2026 midterms handbook

The Sandbox Daily (2.17.2026)

Welcome, Sandbox friends.

Today’s Daily discusses:

2026 midterm election handbook

Let’s dig in.

Blake

Markets in review

EQUITIES: S&P 500 +0.10% | Dow +0.07% | Russell 2000 0.00% | Nasdaq 100 -0.13%

FIXED INCOME: Barclays Agg Bond +0.01% | High Yield -0.05% | 2yr UST 3.435% | 10yr UST 4.058%

COMMODITIES: Brent Crude -0.63% to $67.32/barrel. Gold -2.91% to $4,899.3/oz.

BITCOIN: -1.49% to $67,509

US DOLLAR INDEX: +0.23% to 97.140

CBOE TOTAL PUT/CALL RATIO: 0.88

VIX: -4.29% to 20.29

Quote of the day

“The greatest prison people live in is the fear of what other people think.”

- David Icke

2026 midterm election handbook

Midterm elections are notoriously challenging for a few reasons.

Politically, voters have turned against the party in power. Pundits explain the poor performance on a failure to deliver on campaign promises or the public’s general dissatisfaction with whomever is occupying the White House.

From an investing lens, the stock market tends to perform poorly for two main reasons.

One reason is uncertainty around policy changes should control of one or both chambers of Congress flip to the other party. Another reason markets often struggle during midterms is because the economic stimulus added around the prior presidential election tends to fade, leading to tighter fiscal policy early in the midterm year.

President Trump is attempting to buck historical trends through a series of policy initiatives. Whether they will be successful politically and economically should play a big role in how markets perform over the coming months.

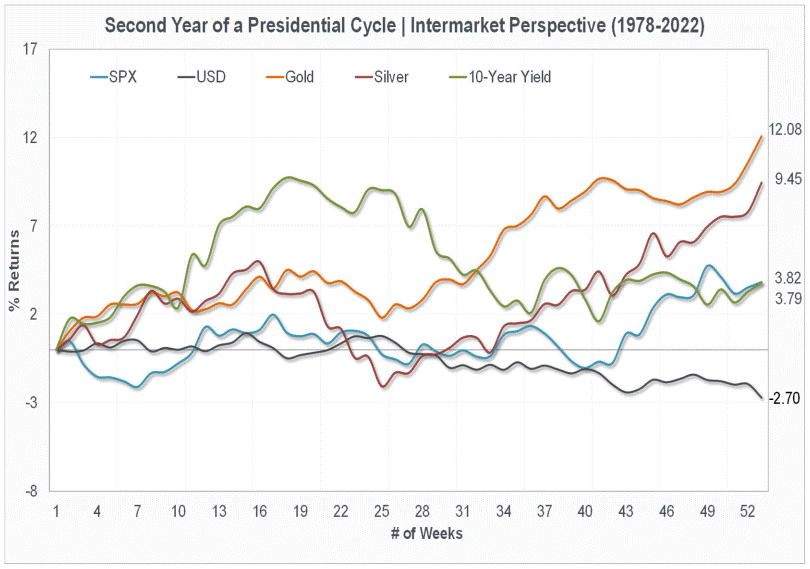

Historically, midterm years have tended to be the weakest of the four-year Presidential cycle for stocks, with the S&P 500 averaging just a meager 3-4% gain. Gold has often outperformed other asset classes.

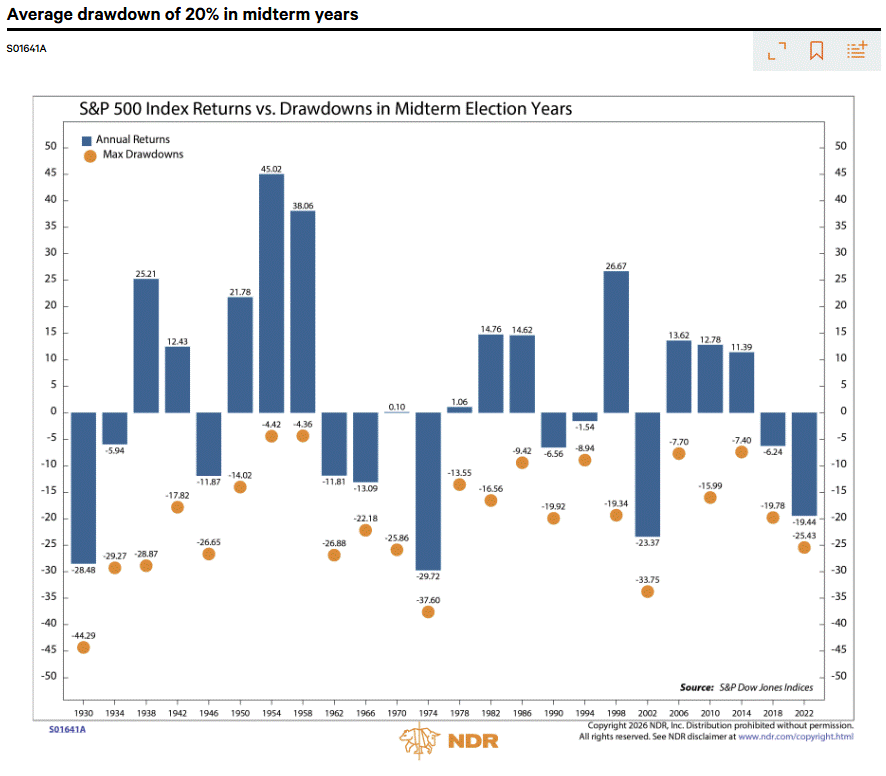

Meanwhile, the S&P 500 index has averaged a maximum drawdown of roughly -20%, the worst of the four-year cycle in terms of correction magnitude.

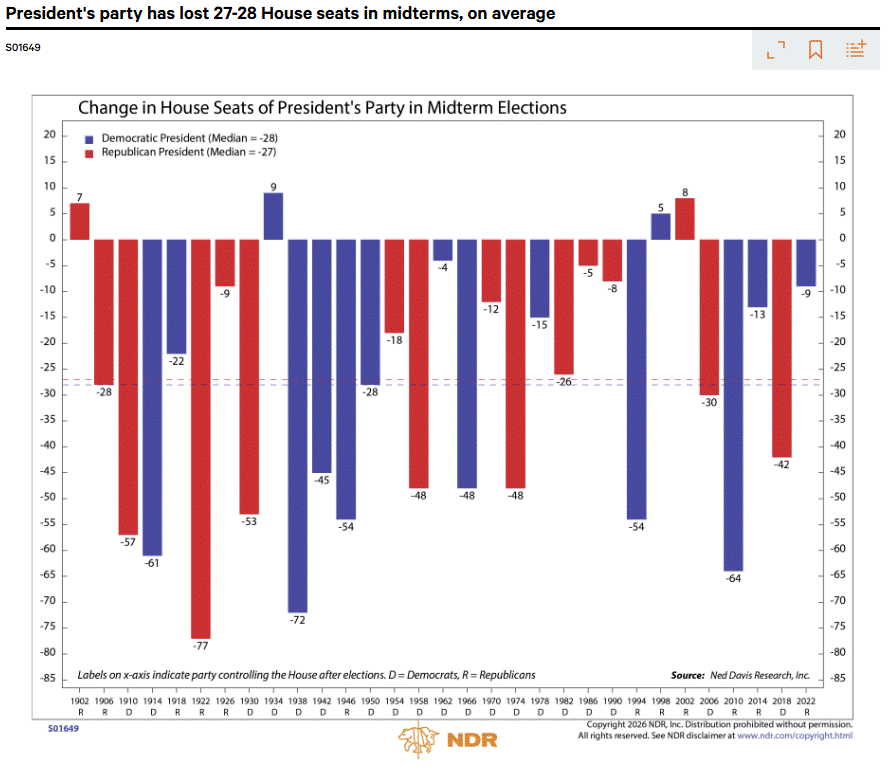

Republicans face an uphill climb in the 2026 midterms.

Their majority in the House of Representatives is razor thin. With three vacancies currently, Republicans have a slim 218-214 majority. Furthermore, since 1900, the President’s party has lost an average of 27-28 House seats in midterm elections.

If Trump’s second year replicates 2018, we can expect continued equity consolidation with elevated volatility, further dollar weakness into mid-year, and rising yields until a potential Q4 reversal when policy uncertainty peaks and growth concerns abate.

Sources: Piper Sandler, Ned Davis Research

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)