A market of stocks, plus calm market moves, U.S. dollar strength, oil slips, and ADP payrolls

The Sandbox Daily (6.1.2023)

Welcome, Sandbox friends.

Today’s Daily discusses:

a market of stocks

stocks remain calm as they climb the wall of worry

U.S. dollar continues to demand respect

a disastrous month for oil

ADP payrolls jump well ahead of expectations

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 +1.31% | Russell 2000 +1.05% | S&P 500 +0.99% | Dow +0.47%

FIXED INCOME: Barclays Agg Bond +0.31% | High Yield +0.60% | 2yr UST 4.345% | 10yr UST 3.601%

COMMODITIES: Brent Crude +2.33% to $74.29/barrel. Gold +0.66% to $1,995.1/oz.

BITCOIN: -0.86% to $26,865

US DOLLAR INDEX: -0.73% to 103.568

CBOE EQUITY PUT/CALL RATIO: 0.81

VIX: -12.76% to 15.65

Quote of the day

“You can talk all you want about having a strategy for your life, understanding motivation, and balancing aspirations with unanticipated opportunities. But ultimately, this means nothing if you do not align those with where you actually expend your time, money, and energy.”

- Clayton Christensen, How Will You Measure Your Life?

A market of stocks

Market breadth, or lack thereof, is overwhelmingly the dominant theme of 2023.

For the 2nd month in a row, both the S&P 500 and the NASDAQ 100 finished at a new 12-month highs. Also for the 2nd month in a row, both of these indexes had more stocks that were down than up. The stock market (SPY) was up +0.5% in May, the market of stocks (RSP) was down -3.8% in May. Even more broadly, the Value Line Geometric Index finished last month at a new closing low for the year.

Breadth must broaden out beyond the 5-10 mega cap names that are carrying the 2023 torch if the market is to sustain further upside momentum into the back half of the year.

Source: Hi Mount Research

Stocks remain calm as they climb the wall of worry

When you consider the economic backdrop and scary headlines blanketing financial markets – most recently, the totally avoidable but potential catastrophe of a U.S. government default – stock markets have continued to climb the wall of worry and remain remarkably quiet and resilient.

This graphic from Chartr quantifies that calmness. The daily moves in percentage terms for the S&P 500 index 2023 have been quite steady.

The sharpest drop in the index came on February 21st, when the market fell -2%. Last year, on the other hand, a -2% drop would have been the 24th worst day – which is nothing compared to the -8%, -10%, or even -12% swings we experienced in 2020, during the early days of the pandemic.

Markets perform much better during these environments and experience much shallower drawdowns.

Source: Chartr

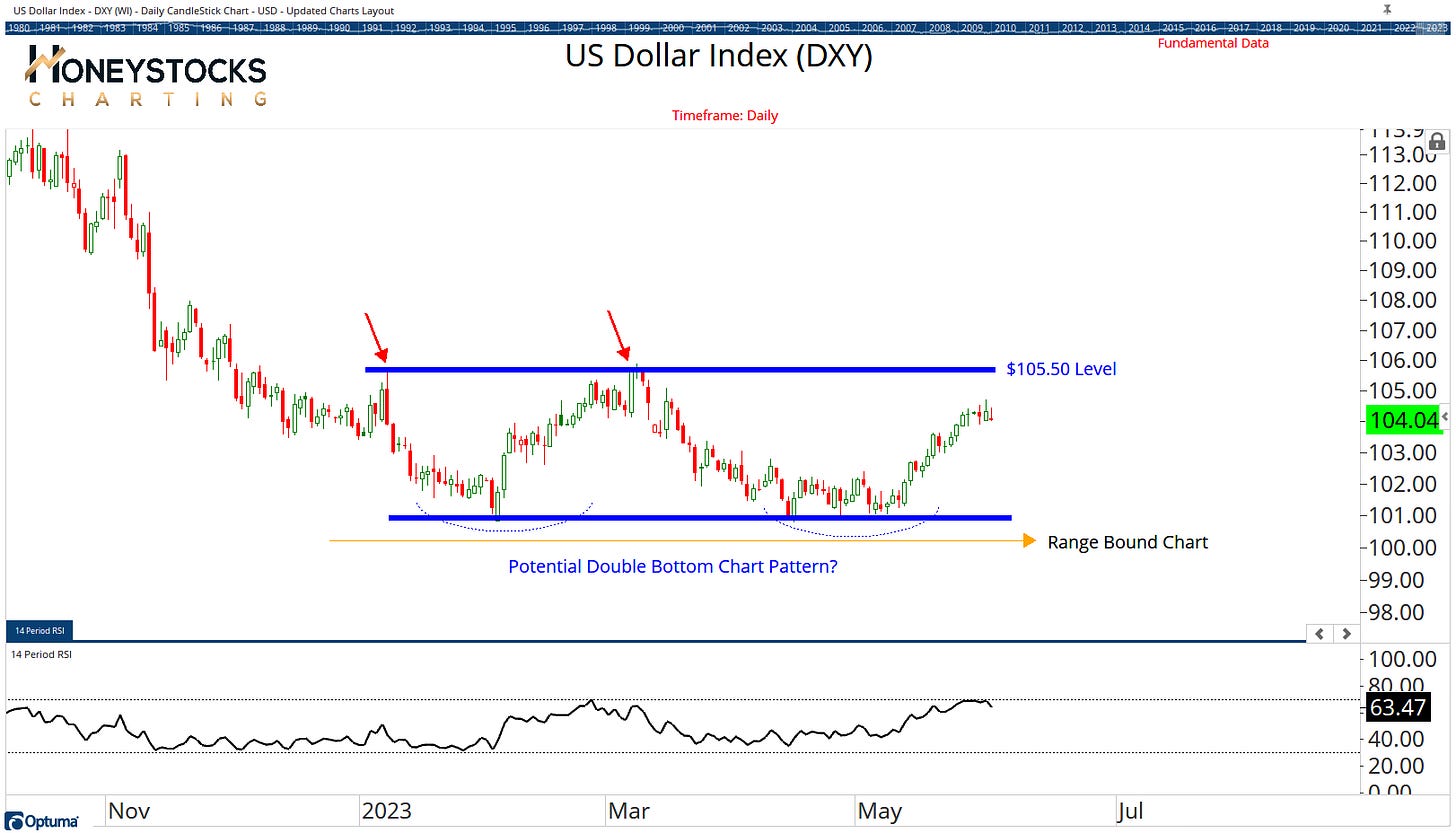

U.S. dollar must be respected

Yesterday, the U.S. dollar hit its highest point since mid-March after backing up for the entire month of March. Some are saying the recent surge is attributed to new data that shows European inflation is cooling quicker than expected while China’s recovery is sputtering.

The U.S. dollar has been a major headwind for risk assets over the last 5 years, so respecting the Dollar Index price action continues to remain important information for investors.

The key polarity level to watch is around $105.50.

Source: Honeystocks Charting

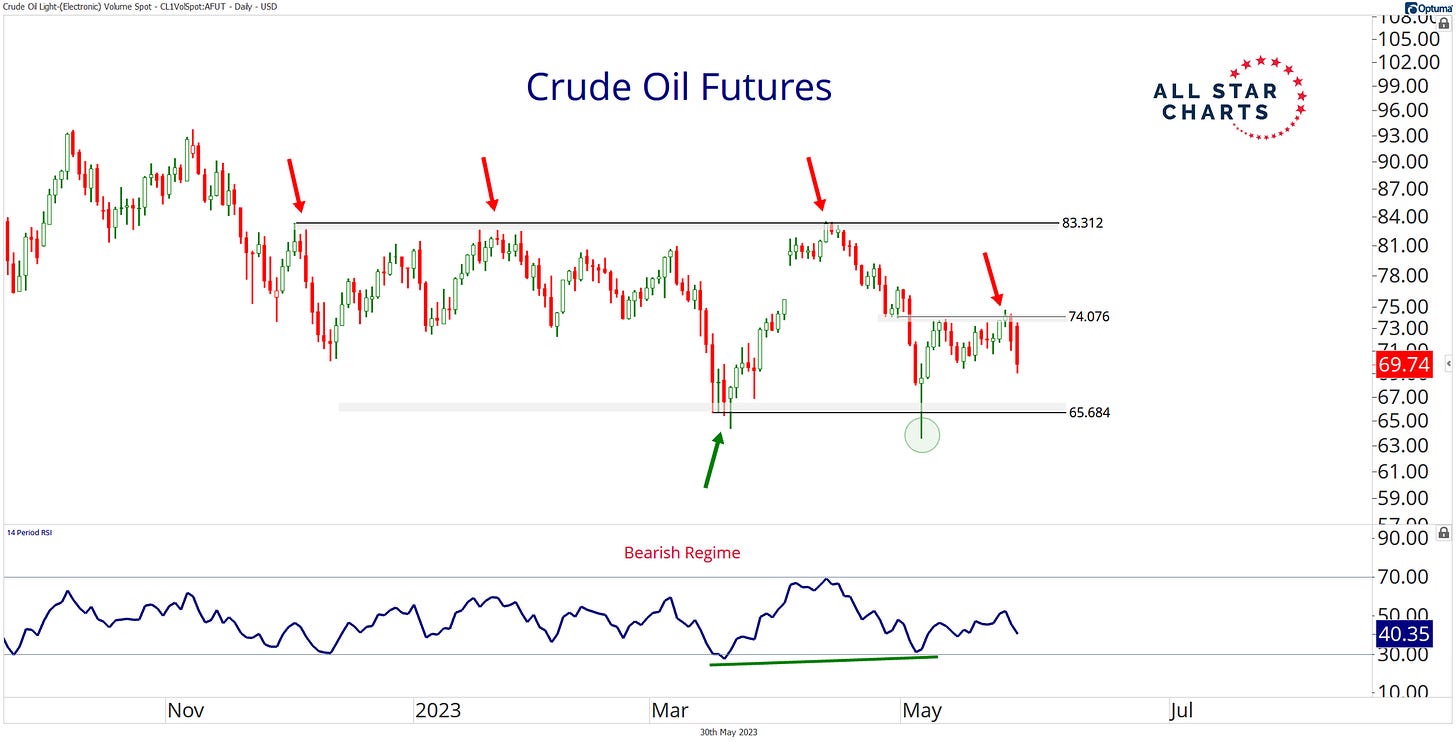

A disastrous month for oil

Oil steadied in the first trading session of June but finished May with its worst monthly performance – down more than 10%-15% depending on which oil blend – since November 2021.

Crude oil continues to find an overwhelming amount of overhead supply at approximately $72-74 per barrel.

As long as crude holds above $65 a barrel, the cyclical strength should continue.

Nevertheless, oil is a range-bound trading mess that’s approaching potential support. If crude oil futures undercut the March and May pivot lows, it’s difficult to imagine a scenario where energy-related equities aren’t experiencing further selling pressure.

Source: All Star Charts

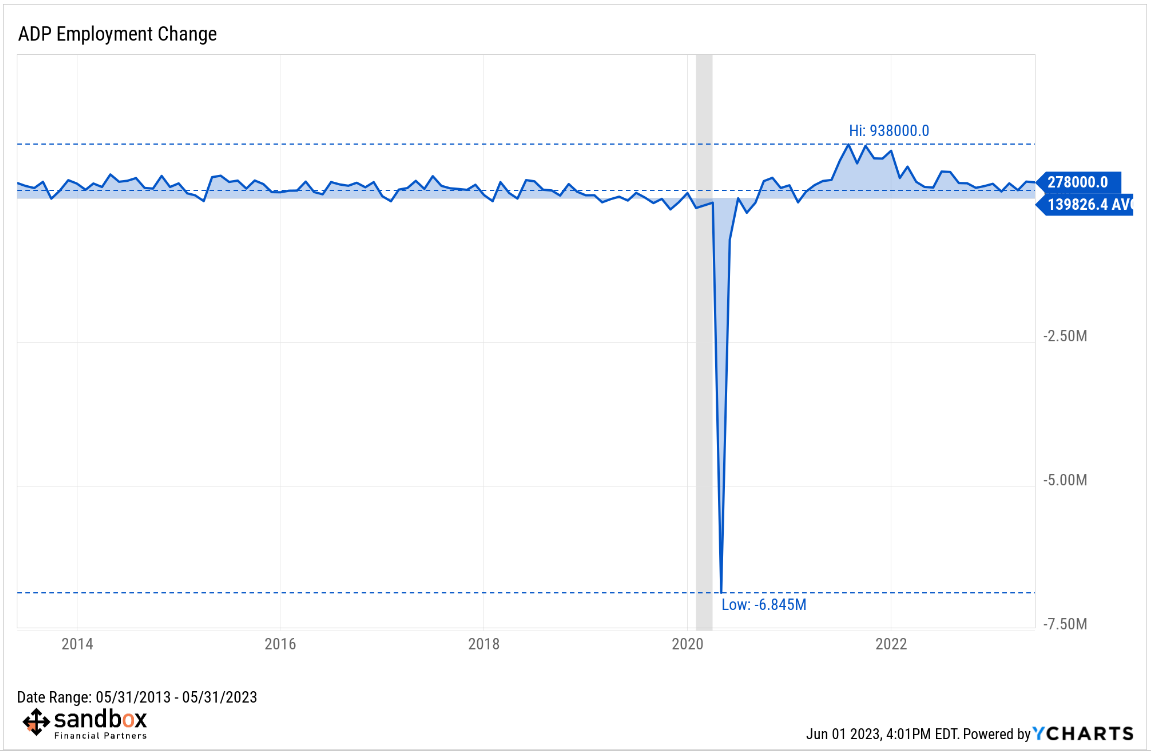

ADP payrolls jump well ahead of expectations

ADP private payrolls jumped 278,000 in May, far above the consensus of 180,000 but a modest deceleration from April’s downwardly revised 291,000 gain.

The 3-month (237k) and 6-month (224k) average payroll gains both ticked up, a sign of near-term trend improvement in job growth. For context, the 10-year average of monthly ADP job gains is ~140,000.

One area of note for ADP was a slowdown in the pace of wage gains, with annual pay for Job Stayers up a still-robust +6.5% in May but down from the +6.7% increase in April. Job Changers reported an annual increase of +12.1%, off a full percentage point from the month before. Both measures have moderated from their respective cycle peaks but not as much as the Federal Reserve would like to see.

Bottom line: job growth remains strong, while pay growth continues to slow.

The jobs report and pay insights from payment processing giant, ADP, aggregate data from over 25 million U.S. employees to provide a broad representation of the labor market.

Source: ADP Research Institute, Ned Davis Research, CNBC, ZeroHedge

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.