A weekly dash around markets

The Sandbox Daily (8.19.2024)

Welcome, Sandbox friends.

After a week off, it is great to be back! Today we’re dashing our sunglasses and Piña Coladas for the charts and market data. Here is the family soaking up the final moments of summer.

Today’s Daily discusses:

a weekly dash around markets

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 +1.32% | Russell 2000 +1.19% | S&P 500 +0.97% | Dow +0.58%

FIXED INCOME: Barclays Agg Bond +0.11% | High Yield +0.16% | 2yr UST 4.072% | 10yr UST 3.875%

COMMODITIES: Brent Crude -2.48% to $77.70/barrel. Gold +0.19% to $2,542.6/oz.

BITCOIN: -1.07% to $59,082

US DOLLAR INDEX: -0.58% to 101.868

CBOE EQUITY PUT/CALL RATIO: 0.51

VIX: -1.01% to 14.65

Quote of the day

“By three methods we may learn wisdom: First, by reflection, which is noblest; Second, by imitation, which is easiest; and third by experience, which is the bitterest.”

- Confucius

A weekly dash around markets

The three major U.S. indexes finished higher last week for the market’s best week since October 2023. The S&P 500 and Nasdaq Composite benchmarks both posted their 1st winning week after four consecutive losses.

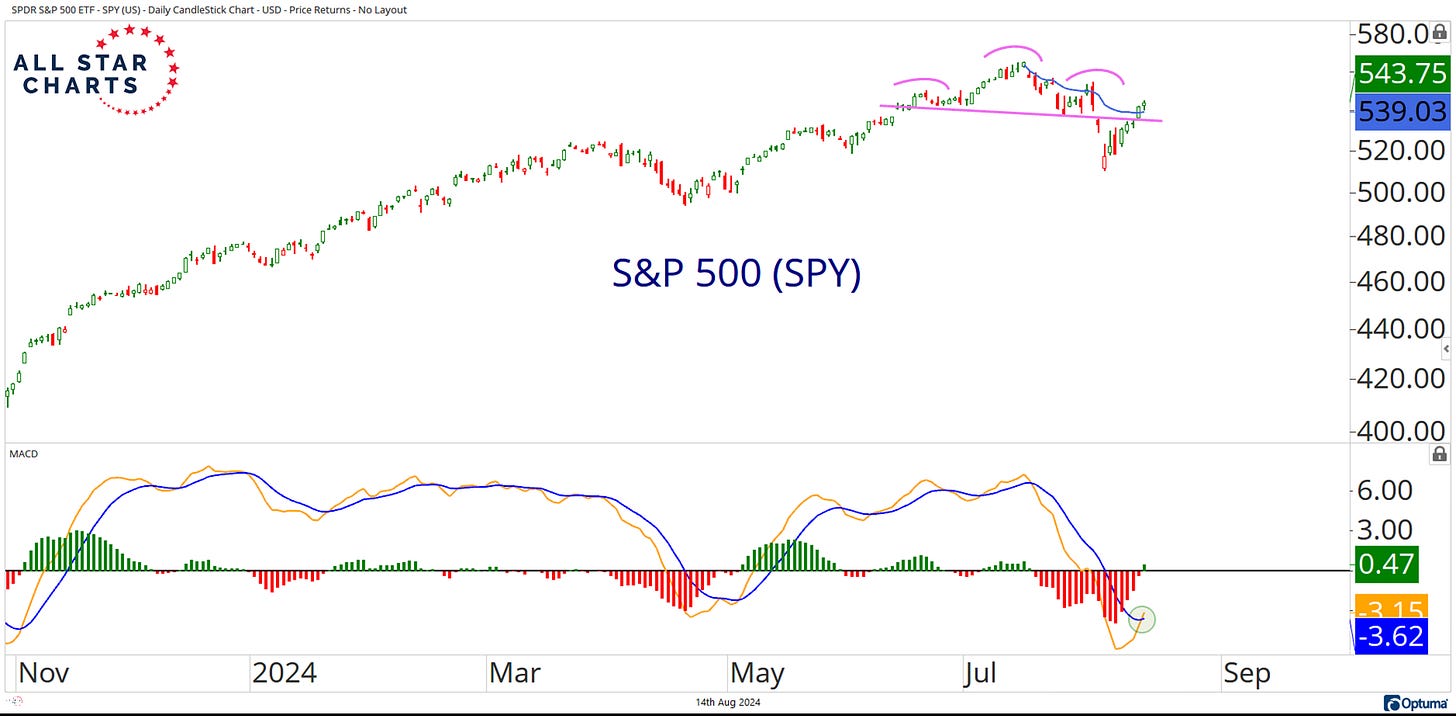

From a technical perspective, the S&P 500 index looks to be in much better shape after:

reclaiming its 50-day moving average

clearing the neckline of a Head and Shoulder topping pattern (purple lines below, purple lines top pane)

rising above the anchored-VWAP from the index’s all-time high (blue line, top pane)

While equities have rebounded strongly off those early August lows, the composition of the market is looking and acting a bit differently.

The high beta trend has broken down (although strongly rebounding), cyclical names have yielded to defensives, and marginal liquidity indicators like crypto are tracing out large top formations.

Since equities peaked in mid-July, much of the strength has come from traditionally defensive areas of the market like Utilities, Consumer Staples, and Healthcare.

Curiously, yields have not rallied alongside stocks even as credit spreads have tightened, suggesting a tighter liquidity environment is being priced into the market. After all, volume and liquidity are generally weak during this seasonal timeframe.

The acute mini-crisis in the Japanese yen appears to have calmed – being mainly structural in nature – as large speculators swung from massive net-short to net-long positions.

Meanwhile, Gold continues to slowly march to new highs.

Last week’s big macro report was inflation data which showed the Consumer Price Index (CPI) increased +0.2% in July, putting the 12-month inflation rate at 2.9% YoY and clocking its lowest level since March 2021. Core CPI, which excludes the more volatile categories like food and energy, now sits at 3.2% YoY.

A 0.4% increase in shelter costs was responsible for 90% of the all-items inflation increase. Remember, the Shelter component of official CPI is very out of step (strong) with what actual rents in the market are doing today (falling/steady) – due to lags in the collection and reporting of data – which has held many CPI measures artificially higher.

July’s inflation data confirms, again, the upward price spirals are a 2022 and 2023 problem – not 2024.

Looking ahead, this week Federal Reserve Chair Jerome Powell will give the keynote address (Friday at 10am ET) at the annual Jackson Hole retreat that attracts central bankers from around the world. The Federal Reserve has held this Economic Policy Symposium in Jackson Hole, Wyoming for more than 40 years now. The topic of this year’s conference is “Reassessing the Effectiveness and Transmission of Monetary Policy.”

Markets will closely watch for signals on the timing and pace of upcoming rate cuts. Recent positive economic data has lifted U.S. stocks, quelling recession fears. Most expect a rate cut at the September Fed meeting, though the size – either a quarter or half-percentage point – is still being debated.

Staying with the U.S. central bank, the Fed will release the minutes from the Federal Open Markets Committee (FOMC) July meeting on Wednesday, where Powell acknowledged inflation progress and kept the door open for a September rate cut.

Several Fed officials, including Christopher Waller and Raphael Bostic, will also speak this week – likely teeing up the market for a September rate cut, similar to what the Fed communicated last week.

The Democratic National Convention has arrived in Chicago, with a focus on boosting Vice President Kamala Harris' presidential campaign. The festivities kick off tonight with a speech by current President Joe Biden and will be billed as a passing of the torch to the party’s future.

As the race with Republican candidate Donald Trump tightens, Harris' policy positions – including her commitment to Federal Reserve independence – will be in the spotlight. Per the online prediction market/exchange PredictIt, Vice President Kamala Harris is currently leading the race.

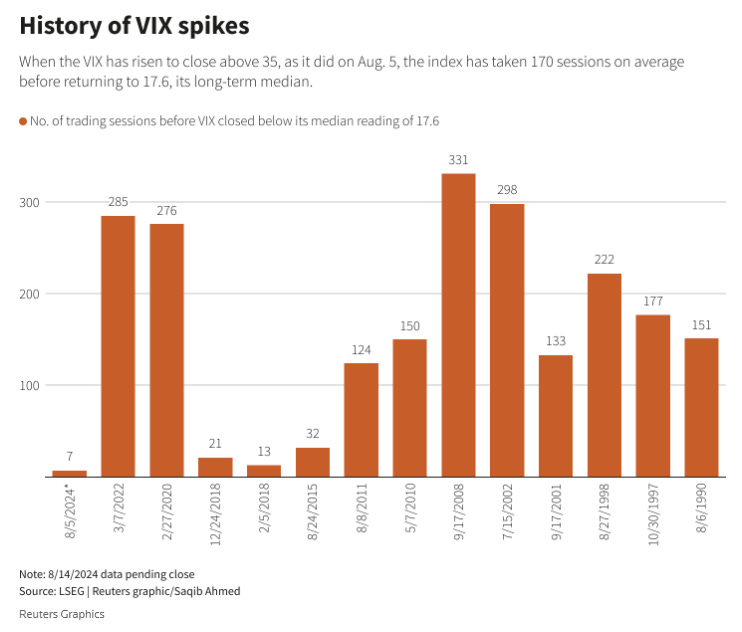

Finally, market fear as expressed by the CBOE Volatility Index (VIX) has completely collapsed.

The VIX hit an intra-day high of 65 on August 5th and closed at a 4-year high of 38.57. The seven trading sessions it took the VIX to return to its long-term median of 17.6 was the index’s fastest ever drop from 35.

After a week of vacation and some much-needed time away from the screens, I've been thinking about what we should do in response to big market news – such as Warren Buffett selling half of Berkshire Hathaway’s Apple position or the yen carry trade unwind over the last couple weeks. How should investors respond to market turbulence? What portfolio moves make sense?

The answer?

In most cases, nothing.

In our world of fast information, social media, and phone notifications constantly dinging, it’s tempting (and perhaps even instinctive) to react immediately. But when it comes to investing, making decisions based on headlines can be a risky move. In other words, market news does not always require action. Sometimes we all must remember: “don’t just do something, stand there!”

For long-term investors, it’s important to keep a clear and objective understanding of your financial goals and time horizons. Big market news can trigger emotional responses, such as panic and excitement, that can lead to poor decisions like selling out of fear during a downturn or buying in a frenzy when the market is overheated.

Days like Monday, August 5 will surely shake the average investor’s confidence. Don’t let that be you.

Simply put, keep a cool head and rise above the day-to-day noise.

Also, by building a diversified portfolio, you can help mitigate risks throughout the market cycle while keeping up with your long-term goals.

Sources: Sam Gatlin, The Chart Report, YCharts, RenMac, Financial Times, Barron’s, Kansas City Fed, PredictIt, CNBC, Reuters, Genuine Impact

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.