AI isn’t displacing jobs yet – but the data is about to change

The Sandbox Daily (1.28.2026)

Welcome, Sandbox friends.

Today’s Daily discusses:

AI isn’t displacing jobs yet – but the data is about to change

Let’s dig in.

Blake

Markets in review

EQUITIES: Nasdaq 100 +0.32% | Dow +0.02% | S&P 500 -0.01% | Russell 2000 -0.49%

FIXED INCOME: Barclays Agg Bond -0.04% | High Yield -0.16% | 2yr UST 3.575% | 10yr UST 4.247%

COMMODITIES: Brent Crude +1.63% to $68.67/barrel. Gold +3.88% to $5,418.3/oz.

BITCOIN: -0.24% to $89,148

US DOLLAR INDEX: +0.13% to 96.341

CBOE TOTAL PUT/CALL RATIO: 0.76

VIX: 0.00% to 16.35

Quote of the day

“If you’re serious about change, you have to go through uncomfortable situations. Stop trying to dodge the process. It’s the only way to grow.”

Job losses from AI

When will job losses from AI start showing up in the data? To what degree will companies replace workers with artificial intelligence or at least hold off on new hires?

These questions are coming up constantly these days, from the water cooler to the board room.

To date, we know artificial intelligence has played only a small role in the slowdown in job growth thus far.

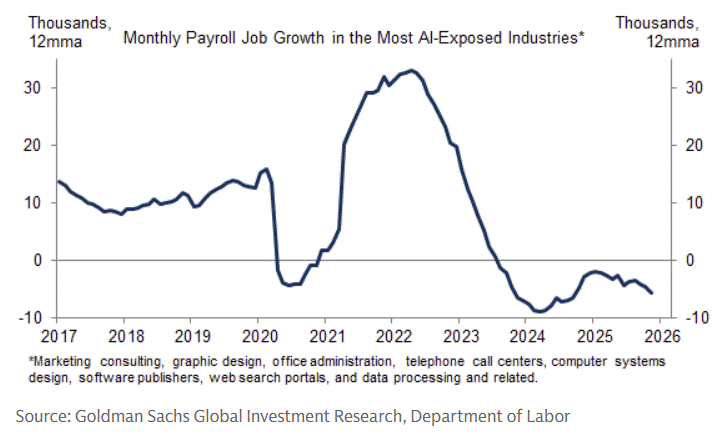

Goldman Sachs estimates that AI accounts for net job losses of 5-10k per month in the subindustries shown where the technology is most ready to deploy. Think call centers, marketing, software, data processing, administration, etc.

But, I think these numbers are too small. At least in the coming 2-5 years.

AI has the potential to eventually automate a large share of job tasks and displace as much as 5-10% of current jobs according to a wide swath of estimates, specifically to white collar industries where previous technological revolutions have never truly threatened their status quo.

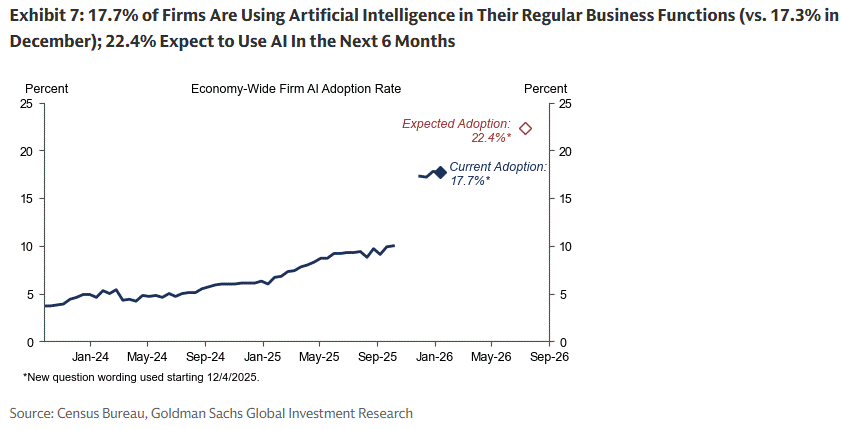

AI adoption increased last year to 17%, especially in areas where work tasks are more exposed to AI automation, and many companies appear eager to implement AI to reduce labor costs. Expect these reported number to only turn higher.

Given emerging evidence that AI (when appropriately deployed) can deliver significant efficiency gains and recent corporate commentaries suggest that AI automation raises the bar for hiring for new roles, I anticipate widespread adoption will lead to meaningful labor displacement.

Productivity gains, labor cost reductions, and better customer service cannot be ignored for too long.

As a result, I’d expect to see a more meaningful decline in employment in these industries as adoption rates and automation ramps higher, though this should be partly offset by AI-related job gains in other areas.

Sources: Goldman Sachs Global Investment Research, Census Bureau

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)