A deep dive into Meta Platforms; plus stocks bottom before fundamentals, $SPX technical breadth, the biggest midterm donors, and time horizon

The Sandbox Daily (11.3.2022)

Welcome, Sandbox friends.

Today’s Daily includes a deep dive into Meta Platforms (aka Mark Zuckerburg and Facebook), then discusses how stocks bottom before fundamentals, modest technical improvement in the S&P 500, the biggest donors of the 2022 U.S. midterm elections, and one’s time horizon (days vs. decades).

Let’s dig in.

Markets in review

EQUITIES: Dow -0.46% | Russell 2000 -0.53% | S&P 500 -1.06% | Nasdaq 100 -1.98%

FIXED INCOME: Barclays Agg Bond -0.37% | High Yield -0.71% | 2yr UST 4.718% | 10yr UST 4.149%

COMMODITIES: Brent Crude -1.65% to $94.57/barrel. Gold -1.08% to $1,632.1/oz.

BITCOIN: +0.36% to $20,257

US DOLLAR INDEX: +1.47% to 112.983

CBOE EQUITY PUT/CALL RATIO: 1.14

VIX: -2.17% to 25.30

META problems

Last week, Meta Platforms (the parent company of Facebook) delivered a disastrous 3rd quarter earnings report. The stock is down an astounding -31.6% from its earnings announcement just eight days ago and down -73.6% year-to-date. This company, valued at a trillion dollar market cap as recently as September 2021, has nose-dived in value to $237 billion dollars.

It was so bad that CNBC’s Jim Cramer teared up on Squawk on the Street last week and apologized to viewers for backing Meta’s stock: "Let me say this: I made a mistake here. I was wrong. I trusted this management team. That was ill-advised. The hubris here is extraordinary, and I apologize."

So what is the market’s issue with Meta Platforms? Why is this stock in free fall?

The problem isn’t eyeballs, where 3.7 billion people – 62% of adults (age 15+) in the world – use a Meta product each month and 2.9 billion every day!! Think about all that content that Meta Platforms doesn’t pay for because billions of people provide it for free every day. *Reminder: the Family of Apps include Facebook, Instagram, WhatsApp, and Messenger.

It isn’t their growth metrics – which have been exceptional – although we must acknowledge that revenue growth has slowed dramatically over the past year, turning negative the past two quarters.

Nor is it the ability to monetize their user base – commonly measured by the metric average revenue per user ("ARPU") – that shows the average revenue the company generates from each person using their platform.

Many think the problem is competition from Tik Tok. Others suggest it was Apple's (AAPL) privacy changes, called App Tracking Transparency ("ATT"), that hurt Meta's ability to target users – and then monetize them. It could be that founder Mark Zuckerburg is wholly unlikable. Maybe it’s the corporate governance structure where the voting shares largely reside with Zuckerburg alone that turn off prospective shareholders.

No. Here’s the issue, front and center: the primary driver of the extraordinary loss in shareholder value derives from their capital allocation plan.

Meta expects its 2022 total expenses to be in the range of $85 billion to $87 billion and 2023 total expenses to be between $96 billion and $101 billion! Meta is spending so much money that the market has lost confidence in Zuckerberg and his team.

The company’s ambitious and expensive pivot to the metaverse has some people estimating a 10-year outlay plan carrying an annual spend of ~$25 billion per year. For context, Meta currently spends ~$4 billion a quarter, or ~$16 billion annually, on this project. As such, it is possible that Meta will end up spending a quarter of a trillion dollars on their metaverse play.

Chamath Palihapitiya, an executive from the early days of Facebook, shared an interesting perspective on the most recent episode of the All-In Podcast. The chart below measures Meta Platform’s possible CapEx outlay against other notable multi-year spending programs in efforts to “understand one quarter of a trillion dollars in the context of other major leaps in humanity.”

Apple spent $3.6 billion dollars to create the first iPhone. The Manhattan Project cost $23 billion dollars to create the atomic bomb. Tesla’s first car? $25 billion. Boeing spent $32 billion on the 787 Dreamliner program. Google was the likely highest corporate spender prior to Meta, with up to $40 billion in outlays to their moonshot “Other Bets” division. Important to note here that all dollar amounts listed are inflation-adjusted for today’s dollar value.

The only thing comparable in history to what Meta Platforms is going to spend on development of the metaverse is the entire Apollo Program funded by the United States government spanning over a decade.

So… many investors are wondering what is the outcome of this vast R&D spend and will the metaverse be a leap in humanity at the scale of the biggest products in modern history. Here are four exceptionally brilliant minds from Silicon Valley debating this very issue:

Only time will tell if META’s moonshot bet on the metaverse will pan out.

Source: Meta Investor Relations, Chamath Palihapitiya, Empire Financial Research

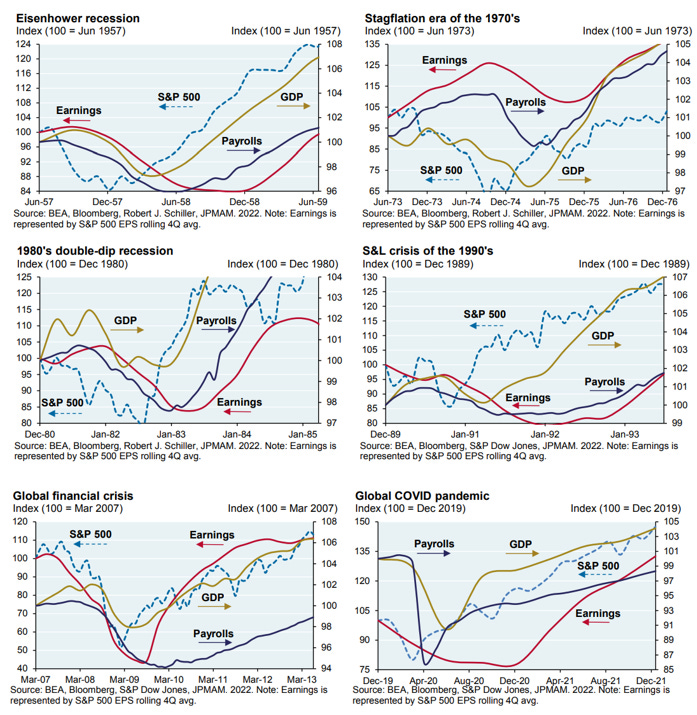

Stocks bottom first

Stocks usually bottom before earnings-per-share growth (EPS), jobs, and gross domestic product (GDP) start to improve. We’ve seen cycles time and time again, although notably it didn't work during the Tech bubble where the earnings decline preceded the equity market decline and there was barely a recession at all.

So it is more likely than not that a lot of the economic data will likely worsen.

Bottom line: the stock market is a forward-looking mechanism in which stocks sniff out better times and rally in the face of bad news. It stops going down while GDP, employment, and earnings deteriorate.

Source: JPMorgan, The Irrelevant Investor

Modest technical improvement

Breadth metrics for the S&P 500 were mixed over the past week, and there remains a lot of work to be done before we can claim that breadth is healthy.

Advance/Decline Line: Testing the 50-day moving average from below, but holding higher after making a cycle low on Friday, October 14th

S&P 500 % of issues above their 200-Day Moving Average: 32%, from 29% last week

S&P 500 % of issues above their 50-Day Moving Average: 49%, from 49% last week

S&P 500 % of issues above their 20-Day Moving Average: 73%, from 83% last week

Source: Potomac Fund Management

The biggest donors of the 2022 U.S. midterm elections

This year’s midterm election is expected to set a new spending record, with over $9 billion being raised. This is significantly higher than the previous record of $7 billion, which was set in 2018.

According to a recent Washington Post analysis, $1 billion of these funds can be attributed to the top 50 donors. From billionaire investors to shipping magnates to casino moguls, these megadonors skew Republican, though they affiliate with both parties. Many of the figures on the list are familiar faces – such as George Soros, the Hungarian-born Holocaust survivor who thrived as both a hedge fund manager and philanthropist to liberal causes globally – but some are now to the scene, including 30-year-old MIT-educated Sam Bankman-Fried who is Chief Executive Officer of the cryptocurrency exchange FTX.

Source: Washington Post, Visual Capitalist

Days vs. decades

We. Get. To. Decide. What. We. Focus. On.

When it comes to investing, that means you have a choice.

You can tune into the financial click-baiting and fear-mongering media, go through endless cycles of “buy buy, sell sell,” obsess over the latest IPO, and deal with the apocalypse du jour while cycling through all the emotions that come with it.

OR…

You can focus on what actually matters when it comes to investing. And that's time. A very long time, in fact. Decades.

If you choose to focus on days, you are signing up to make yourself miserable. And for no good reason. There’s actually no benefit to that. Or we can focus on decades by ignoring most of the noise and let time and compounding do the heavy lifting.

Source: Carl Richards

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.