12 out of 10: Trump scores several rare earths deals

The Sandbox Daily (10.30.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

rare earths

Let’s dig in.

Blake

Markets in review

EQUITIES: Dow -0.23% | Russell 2000 -0.76% | S&P 500 -0.99% | Nasdaq 100 -1.47%

FIXED INCOME: Barclays Agg Bond -0.19% | High Yield -0.19% | 2yr UST 3.608% | 10yr UST 4.097%

COMMODITIES: Brent Crude -0.32% to $64.71/barrel. Gold +0.96% to $4,039.9/oz.

BITCOIN: -3.61% to $107,548

US DOLLAR INDEX: +0.31% to 99.529

CBOE TOTAL PUT/CALL RATIO: 0.78

VIX: -0.06% to 16.91

Quote of the day

“Know your circle of competence and stick within it. The size of that circle is not very important; knowing its boundaries, however, is vital.”

-Warren Buffett

12 out of 10

President Trump’s recent overseas trip to Asia underscores the growing strategic importance of “rare earths,” the group of metals critical to everything from smartphones to fighter jets.

Trump signed a series of deals this week with Japan, Malaysia, Thailand, Vietnam, and Cambodia aimed at diversifying supply away from China.

And, in his much-anticipated summit with Xi Jinping, China agreed to defer new export curbs on rare earths – a move Trump described as lifting a “road-block” to U.S. industry. Trump told reporters on Air Force One: “On a scale from zero to 10, with 10 being the best, I would say the meeting was a 12.”

Great, lots of deals securing America’s future, but let’s back up for one minute.

What are these rare earth elements?

Rare earths are a group of 17 heavy metals that are abundant throughout the Earth’s crust. These include metals like neodymium, dysprosium, terbium, and many others you and I have never heard of.

They are a specific, highly useful category of critical minerals. Their unique magnetic, conductive, and luminescent properties make them indispensable for clean energy technologies (wind turbines, EV motors), consumer electronics (smartphones, lasers), and defense systems (jet engines, precision-guided missiles).

In simple terms, these are essential minerals for modern tech.

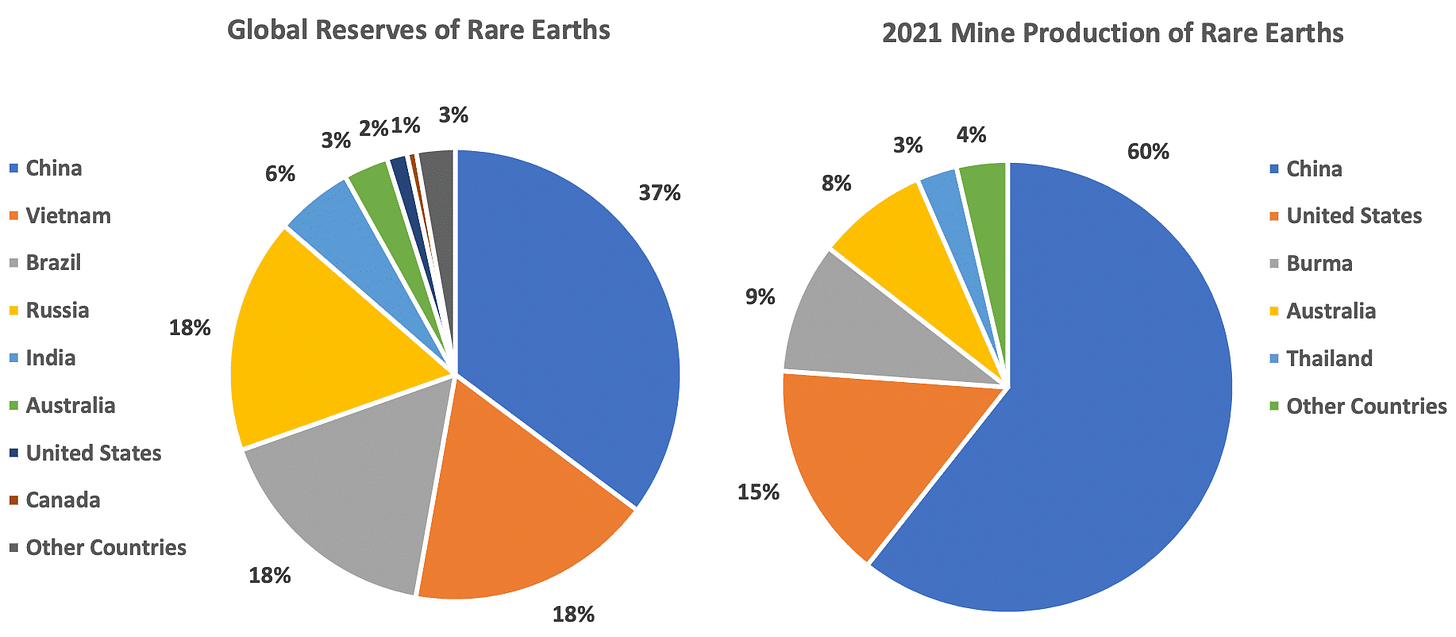

The U.S. Geological Survey estimated in 2024 there were 110 million metric tons of deposits worldwide. China holds the largest share of these reserves, estimated at 44 million metric tons.

From the 1960s to the early 90s, the United States dominated global production of rare earths thanks to its Mountain Pass Mine in California, providing as much as 70% of the world’s supply. But, following a myriad of environmental/legal issues domestically, China scaled up rapidly and gradually undercut U.S. market share through cheaper labor and fewer environmental restrictions.

Today, China controls roughly 90% of global refining capacity and over between 60-70% of mining output.

That dominance gives Beijing a powerful lever in global supply chains. With China able to choke off key inputs, the U.S. sees rare earths as a material vulnerability.

In response, the U.S. is ramping up efforts under the strategic initiative of national security: domestic mines and refiners are being supported, export controls and price-floors are being introduced, and partnerships with allies like Australia are being secured.

For investors, the takeaway is clear: capital is moving toward the materials and infrastructure that power modern technology – from miners to processing and logistics firms.

Slowing dependence on China may take years and cost more but the alternative is deeper exposure to a single dominant supplier.

Sources: AP, CNBC, New York Times, JP Morgan

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)