A key manufacturing indicator gains momentum, strengthens case for Industrials

The Sandbox Daily (2.3.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

U.S. Manufacturing PMIs strengthen ahead of tariffs; look at Industrials

Let’s dig in.

Blake

Markets in review

EQUITIES: Dow -0.28% | S&P 500 -0.76% | Nasdaq 100 -0.84% | Russell 2000 -1.28%

FIXED INCOME: Barclays Agg Bond +0.09% | High Yield -0.13% | 2yr UST 4.251% | 10yr UST 4.559%

COMMODITIES: Brent Crude -0.17% to $75.53/barrel. Gold +0.51% to $2,826.9/oz.

BITCOIN: +4.67% to $101,302

US DOLLAR INDEX: +0.08% to 108.456

CBOE TOTAL PUT/CALL RATIO: 0.85

VIX: +13.33% to 18.62

Quote of the day

“Believe nothing you hear, and only one half that you see.”

- Edgar Allan Poe

U.S. Manufacturing PMIs strengthen ahead of tariffs

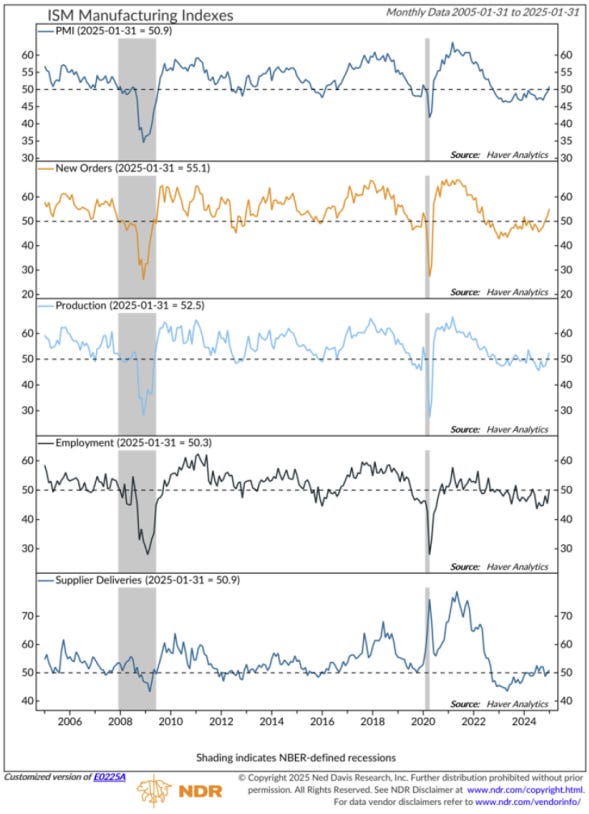

For the first time in 27 months(!!), the ISM Manufacturing PMI is no longer below the break-even level of 50 – ending the longest stretch of contraction in factory activity on record.

January’s reading rose 1.7 points to a higher-than-expected 50.9 – pushing the index into expansion territory for the first time since October 2022.

The ISM Manufacturing Purchasing Managers' Index, or Manufacturing PMI for short, is a monthly survey that measures the health of U.S. manufacturing activity based on New Orders, Production, Employment, Supplier Deliveries, and Inventories. The survey – covering supply chain managers across 19 industries – gauges the prevailing direction of economic trends in manufacturing, which can influence market sentiment, interest rate expectations, and economic outlook.

Investors use the PMI to assess economic momentum. A reading above 50 signals expansion, while below 50 indicates contraction.

Most PMI components strengthened last month.

New Orders increased for a third successive month and at the fastest pace since May 2022. Production and Employment rebounded into positive territory, although their rates of growth are still modest. Supplier Deliveries slowed marginally, reflecting firmer demand.

Inventories continued to fall, but so did inventory sentiment, a sign that replenishing stocks could add to demand and production in the near-term.

Ahead of the tariff blitz this weekend, both export orders and imports rose in January. Although tariffs on Mexico and Canada have now been delayed by a month, tariffs on China remain on schedule.

Heightened trade uncertainty will likely weigh on U.S. goods exports and growth, but is unlikely to cause a recession at this time. Import tariffs, if sustained, are expected to raise production costs and consumer prices in the United States.

The Manufacturing PMI last peaked at 64.7 back in March 2021, then proceeded to soften until bottoming over the summers of 2023 and 2024.

Now, ISM estimates that the latest PMI reading corresponds with 2.4% real GDP annualized growth, consistent with continued economic expansion in early 2025.

One of the most effective ways to leverage this manufacturing sector reacceleration will be via Industrials exposure.

Industrials are very sensitive to manufacturing PMIs inflecting higher. Whenever PMIs bottom, Industrials tend to also bottom. As PMIs turn higher, Industrials follow. See below.

Since 1948, when PMIs are <50 and rising (n=60), Industrials see positive forward 6-month gains 85% of the time with a median gain of +12.6% and 12-month gains 95% of the time with a median gain of 21.5%.

Historically, this setup has offered a favorable risk/reward for investors and the opportunity for meaningful absolute returns.

Sources: Institute for Supply Management, Advisor Perspectives, Ned Davis Research, Bloomberg

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures at the Sandbox Financial Partners website:

Awesome charts as always