoM and +5.1% YoY.

Purchases of goods and services increased +0.6%, but when adjusted for inflation, personal spending rose +0.3%.

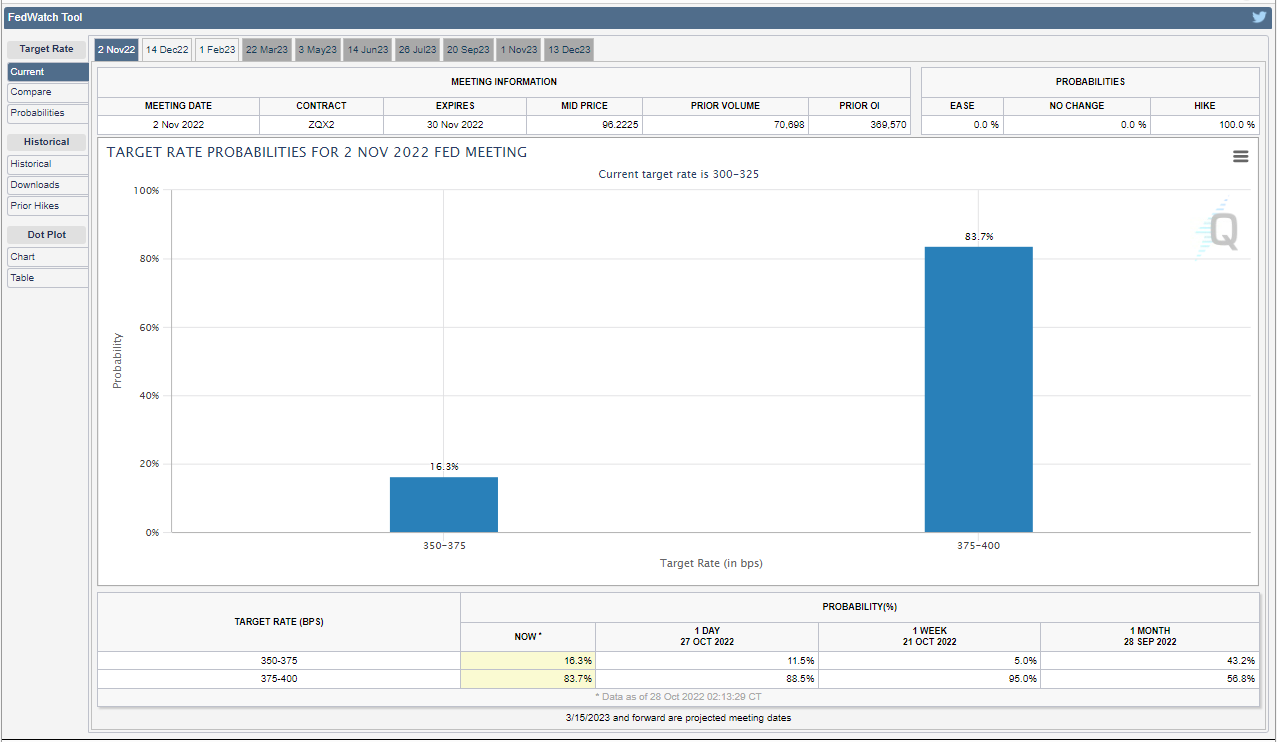

The report comes as the Fed is prepared to enact its 6th interest rate increase of the year at its policy meeting next week, where the market is pricing in a 4th consecutive 75 bps interest rate hike to take the target range to 3.75%-4.00%. In an effort to combat inflation running at its fastest pace in nearly 40 years, the Fed has been raising rates, with increases totaling 3.00% thus far.

Inflation pressures peaked in Q1 but have moderated only slightly since then, despite aggressive Fed tightening this year. Core inflation is currently running hotter than both its near-term and long-term trends, showing limited progress toward the Fed’s 2.0% target. Nevertheless, given evidence of weak domestic demand in the Q3 GDP report, and accounting for the delayed impact of Fed rate hikes on the real economy, some are now expecting the Fed to downshift to a less restrictive monetary policy path going forward.

Source: Ned Davis Research, Bloomberg, CNBC

America’s fast food chains

Fast food is big business in America. From national chains to regional specialties, the industry was worth $331.4 billion as of June 2022.

Each year, QSR Magazine puts together a report that ranks America’s top 50 fast food chains. It uses a number of metrics to determine this, including total sales, average-unit volume (AUVs), and growth figure. For today, here are the top 50 chains by number of restaurants they each have across America – with Subway topping the list with over 21,000 restaurants across the country.

Source: Visual Capitalist

The week in review

Stocks: Stocks finished higher as Q3 earnings, so far, have come in better-than-feared by market participants and overcoming disastrous results from the tech titans of Silicon Valley. So far, with help from upside surprises in the energy space, S&P 500 earnings are now tracking to a more than 2% year-on-year increase.

Bonds: The Bloomberg Aggregate Bond Index finished the week higher as yields declined as some traders believe that the Federal Reserve’s rate-tightening pace will soon moderate. High-yield corporate bonds, as tracked by the Bloomberg High Yield index, gained ground for the week, mirroring their equity counterparts.

Commodities: Both oil and natural gas prices finished the week higher. Many commodity analysts have noted that 2022 has seen much volatility for natural gas prices. The U.S. market for natural gas has shifted from concerns about tight supplies amid the geopolitical landscape now to the potential for lower heating fuel demand given warmer weather forecasts. The major metals, gold and silver, finished lower this week even as some traders see a possibility for less aggressive Fed rate hikes.

Source: LPL Research

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.