A mixed bag for December's inflation report

The Sandbox Daily (1.15.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

December’s inflation report

Let’s dig in.

Blake

Markets in review

EQUITIES: Nasdaq 100 +2.31% | Russell 2000 +1.99% | S&P 500 +1.83% | Dow +1.65%

FIXED INCOME: Barclays Agg Bond +0.87% | High Yield +0.88% | 2yr UST 4.268% | 10yr UST 4.655%

COMMODITIES: Brent Crude +3.18% to $82.46/barrel. Gold +1.50% to $2,722.6/oz.

BITCOIN: +3.09% to $99,638

US DOLLAR INDEX: -0.16% to 109.098

CBOE TOTAL PUT/CALL RATIO: 0.77

VIX: -13.84% to 16.12

Quote of the day

“The real key to making money in stocks is to not get scared out of them.”

- Peter Lynch, Fidelity Magellan Fund, Former PM

Noisy inflation data shows path lower remains choppy, protracted

The center of attention for this week’s eco data was today’s Consumer Price Index (CPI) report for December, which gave decidedly mixed signals on inflation at year-end.

Headline CPI inflation (blue bars, upper pane) rose from the prior month by a larger-than-expected +0.4% in December, which has been moving higher for several months. Energy prices accounted for nearly half the increase.

The core CPI (yellow bars, lower pane), which excludes the more volatile food and energy components, rose +0.2%, its lowest monthly increase since July 2024.

There was a lot of movement under the surface.

Energy popped, while food prices rose meaningfully. There were also sizable price increases across various transportation services (air fares +3.9%, used cars and trucks +1.2%, vehicle insurance +0.4%) that contributed to today’s report.

Shelter, the biggest core component, rose +0.3% – a touch high but still notably weaker than most months since inflation soared in the spring of 2021.

As we’ve stated for the better part of two plus years, the stickiness in the data continues to largely reside within the Shelter category which accounts for most of the inflation in the pipeline.

The BLS data is out of step (strong/holding firm) with what actual rents in the market are doing today (steady/falling).

In other words, if you remove housing, you eliminate any concern over inflation. CPI ex-shelter is up just +1.9% versus this time last year.

In fact, if you zoom in, this measure of inflation hasn’t been a problem since May 2023.

On a year-over-year basis, headline CPI rose to 2.9%, a five-month high.

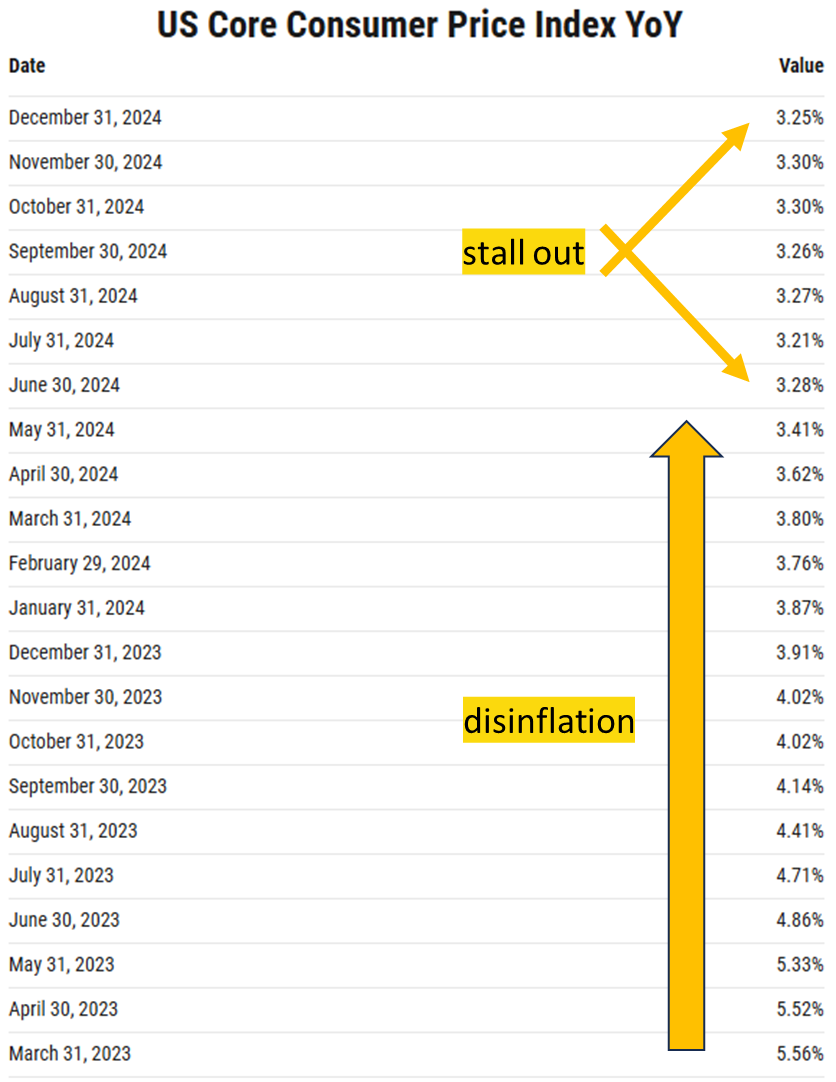

Core CPI inflation slowed to 3.2%. Core inflation has changed little over the past 6-7 months, as disinflation has stalled.

Both YoY measures are still running well above the Fed’s stated target of 2%.

Americans have been fed up with inflation for a while – and for good reason. Some of the prices that have risen the most are on goods that are key to most households: gas, food, car insurance, home prices, etc.

Since 2020, inflation stacking has meant the general level of prices for most goods and services have increased by 20-25% !

Now, economists worry inflation could get worse under Trump.

Although wages have generally been rising alongside (in tandem but on a lag), this trend is not substantially easing the financial burdens on many households across the country.

Bottom line, underlying price pressures remain sticky, largely attributable to lagging housing data. While the Federal Reserve has made a ton of progress on inflation since the four-decade high of 9.1% that hit in mid-2022, reaching the Fed’s 2.0% mandate may take longer than many wished.

This should allow the Fed to continue to normalize monetary policy, but at a slower pace than last year. I’d expect the Fed to pause this month.

Source: Bloomberg, Liz Ann Sonders, St. Louis Fed, Jason Furman, YCharts, Ned Davis Research

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures at the Sandbox Financial Partners website: