13F filings and Michael Burry, plus Bitcoin, U.S. total debt surpasses $17 trillion, retail sales, and the worse investment decision of all time

The Sandbox Daily (5.16.2023)

Welcome, Sandbox friends.

Today’s Daily discusses:

13F filings for Q1 and an important lesson from Michael Burry

Bitcoin forms a top

total U.S. debt surpasses $17 trillion dollars

Retail Sales rise in April but miss expectations

the worst investment decision of all time

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 +0.09% | S&P 500 -0.64% | Dow -1.01% | Russell 2000 -1.44%

FIXED INCOME: Barclays Agg Bond -0.23% | High Yield -0.70% | 2yr UST 4.076% | 10yr UST 3.538%

COMMODITIES: Brent Crude -0.84% to $74.60/barrel. Gold -1.45% to $1,993.3/oz.

BITCOIN: -1.61% to $26,957

US DOLLAR INDEX: +0.19% to 102.627

CBOE EQUITY PUT/CALL RATIO: 0.56

VIX: +5.08% to 17.99

Quote of the day

“It is remarkable how much long-term advantage people like us have gotten by trying to be consistently not stupid, instead of trying to be very intelligent.”

- Charlie Munger, Berkshire Hathaway

An important lesson to learn from Michael Burry

Yesterday saw the release of the latest 13F disclosures, a big day in the investor community.

The Securities and Exchange Commission (SEC) Form 13F is a quarterly report that is required to be filed by all institutional investment managers with at least $100 million in assets under management (AUM).

These filings provide insight into what the “smart money” is doing in the market, although the holdings are dated as of the most recent quarter end – so not exactly timely or actionable or even still relevant.

Of particular interest for me – beyond what Bill Ackman (Pershing), David Einhorn (Greenlight), David Tepper (Appaloosa), and the rest of the power investors were buying/selling and holding in 1Q23 – was what Michael Burry was doing.

Michael Burry was the Christian Bale character from The Big Short who famously bet against the United State housing market and benefitted handsomely doing so. Michael Burry is a famed short seller – right or wrong – gets a lot of attention when he speaks and makes trades.

Here is what Michael Burry tweeted to the public on January 31st, receiving 2 million views on just the 1st day:

“Sell.”

And what was Michael doing behind the scenes? Buying stocks, of course! Michael’s firm, Scion Capital, went on its biggest buying spree in years, adding to his existing Chinese exposure (JD and Alibaba), starting new positions across a few energy names, and building lots of positions across financials. Here is the 13F showing Scion’s holdings as of March 31st:

There’s a very important lesson here. Everyone has their own risk tolerance, return objectives, time horizon, agenda, opinion on markets, and ability to trade markets. None of that matters to you. What someone else is buying/selling should have no bearing on how you manage your own portfolio. And worst of all, when you listen to talking pundits and big money managers on CNBC, they can say one thing and do another/change their mind in a moment’s notice. They don’t have to check in on you. So best practice is to listen and mostly ignore it, because it has nothing to do with your financial plan, goals, and situation.

Source: Securities and Exchange Commission, ZeroHedge, Investopedia

Bitcoin forms a top

When it comes to cryptocurrencies, Bitcoin (BTC) has been carving out a head and shoulders formation since mid-March - bearish techincal pattern. Fast forward to today, and it’s threatening to breach the lower bounds of the pattern.

This topping formation would form a decisive downside resolution below the pivot lows at approximately $26,700.

If Bitcoin violates its support level at these recent lows, the path of least resistance would turn downward over the short term. If and when this pattern completes, watch the February highs around $25,000 as the first line of support.

Source: All Star Charts

Total U.S. debt surpasses $17 trillion dollars

Total consumer debt surpassed $17 trillion for the very first time, according to the latest Quarterly Report on Household Debt and Credit from the New York Fed.

Mortgage balances climbed by $121 billion and stood at $12.04 trillion at the end of March. Auto loan and student loan balances also increased to $1.56 trillion and $1.60 trillion, respectively, but credit card balances were flat at $986 billion.

Since the pre-pandemic era in 2019, the debt load has increased by $2.9 trillion, $148 billion (or 0.9%) of which came between January and March 2023.

Elsewhere, credit card and auto loan delinquencies are ticking up across the board.

Signs of economic stress are flaring up especially for young adults aged 18-39.

Here are credit card broken out by age bracket for loans transitioning into serious delinquency (90+ days):

And here are auto loans transitioning into serious delinquency (90+ days):

Bottom line, Americans’ debt levels continue to climb to new heights at a time when economic conditions are becoming increasingly less stable. The refinancing boom over the last few years should make for a stable housing market, but it will be worth watching delinquencies across other loan categories in the coming quarters.

Source: Federal Reserve Bank of New York

Retail Sales rise in April but miss expectations

Retail Sales rose last month for the 1st time since January, a sign of consumers’ continued resilience despite high inflation and rising interest rates.

The Commerce Department said April’s Retail Sales – an economic measure of spending in stores, online, and restaurants to track consumer demand – increased +0.4%, only half the expected advance by economists. The year-over-year gain of 1.6% is the slowest annual growth pace since July 2020.

“Consumer spending is not about to contract and will instead support at least modest continued economic growth,” said Andrew Hollenhorst, chief U.S. economist at Citi.

Consumer spending is the primary driver of U.S. economic growth. This report provides more evidence of a slowdown in economic activity following last week's cooler inflation readings.

Source: Ned Davis Research, Bloomberg

The worst investment decision of all time

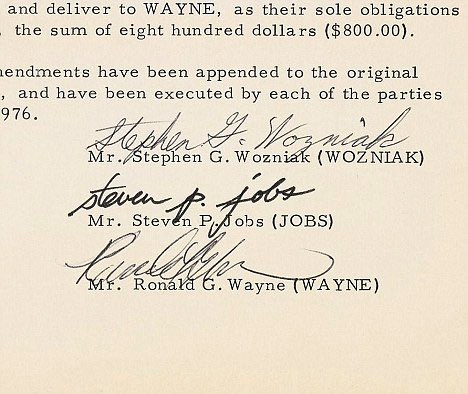

Apple's 3rd co-founder, Ronald Wayne, sold his 10% stake of Apple for $800 in 1976.

I'd never heard of Apple's third co-founder, so I did some digging. It's not surprising that nobody's heard of him, as he sold his stake only 12 days after the company was formed.

Wayne is still alive at age 88, though he "was compelled to sell his house and retire to a mobile home park in Pahrump, Nevada" after he was robbed of his life's savings in 2004.

Source: World of History, Wikipedia

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.