A framework to financial freedom, plus gasoline prices and how to beat the market

The Sandbox Daily (9.10.2024)

Welcome, Sandbox friends.

Today’s Daily discusses:

“earn, save, grow, preserve” - is it really that simple?

aiding the consumer: gasoline

how to outperform the market

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 +0.90% | S&P 500 +0.45% | Russell 2000 -0.02% | Dow -0.23%

FIXED INCOME: Barclays Agg Bond +0.31% | High Yield -0.19% | 2yr UST 3.594% | 10yr UST 3.642%

COMMODITIES: Brent Crude -2.87% to $69.76/barrel. Gold +0.51% to $2,545.5/oz.

BITCOIN: +1.54% to $57,847

US DOLLAR INDEX: +0.09% to 101.645

CBOE EQUITY PUT/CALL RATIO: 0.64

VIX: -1.90% to 19.08

Quote of the day

“I didn’t come this far to only come this far.”

- Unknown

Earn, Save, Grow, Preserve

Reaching financial freedom is a goal we all aspire to.

As such, we should spend our time and energies constructing a framework that allows us to save and invest for retirement with the highest probability of success.

Could it really be as simple as Michael Kitces’s “Earn, Save, Grow, Preserve” mantra?

Earn: First, you need income. Focus on your human capital to help you earn more. Invest energy into your education, career skills, and network.

Save: Once you have enough disposable income, make certain to save bigger and bigger portions of it. Create systems and habits to help keep your spending modest. Savings rates will depend on lifecycle and lifestyle needs.

Grow: After you’ve accumulated a certain level of savings, spend some time developing a set of solid investment beliefs and a written plan. Devote time specifically to learning about investing and/or hire a trusted advisor. Your money should always be making more money.

Preserve: You only need to get rich once. Think appropriate risk tolerance levels, cash flow planning, annuities, insurance, etc. Create a long-term plan to preserve and ultimately live off the income from your investment portfolio and other assets.

Source: Michael Kitces

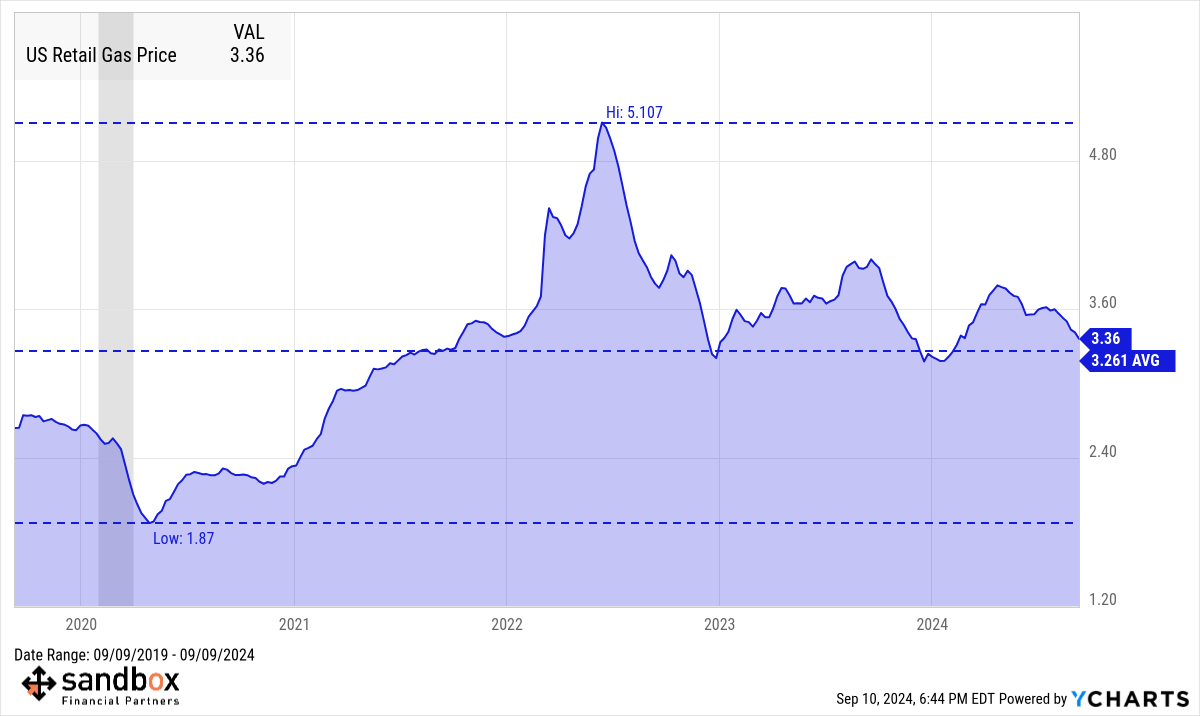

Aiding the consumer: gasoline prices

Crude oil prices have been pushed lower by ~20% since early July, now sitting around a key long-term support level.

Oil prices – and energy derivatives more generally – impact inflation as key inputs for a myriad of production processes, as well as directly influencing the CPI basket via commodity-sensitive consumer products – like gasoline, for example.

As oil and a wide variety of commodities have cooled in recent months, gasoline prices have followed suit and are now testing their lowest levels over the last three years.

Gasoline prices are ~15% lower than a year ago, which is translating into lower prices at the pump (national average of $3.30/gallon vs. $4.00 this time last year).

As the seasonal summer demand fades into the rearview mirror, the national average price could fall below $3 in October.

Lower oil and gasoline prices will spur greater consumption, a reassuring sign regarding the health of the U.S. consumer and a reminder that declining energy prices tend to extend economic expansions.

Source: AAA Gas Prices

How to outperform the market

Bank of America’s equity research team finally uncovered the keys to the magic kingdom…

Source: Jim Bianco

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

That Bank of America chart 🤣