AI adoption, plus bonds and Michigan football, alternative investments, cash/cash alternatives, and the week in markets

The Sandbox Daily (8.25.2023)

Welcome, Sandbox friends.

Today’s Daily discusses:

identifying long-term beneficiaries of AI adoption

bonds: large speculators/hedge funds vs. everyone else

insights into Alternative Investments

opportunities outside the peak rates in cash/cash alternatives

a brief recap to snapshot the week in markets

Annapolis sunsets are the crème de la crème.

It’s summer Friday, folks – get out there and have a great weekend. Work hard, play hard !!

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 +0.85% | Dow +0.73% | S&P 500 +0.67% | Russell 2000 +0.40%

FIXED INCOME: Barclays Agg Bond -0.06% | High Yield +0.42% | 2yr UST 5.082% | 10yr UST 4.233%

COMMODITIES: Brent Crude +1.54% to $84.64/barrel. Gold -0.29% to $1,941.5/oz.

BITCOIN: -0.24% to $26,003

US DOLLAR INDEX: +0.21% to 104.204

CBOE EQUITY PUT/CALL RATIO: 0.79

VIX: -8.84% to 15.68

Quote of the day

“As is often the case, we are navigating by the stars under cloudy skies. In such circumstances, risk-management considerations are critical.”

- Jerome Powell, Chairman of the Federal Reserve today on Inflation: Progress and the Path Ahead

Identifying long-term beneficiaries of AI adoption

Goldman Sachs released a note to clients earlier this week identifying potential long-term beneficiaries of AI adoption in what they called “The (AI) trade after the trade.”

Goldman grouped the stocks across 3 buckets:

Enablers (makers of semiconductors and related equipment needed to build AI technology): NVDA, MRVL, CRDO

Hyperscalers (mega-caps using their extensive cloud computing infrastructures to commercialize AI on a large scale): MSFT, GOOGL, AMZN

Empowered users (tech companies leveraging AI technology to amplify their businesses): META, CRM, ADBE, NOW, INTU

An equal-weighted basket of these 11 stocks has returned 69% YTD, far outpacing the equal-weight S&P 500 (+7%) by 62% !

Earnings estimates for some stocks have already started to reflect this AI boom. All 11 companies have experienced positive EPS revisions since March 31st, in contrast to a 1% decline for S&P 500 EPS estimates.

The broader, longer-term benefit from AI adoption will accrue to companies as they harness AI to improve productivity -> leading to greater revenues, higher margins (via lower labor costs), or some combination of both. The timing of AI adoption is highly uncertain, but Goldman expects it will likely begin to have a meaningful macro impact some time between 2025 and 2030.

“Firms employing a large number of knowledge workers (i.e. financial, information, and other technical fields) and in administration-heavy sectors (i.e. education and healthcare) likely have the most to gain from AI adoption.”

Source: Goldman Sachs Global Investment Research

Bonds: large speculators/hedge funds vs. everyone else

The outlook for the bond market is murky, at best – the same feeling I get every August from my alma mater in football. Do we beat Ohio State this year or not??!?! (Go Blue !!)

I find it quite interesting to see large speculative players on one side of the bond market (expect rates to move higher), while asset managers and longer-term investors are on the other side (expect rates to move lower).

Large speculators/hedge funds haven't pulled back on their net short positions in 2-yr Treasury bonds. In fact, these players are massively short and the size of the trade is hovering near multidecade lows. In fact, this seems to be quickly becoming the crowded trade.

Yet, on the other side of the table, investors are increasing their Treasury positions as rates increase. Asset managers, as tracked in Commitments of Traders (COT) data, are currently long 10-year Treasury futures to the greatest extent since the Global Financial Crisis, meaning that they are positioned for bond prices to rise and yields to fall.

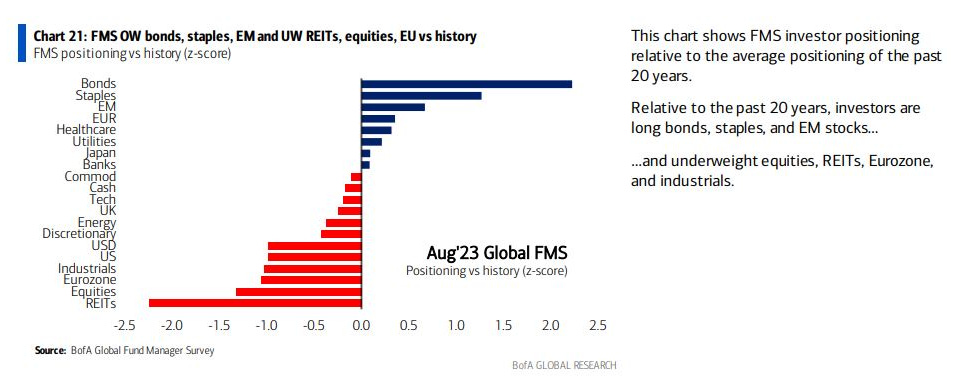

In fact, a recent Bank of America Global Fund Manager Survey confirms as much for your average fund manager. More bonds and less stocks…

So which is it?

Source: Liz Ann Sonders, John Authers, Larry Tentarelli, Commitments of Traders

The good and bad of alternative investments

iCapital recently surveyed 400 registered financial professionals to explore the dynamics of alternative investments in today’s investment landscape and client portfolios.

The findings revealed the use of alternative investments is on the rise, with 95% of all survey respondents indicating they plan to begin, maintain, or increase allocations to alternative investments in the coming year.

Advisors highlight many advantages when it comes to incorporating alternative investments in their clients’ portfolios, with diversification cited as the overwhelmingly top benefit:

On the flip side, survey respondents offered their opinions on the various challenges with this broad asset class, citing the lack of liquidity, high fees, and strategy complexities as the top barriers to implementing alternative investments:

Alternative investments are increasingly becoming a core component in individual investor allocations. Expect more, not less, of these strategies to emerge in the financial services industry and across client portfolios.

Source: iCapital

Opportunities outside the peak in cash/cash alternative rates

Throughout history, peak yields for cash and cash alternatives have not persisted, while other fixed income investments and the stock market have typically outpaced the return on cash.

Source: J.P. Morgan

The week in review

Talk of the tape: The highly anticipated speech from Fed Chairman Jerome Powell at the Kansas City Fed’s Jackson Hole Economic Symposium came and went this morning without major fanfare – a good thing. The Fed is prepared to raise rates further if appropriate and intends to hold policy at a restrictive level until it is confident that inflation is moving sustainably down toward its objective. Given how far the economy has come, the Fed is in a position to proceed carefully and will assess incoming data and the evolving outlook/risks at upcoming meetings. The Fed's 2% inflation target is and will remain the target level. No mention of the word “pain” like 2022. Bottom line: no surprises, not overly hawkish, and seemingly in line with market expectations. Bravo, chairman!

Soft-landing expectations are the key driver of the bullish narrative. Disinflation traction cited as another tailwind. Consumer resilience, although showing some signs of fatigue, continues to be a higher-profile bright spot. The 2H23/2024 earnings rebound and record amount of money market assets on the sidelines flagged as some of the other bullish drivers.

Technicals, liquidity headwinds, the lagged effects of policy tightening, and extended valuations are talking points among the bearish narrative. The higher-for-longer Fed another overhang as markets reprice Fed Funds Rate expectations for year-end 2023 and 2024. Seasonal headwinds shouldn’t be dismissed. The recent macro data reported from China confirm the risk to global growth.

Stocks: After several weeks of decline, the major U.S. indexes ended the week mixed. Flow data highlighted a 3rd straight week of outflows from U.S. equities and continued inflows into Treasuries. As discussed in yesterday’s Daily note, equity sentiment and positioning have deteriorated recently.

Bonds: The Bloomberg Aggregate Bond Index ended the week slightly up, reversing 5 straight weeks of declines amidst another tough stretch for bond investors.

Commodities: Oil prices ended lower, while the major metals (gold, silver, and copper) finished the week positive.

Source: LPL Research

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.