A no "BS" reading on the U.S. consumer economy

The Sandbox Daily (6.10.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

readthrough from Costco on tariffs and the American consumer

Let’s dig in.

Blake

Markets in review

EQUITIES: Nasdaq 100 +0.66% | Russell 2000 +0.56% | S&P 500 +0.55% | Dow +0.25%

FIXED INCOME: Barclays Agg Bond +0.23% | High Yield +0.24% | 2yr UST 4.018% | 10yr UST 4.472%

COMMODITIES: Brent Crude -0.48% to $66.72/barrel. Gold -0.19% to $3,348.4/oz.

BITCOIN: +0.89% to $109,510

US DOLLAR INDEX: +0.08% to 99.018

CBOE TOTAL PUT/CALL RATIO: 0.79

VIX: -1.22% to 16.95

Quote of the day

“Emotions need motion. Bottling them up only makes them heavier.”

- Brene Brown, Author

A no “bullshit” reading on the U.S. consumer economy

Coming out of Q1 corporate earnings season, many companies noted that customers would not see broad based price increases as companies would employ mitigation efforts and not take price on every item, while others said tariff-induced prices increases were unavoidable.

As in most cases: watch what they do, not what they say.

Enter the New York Fed, where a recent survey from Liberty Street Economics asked businesses how they were adjusting their operations in response to the administration’s new trade policies.

As one would expect, tariffs generally resulted in higher prices to consumers.

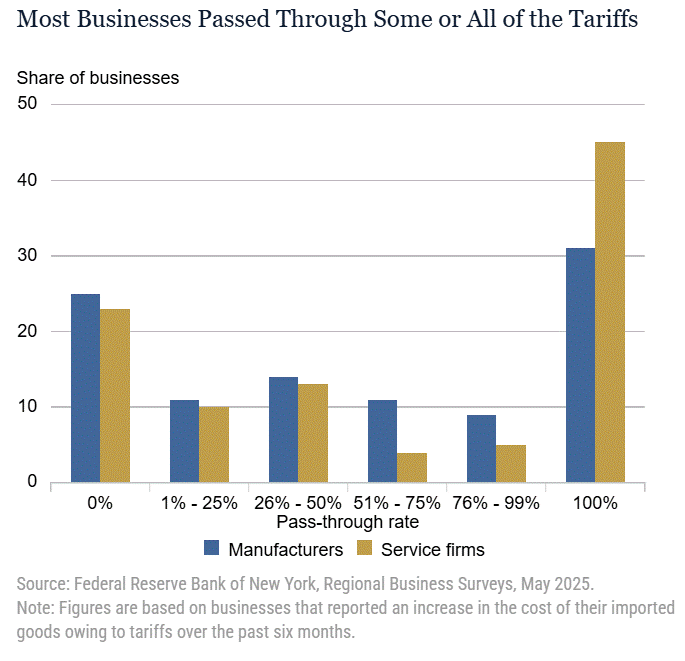

“About three-quarters of businesses facing tariff-induced cost increases in both the manufacturing and service sectors passed along at least some of these higher costs to their customers by raising prices.”

Nearly one-third of manufacturers and almost half of service firms responded that all tariff-related cost increases would be fully passed onto the consumer.

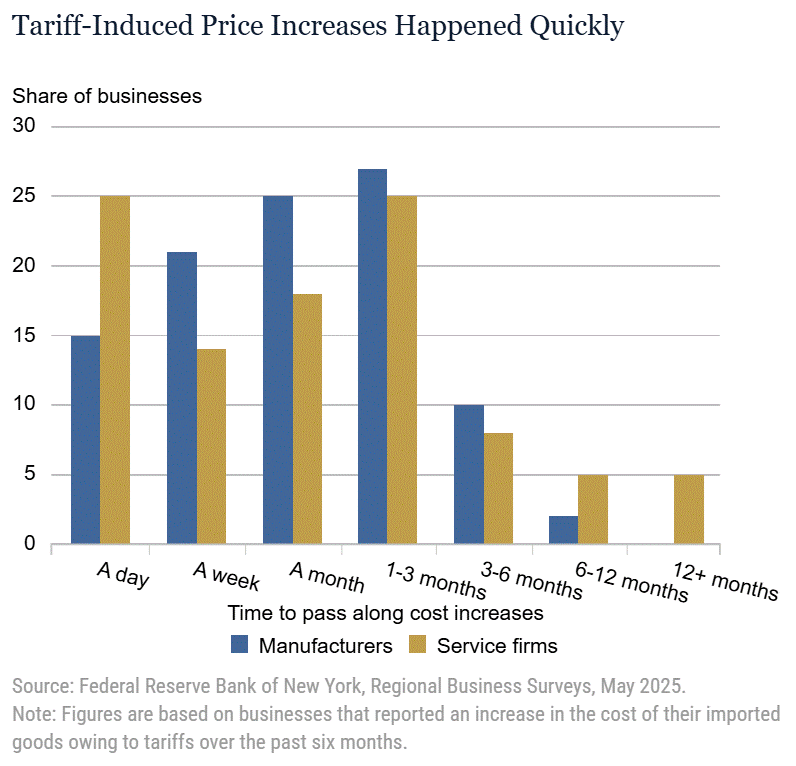

As businesses must adjust operations to protect margins and profitability, investors are wondering when we could see higher prices in the store.

Now sounds good.

As we learned from the pandemic, businesses are very adept in adapting quickly to changing macro trends.

And yet, so is the consumer. After years of inflation stacking, consumers are showing some fatigue to further price increases.

Here’s Goldman Sachs on Costco, the third-largest retailer in the world, and how 2025 comps continue to slow, both in traffic and topline sales:

“Costco reported May “Same Store Sales” (ex-gas/FX) of +6.0%, below consensus at +6.2% and decelerating from +6.7% in April. U.S. comps came in at +5.5%, below consensus at +6.4% and decelerating from +7.1% in April.”

While it’s still too early to see signs of weakness in consumer spending, households’ spending power will be put to the test in 2H25 after the full brunt of higher tariffs pass through to the prices of consumer goods on store shelves.

Sources: Goldman Sachs Global Investment Research, New York Fed

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)