A market of stocks, plus seasonal trends flashing yellow and the Fed on credit conditions

The Sandbox Daily (8.1.2023)

Welcome, Sandbox friends.

Today’s Daily discusses:

a market of stocks

seasonal trends flashing caution ahead?

Fed says credit conditions continues to broadly tighten

Let’s dig in.

*BREAKING: Fitch downgrades U.S. credit rating from AAA to AA+. Cue the 2011 analogue.

Markets in review

EQUITIES: Dow +0.20% | Nasdaq 100 -0.25% | S&P 500 -0.27% | Russell 2000 -0.45%

FIXED INCOME: Barclays Agg Bond -0.66% | High Yield -0.50% | 2yr UST 4.906% | 10yr UST 4.037%

COMMODITIES: Brent Crude +0.52% to $85.87/barrel. Gold -1.37% to $1,981.6/oz.

BITCOIN: +0.19% to $29,234

US DOLLAR INDEX: +0.32% to 102.186

CBOE EQUITY PUT/CALL RATIO: 0.56

VIX: +2.20% to 13.93

Quote of the day

“Life is 10% what happens to you and 90% how you react to it.”

- Charles Swindoll

It’s a market of stocks

Since the market bottomed on October 12th, 2022, Technology has led all sectors to date, with tech-adjacent Communication Services a close second.

When names like Apple, Google, and Nvidia sell down 30%, 40%, 50%, and some close to 80% (hello, Facebook and Netflix), its natural to see a sharp snapback as buyers come back into the market absorbing excess supply (i.e. sellers). After all, several of the beaten-down names from 2022 are their respective category leaders now, and for years to come, so it should come as no surprise to see them lead the market higher once again.

It’s also worth noting the performance difference from the best performing sector (Tech) to the worst (Health Care) is ~43%, a fairly wide dispersion but not necessarily by historical standards.

But, if we remove the outsized influence of the mega-caps and equal-weight the constituents across the index and sector groupings, we get a better idea of how the median stock under the hood is actually performing in this bull market.

Quite well, in fact. And the dispersion in returns is much tighter – just a 30% spread between the highest performer (Tech) and worst performer (Financials).

When looking at these charts, a few things quickly come to mind:

This bull market is not just the “Magnificent 7”

Opportunity has been rotating through sectors based on sentiment, positioning, and macro data

Every sector is positive off the lows, all up double digits save one (equal-weight Financials)

The crowded trade is not always the right trade. Strategists and economists were way off coming into 2023.

Pay attention to how markets are positioned

4-5% Treasuries and Money Market Funds are great risk-free rates, just not a replacement for risk assets

Picking the winners off the bottom is hard; remember when no one wanted to touch Tech and it was all about valuations, balance sheets, cash flows and pricing power?

History does not repeat itself but it often rhymes

Source: Sandbox Financial Partners

Weakness ahead?

As we enter a new month, we welcome the dog days of summer – the hottest and most unbearable days under the summer sun – which also coincides with the weakest seasonal months on the calendar.

August’s average gain since 1950 is +0.01%, making it the 3rd-weakest month of the year. What’s more, September offers even more dismal performance, averaging -0.66% for the last ~70 years and good for last place in monthly returns.

The S&P 500 and Nasdaq indexes just closed out July on 5-month winning steaks. The Dow Jones had its 4th positive month in the last 5, with a 13-day winning streak to boot. Market breadth has continued to widen out. Investor sentiment has improved on the back of the disinflation narrative. Earnings are better-than-feared. No more bank failures, yet.

After monster equity gains, this seems like a logical place to take a breather – at least according to the seasonal data.

Source: All Star Charts, Carson Group

Fed SLOOS report shows bank lending continues to tighten

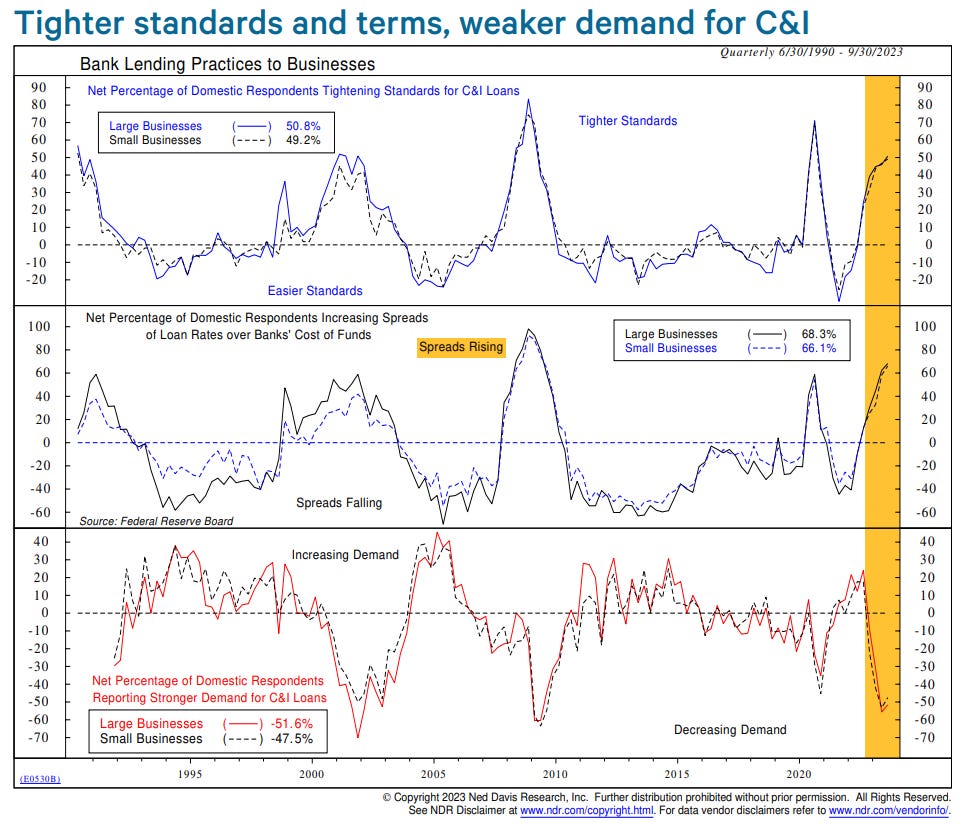

The Federal Reserve released its quarterly Senior Loan Officer Opinion Survey (SLOOS) on Bank Lending Practices yesterday and it continues to show banks are tightening lending standards on commercial and industrial (C&I) loans.

The collapse of 4 U.S. regional banks and the Fed taking the target benchmark rate to 5.25%-5.50% across 11 rates hikes will cause financial conditions to tighten. This we know.

Loan standards are now nearly the tightest since at least the 2008 Global Financial Crisis, outmatched only by the onset of the pandemic. The proportion of U.S. banks tightening terms on C&I loans for large- and medium-sized businesses rose to 51%, up from 46% in Q1 of 2023. See top section of the chart below.

Why does this Fed survey matter?

C&I loans are an important funding source for companies that can’t access capital markets to fund growth initiatives or to just help pay the bills and service existing debt. C&I loans are an especially important funding source for lower-rated companies because borrowing (or issuing additional equity shares) can be too restrictive and costs prohibitive at times, whereas C&I loans are short-term loans with variable interest rates that are generally secured by company collateral.

With the recent Fed report showing banks are making it harder for some companies to access C&I loans and/or only access them at higher rates, it could mean higher yields and spreads for the High Yield index broadly.

Source: Federal Reserve, Ned Davis Research, Calculated Risk, CNBC

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.