Activate: market correction mode, plus 3rd quarter earnings, U.S. dollar, and the week in review

The Sandbox Daily (10.27.2023)

Welcome, Sandbox friends.

Today’s Daily discusses:

S&P 500 enters correction

3rd quarter earnings update

is the U.S. dollar the tell?

the week in review

Tough week in markets - let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 +0.50% | S&P 500 -0.48% | Dow -1.12% | Russell 2000 -1.21%

FIXED INCOME: Barclays Agg Bond -0.03% | High Yield -0.12% | 2yr UST 5.006% | 10yr UST 4.845%

COMMODITIES: Brent Crude +2.34% to $89.99/barrel. Gold +0.07% to $1,988.6/oz.

BITCOIN: -1.03% to $33,840

US DOLLAR INDEX: -0.03% to 106.573

CBOE EQUITY PUT/CALL RATIO: 0.77

VIX: +2.85% to 21.27

Quote of the day

“What is it that drives prices in the markets? Is it intrinsic value? The present value of future cash flows, the pace of earnings acceleration, dividend and buyback policies? Is it economic growth, interest rates, or manufacturing activity?

Each of these plays an important role in building an investment outlook, but the truth is, they don’t make prices move. Not directly. The reality is more simple than that. Prices move based on changes in supply and demand, or put another way, on peoples’ decisions to buy or sell securities.”

- Austin Harrison, CFA and CMT, Grindstone Intelligence

S&P 500 enters correction

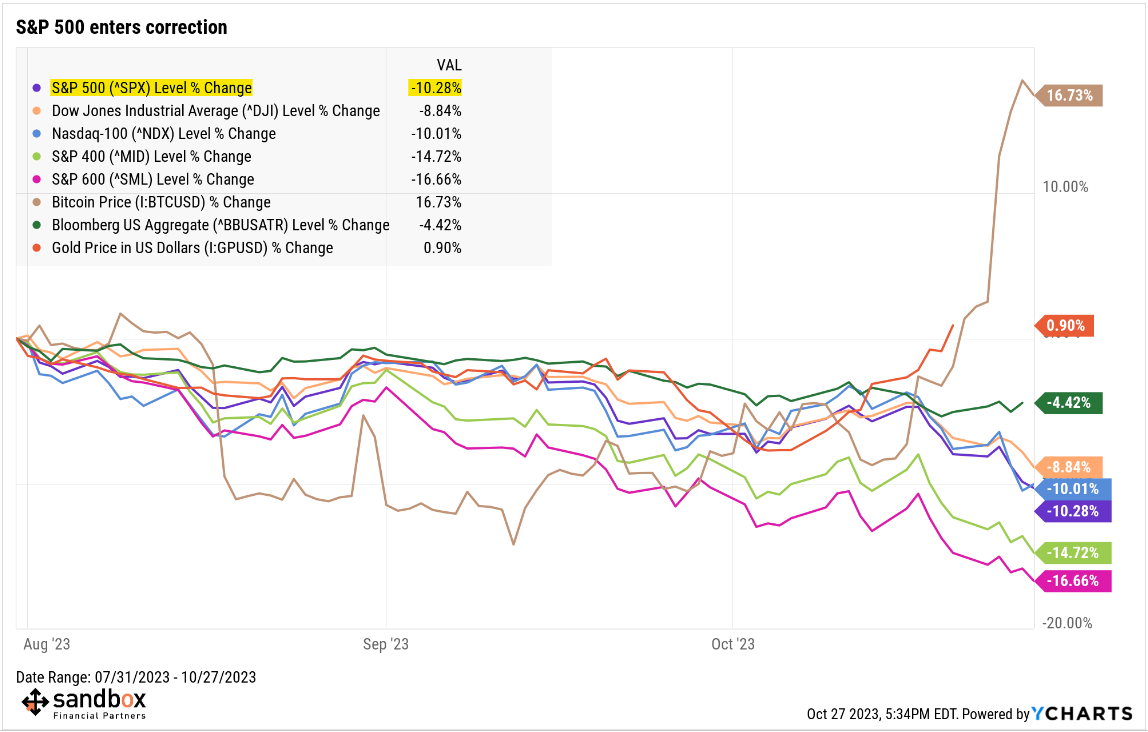

The bears have regained control of this market, with the S&P 500 index now officially off 10% from the July 31 closing high of the year.

Here’s price action of major indexes and asset classes since July 31st:

It’s important to provide some necessary context, though, before fear creeps into the collective frontal lobe of the investing community.

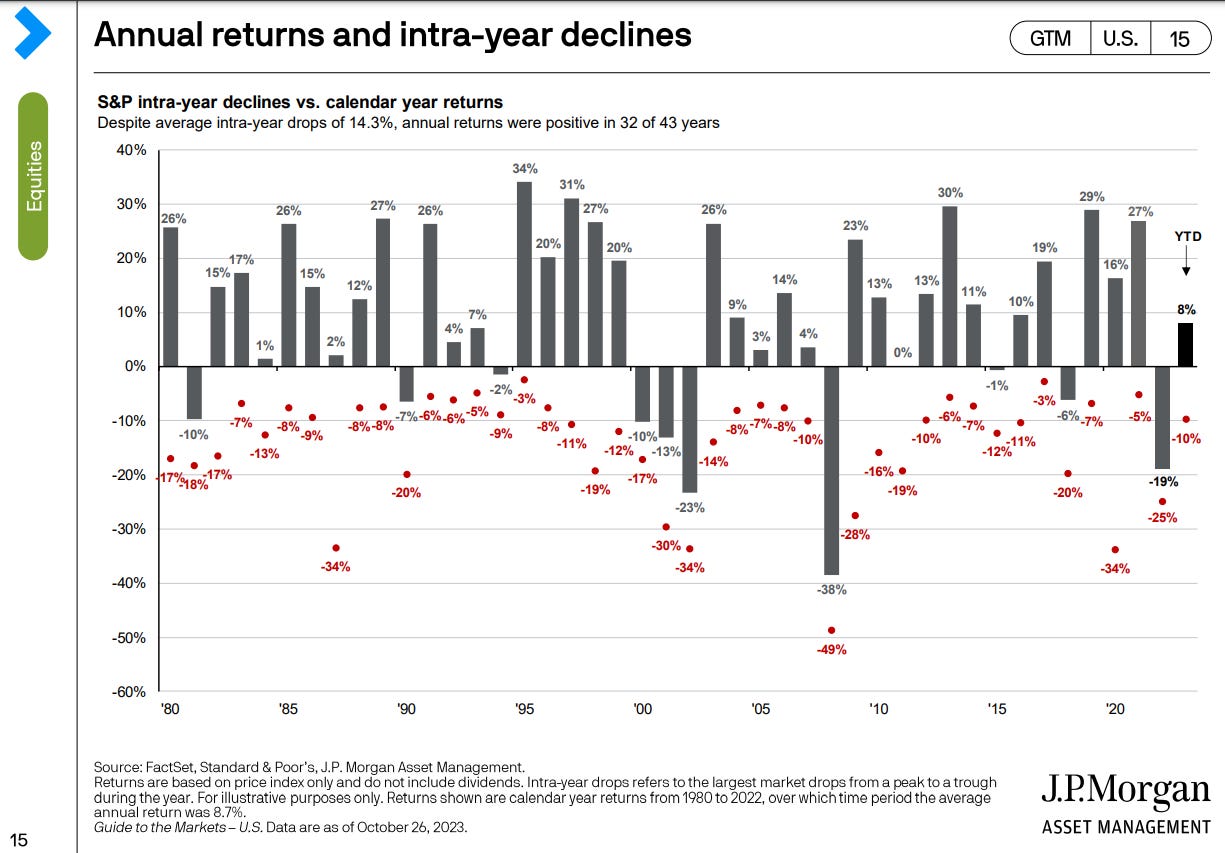

Since 1980, the S&P 500 has averaged a peak-to-trough decline of 14.3% each year. And despite those intra-year declines, stocks managed a positive return in 32 of those 43 years.

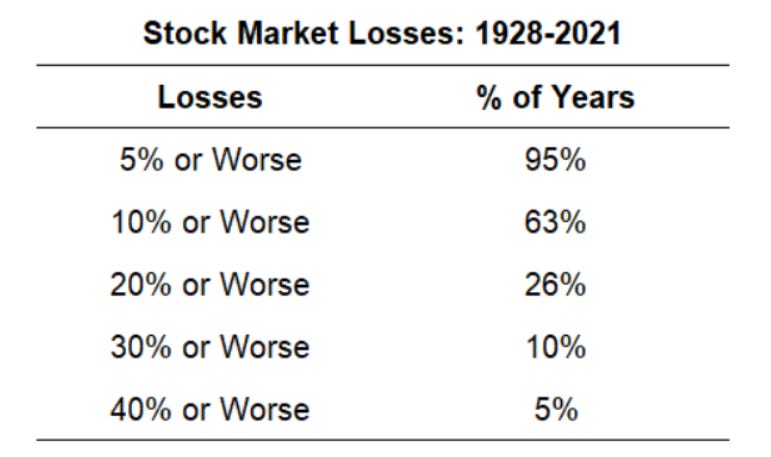

But that is just the average across the last 43 years, not telling us the frequency of different drawdowns. After all, a 5% or 10% correction is a very different psychological experience than say a 15% or 20% drawdown.

This next chart from Ben Carlson, CFA shows us how often the U.S. stock market has experienced the following losses during a calendar year:

This tells us we should expect a double-digit correction at some point during a calendar year roughly two-thirds of the time.

Using a slightly different approach, the Capital Group quantified how often we experience different levels of drawdown. Their data suggests we will experience a double-digit drawdown about once per year, 15% drawdown once every three-and-a-half years, and a 20% bear market every six years.

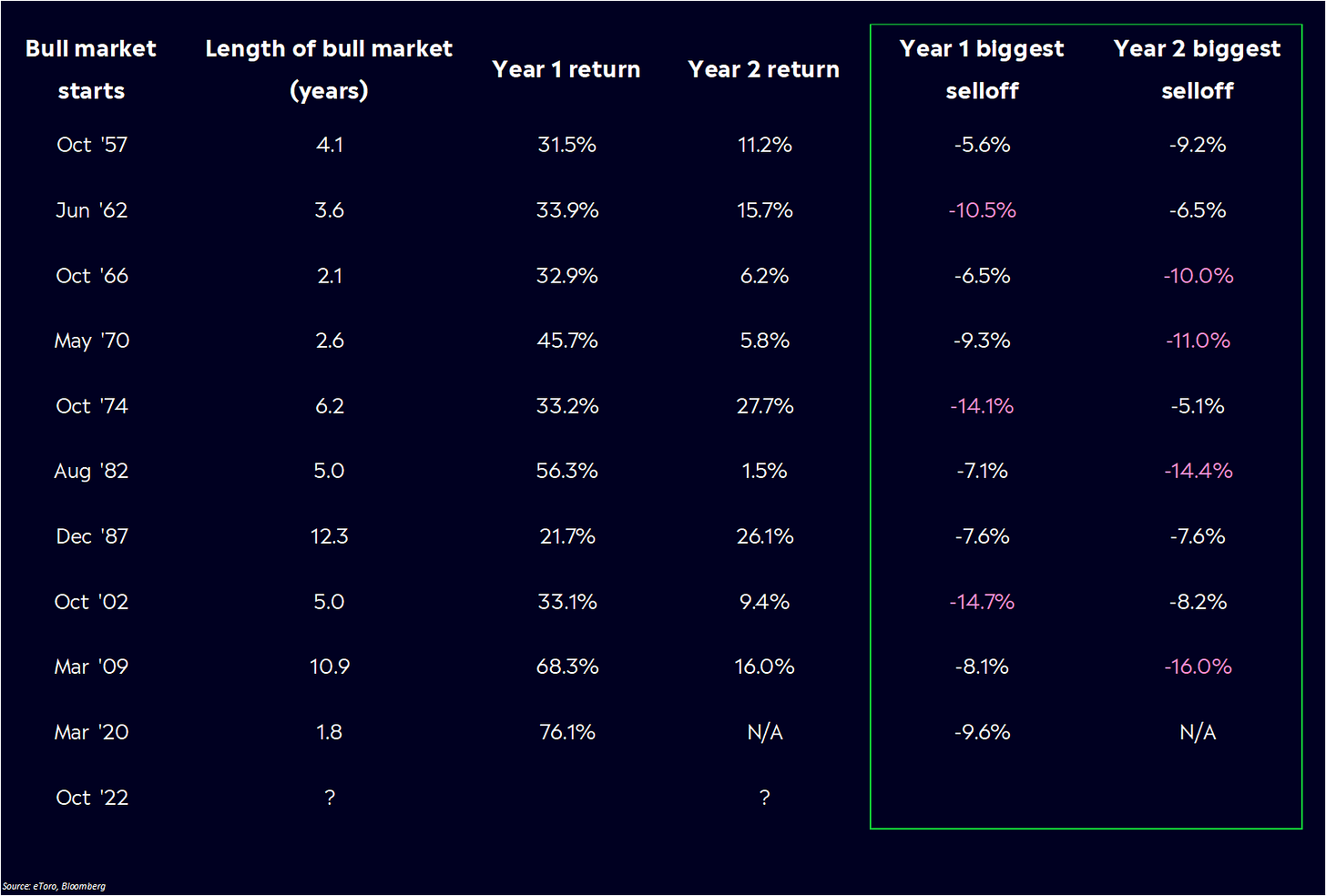

And given we are now entering year 2 of this bull market off the October 2022 lows, it’s worth noting that 7 of the last 10 bull markets overcame at least one 10% correction during its first two years – so this latest indigestion does not necessarily mean the bull is already finished.

Market drawdown are never fun, but they are perfectly normal and allow investors to accumulate additional shares at lower prices.

Source: JPMorgan Guide to the Markets, A Wealth of Common Sense, Capital Group, Callie Cox

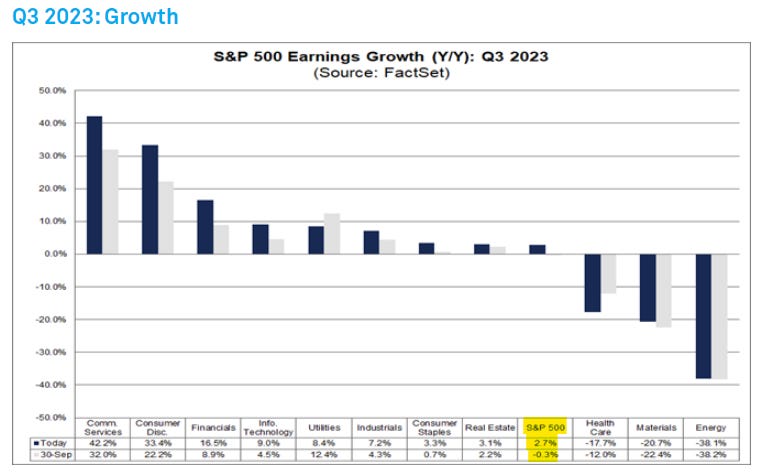

3rd quarter earnings update

Earnings had an up-and-down week with something for everyone, despite much of the widely-tracked mega-cap tech names printing mostly solid results. Unfortunately, this is a tough market backdrop for beats and an even nastier environment for misses.

Of the 234 companies that have reported so far (47% of the S&P 500 index), 79% are beating estimates and those that “beat” are beating by a median of 7%.

This 79% beat rate is above the 5-year average of 77% and 10-year average of 74%.

The blended earnings growth for the 3rd quarter is +2.7% as of today, which is the first quarter of YoY earnings growth since the 3rd quarter of 2022.

Since reporting began (September 30), positive earnings surprises are being driven by the Communication Services, Consumer Discretionary, and Financials sectors.

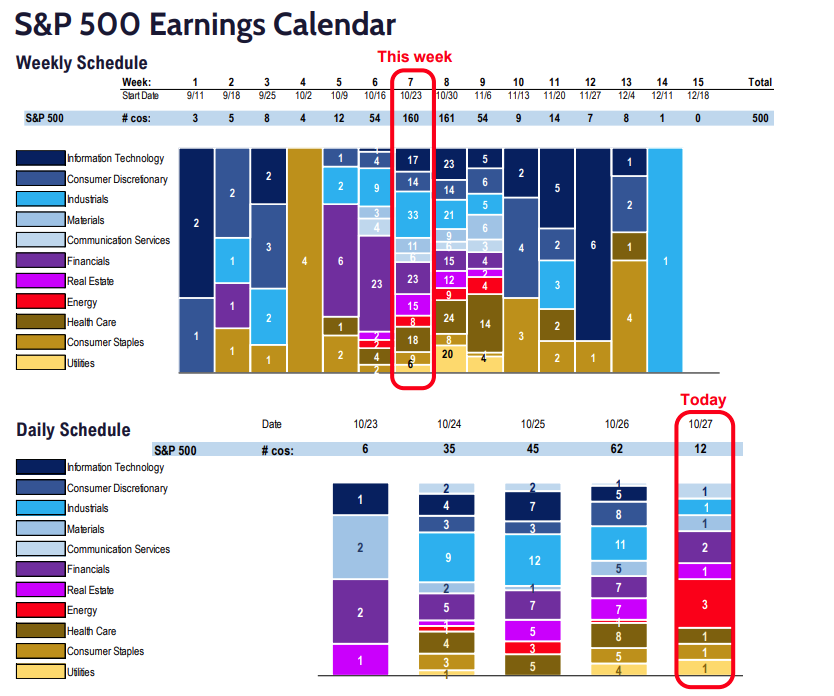

After 160 companies reported results this week, next week is another big one for markets with another 161 companies reporting earnings:

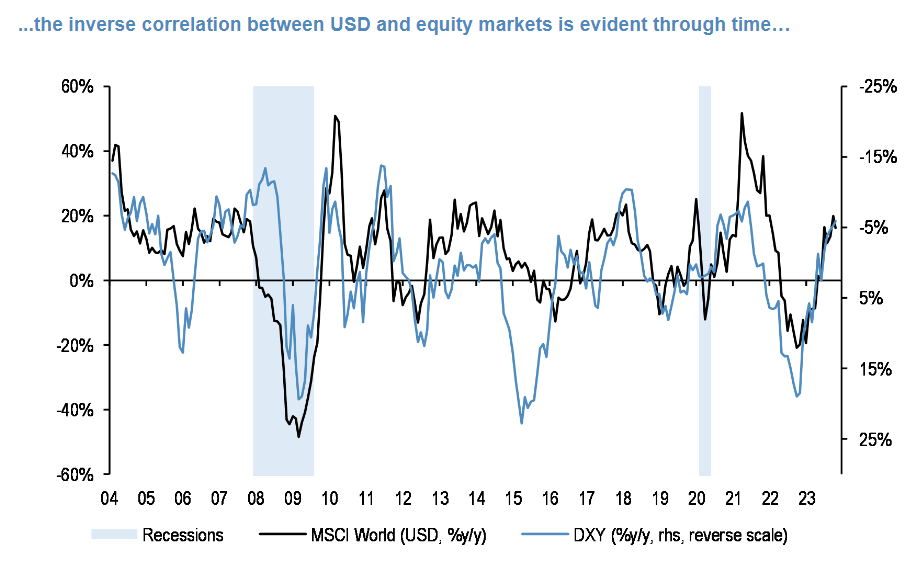

Is the U.S. dollar the tell?

Last October the U.S. dollar peak coincided with the equity market bottom, while the recent low in the dollar index marked the peak in stocks over the summer.

When looking at this relationship over the last 20 years, the inverse relationship between the U.S. dollar and equities is unmistakable.

Paying attention to market signals like any upcoming weakness from the dollar may be very informative for equity investors.

Source: J.P. Morgan Markets

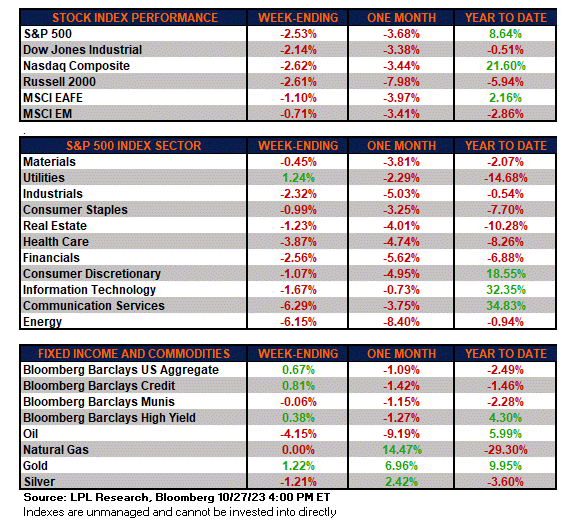

The week in review

Talk of the tape: The green shoots that sprouted at the beginning of October are nowhere to be found.

The S&P 500 index dropped -2.4% last week and another -2.5% this week, wiping out the summer rally and taking the index back to May prices. The Dow Jones Industrial Average has now erased its year-to-date gains. Small-caps continue to be the laggard. Meanwhile, interest rates are consolidating after a major ascent higher, with the 10-Year Treasury yield oscillating around 4.8-4.9%; benchmark mortgage rates are climbing above 8%. Precious metals have offered investors a safe haven this month, with gold and silver both positive in October. VIX has continued to expand, making higher highs and higher lows, off the September bottom.

The futures markets are pricing in almost no chance of another interest rate hike at the November FOMC meeting. That comes after Fed Chair Jerome Powell spoke last week, reinforcing the Fed's resolve to control inflation, but acknowledging the impact that higher long-term interest rates are having on financial conditions. Powell has often repeated the same message that it will likely take a period of below trend economic growth for inflation to reach the Fed's 2% target. Below trend growth, however, is not what we got in Q3: the U.S. economy grew at +4.9% annualized as consumer demand rebounded.

Stocks: The market-cap weighted S&P 500 index officially entered a correction with today’s rout, while the equal-weight S&P 500 index printed fresh 52-week lows.

According to the most recent AAII Sentiment Survey, the percentage of bullish investors declined from 34% to 29%, below the historical long-term average of 37.5%. This week bearish investors jumped to 43%, above the historical average. The overall report reflects bearish market sentiment amid a backdrop of a high 10-year yields, some sticky components of inflation, and geopolitical turmoil.

Bonds: Bond investors would rather not look at their October statements as the carnage in rates markets has been extremely tough.

Commodities: Commodities had a mixed week as investors digest strong economic growth in the United States, the risk of a Federal Reserve response, and a dangerous geopolitical crisis in the Middle East.

Source: Dwyer Strategy, LPL Research

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

great report -thank you!