A Value regime change or countertrend rally?

The Sandbox Daily (1.14.2026)

Welcome, Sandbox friends.

Today’s Daily discusses:

a Value regime change or countertrend rally?

Let’s dig in.

Blake

Markets in review

EQUITIES: Russell 2000 +0.70% | Dow -0.09% | S&P 500 -0.53% | Nasdaq 100 -1.07%

FIXED INCOME: Barclays Agg Bond +0.15% | High Yield 0.00% | 2yr UST 3.516% | 10yr UST 4.141%

COMMODITIES: Brent Crude -1.15% to $64.72/barrel. Gold +0.70% to $4,631.3/oz.

BITCOIN: +3.49% to $97,625

US DOLLAR INDEX: -0.03% to 99.103

CBOE TOTAL PUT/CALL RATIO: 0.88

VIX: +4.82% to 16.75

Quote of the day

“The bravest are surely those who have the clearest vision of what is before them, glory and danger alike, and yet notwithstanding, go out to meet it.”

- Thucydides

Stronger economic growth should benefit cyclical sectors

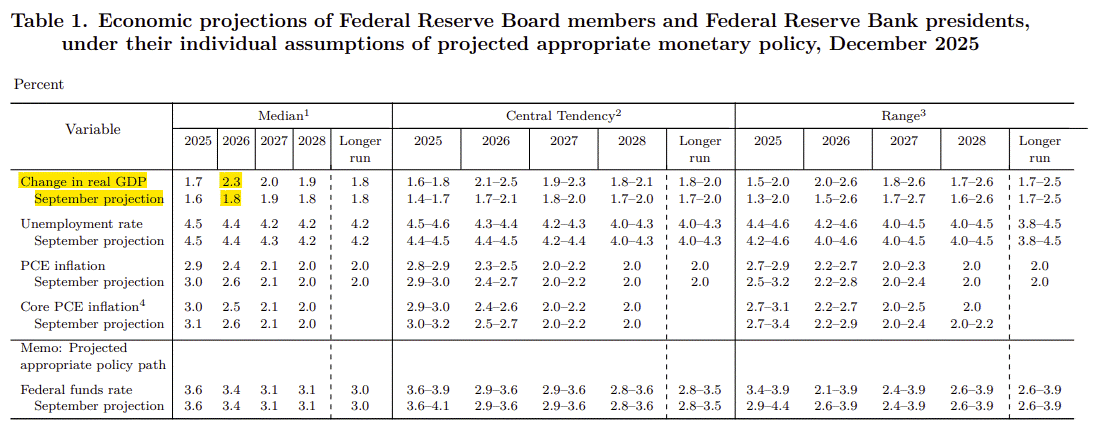

The Federal Reserve’s most recent Summary of Economic Projections (SEP) showed that Fed officials upgraded their median GDP growth forecast from 1.8% to 2.3%, reflecting a rebound from the government shutdown, higher productivity from AI investments, and strong corporate profits.

At the same time, projections for 2026 inflation were revised modestly lower while unemployment estimates were unchanged.

Recent economic data confirms these trends, and these developments have supported Value stocks and hard asset oriented positions.

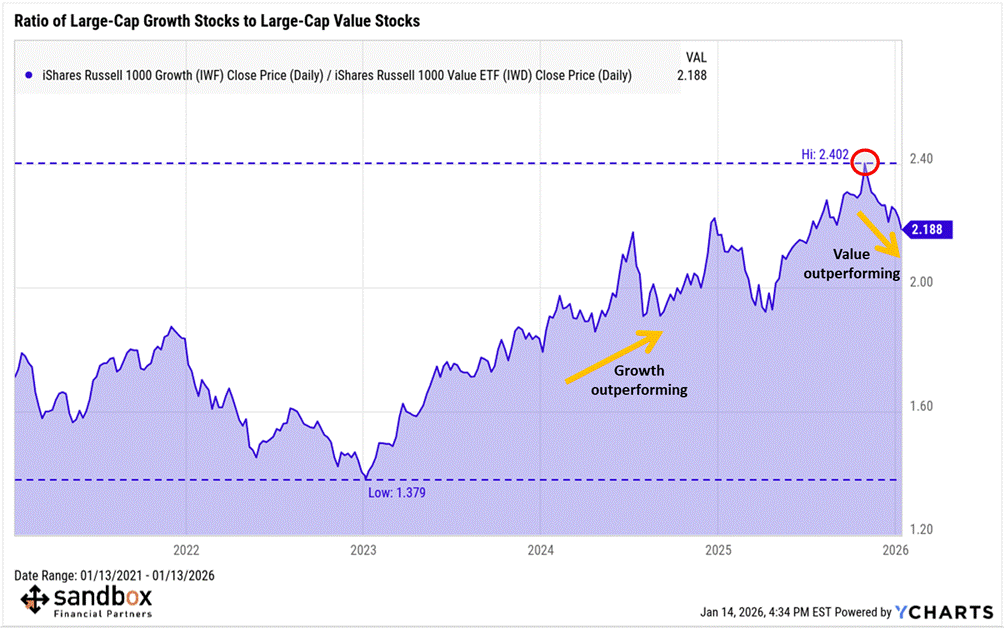

The logic behind the rotation is that if the economy is accelerating, then there is less justification to pay a premium for relatively expensive Growth stocks.

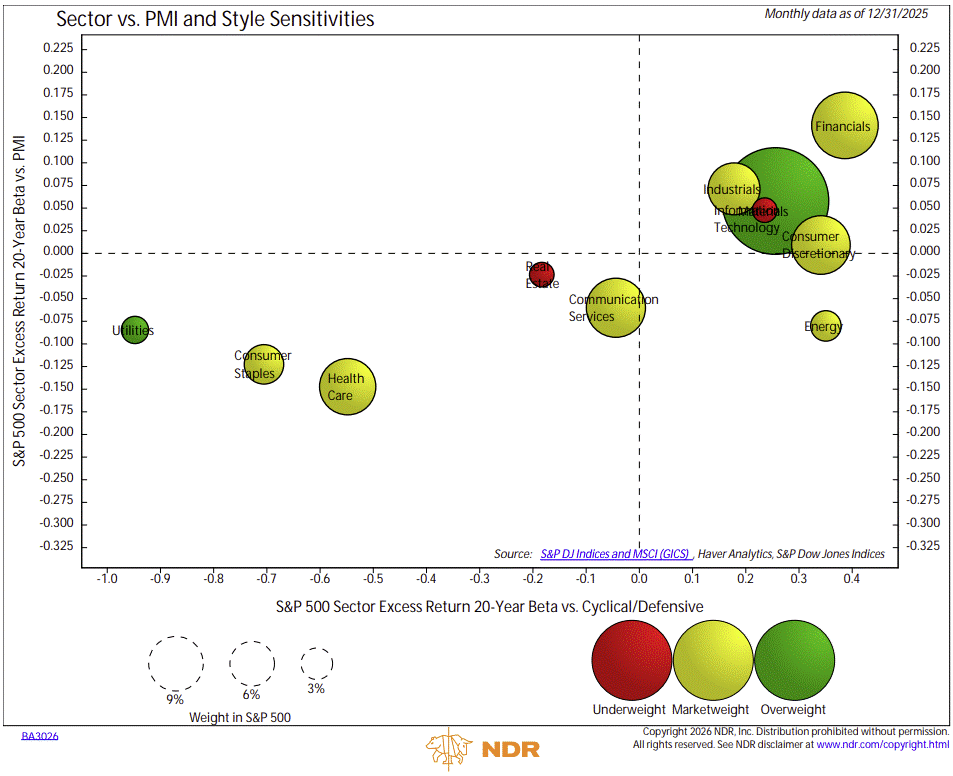

Cyclical sectors, including Financials, Industrials, Energy, and Materials, tend to be among the most positively sensitive to economic growth – using the Manufacturing Purchasing Managers’ Index (PMI) as a proxy.

The Value rotation began prior to the recent Fed meeting however, as AI CapEx spending commitments and ROI have come under more intense investor scrutiny.

The Russell 1000 Growth/Value ratio peaked all the way back on October 29.

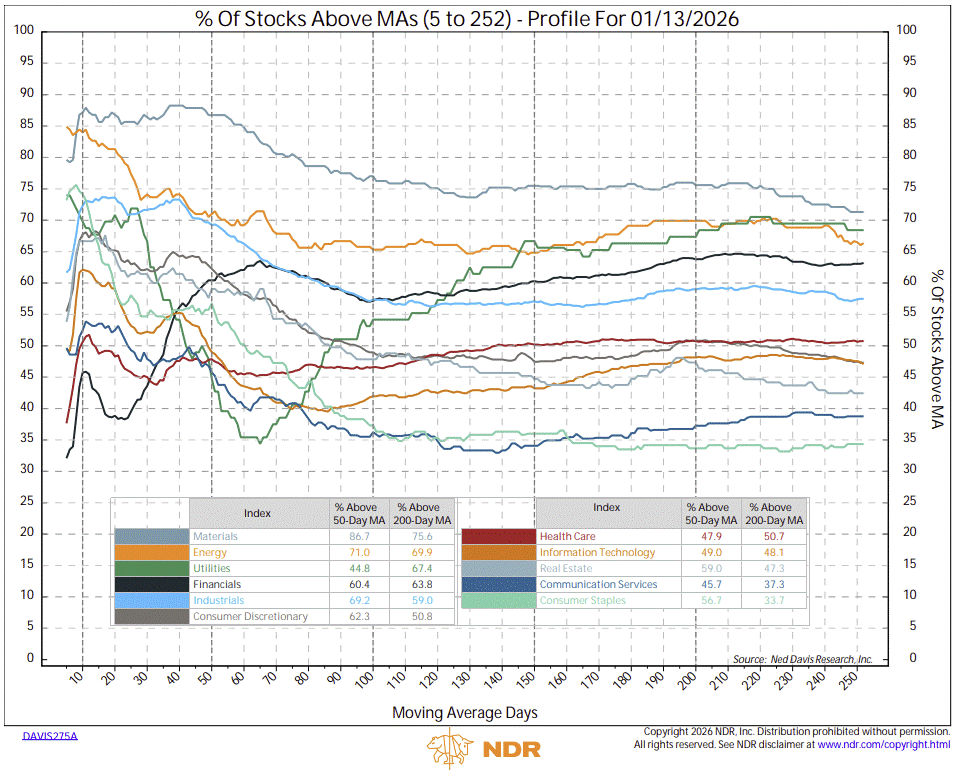

The burden of proof remains with Value as trends and breadth remain broadly constructive.

Will this market shift continue to have legs into 2026?

Something to keep in mind.

Sources: Federal Reserve, Ned Davis Research, YCharts

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)