50/30/20 budget heuristic, 5% Treasuries, holding periods, producer prices, and simple truths about money

The Sandbox Daily (2.16.2023)

Welcome, Sandbox friends.

Today’s Daily discusses the 50/30/20 budget heuristic, 5% yields motivate investors into Treasuries, the average investor’s holding period, producer prices increase, and simple truths about money.

Let’s dig in.

Markets in review

EQUITIES: Russell 2000 -0.96% | Dow -1.26% | S&P 500 -1.38% | Nasdaq 100 -1.93%

FIXED INCOME: Barclays Agg Bond -0.42% | High Yield -0.80% | 2yr UST 4.644% | 10yr UST 3.867%

COMMODITIES: Brent Crude -0.85% to $84.65/barrel. Gold +0.05% to $1,846.3/oz.

BITCOIN: +1.38% to $24,516

US DOLLAR INDEX: +0.11% to 104.035

CBOE EQUITY PUT/CALL RATIO: 0.58

VIX: +10.64% to 20.17

The 50/30/20 budget heuristic

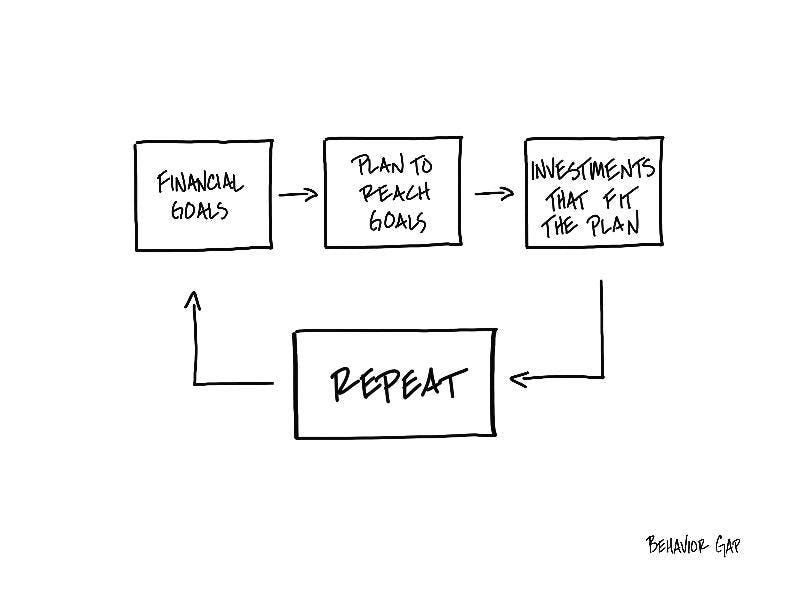

Figuring out how to manage your hard-earned dollars can often feel overwhelming.

Establishing guidelines around your personal budget isn’t fun, but it’s absolutely necessary to institute some structure in efforts to keep your financial house in order and empower you to make informed decisions along life’s journey.

One of the most common percentage-based budgets is the 50/30/20 rule. The idea is to divide your income across three buckets:

50% on needs

30% on wants

20% on savings

Everyone has their own process – what works best for you may not work for the person next to you.

Ultimately, what matters most is setting up a budget to meet your financial goals, following it closely over time, and adjusting along the way. Life is dynamic; your budget should be, too.

Source: Sandbox Financial Partners, Carl Richards

5% yields motivate investors into Treasuries

6-month and 1-year Treasury bills yields are above 5 percent, marking the first time a Treasury yield was over 5% since 2006.

Savers are enthused at the prospect of earning a historically excellent risk-free return.

On the other side of the coin are stock investors. Their decision-making is becoming more complex. Are they willing to bet that stocks will post a return of greater than 5 percent? Since 1970, the average annualized return on the S&P 500 is 7.39%, and about two-thirds of the annual returns were above 5%.

Source: Lance Roberts

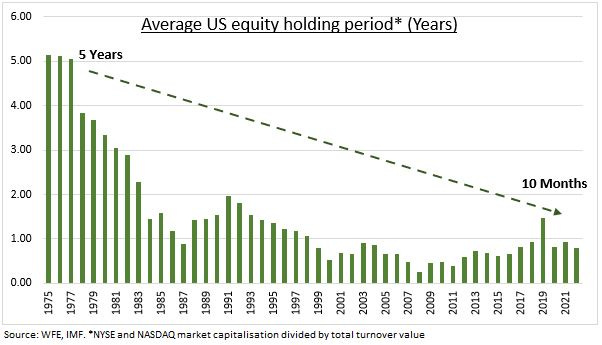

Average holding period

Warren Buffett’s favorite holding period is “forever,” but based on the evidence here, the same cannot be said for the average investor.

eToro’s global retail investor survey (10,000 participants across 13 countries) shows, on average, investors do not even hold equities long enough to even earn long-term capital gains’ treatment.

Source: eToro

Producer prices increase

3 for 3.

First it was CPI consumer prices (Tuesday), then Retail Sales (Wednesday), and now it’s PPI producer prices (Thursday) – all showing the same thing.

The consumer is holding strong. Despite everyone screaming recession, the data isn’t showing it yet.

The Producer Price Index (PPI) for final demand rebounded 0.7% in January, the most since June 2022, and above the consensus of 0.4%. It was driven by a 5.0% jump in energy goods prices, about of third of which could be traced to higher gasoline prices.

On a YoY basis, producer prices continued to decelerate. The PPI eased to 6.0%, while its core slipped to 5.4%, both the slowest rates since the spring of 2021.

This report strengthens our expectation that the Fed will continue tightening monetary policy in the coming months. We expect two more rate hikes this year.

Source: Ned Davis Research, Bloomberg

Simple truths

Print out these rules and take a look at them every single week.

Source: Compounding Quality

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.