Aligning financial priorities, plus savings account rates, jobs, and We(NoLonger)Work

The Sandbox Daily (11.1.2023)

Welcome, Sandbox friends.

Today’s Daily discusses:

aligning your financial priorities

savings account rates remain abysmal

JOLTS show labor market still out of balance

We(NoLonger)Work

Goodbye, SoberOctober – it’s been real. If I could sum up the last month in one word: productive.

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 +1.77% | S&P 500 +1.05% | Dow +0.67% | Russell 2000 +0.45%

FIXED INCOME: Barclays Agg Bond +1.11% | High Yield +0.95% | 2yr UST 4.952% | 10yr UST 4.742%

COMMODITIES: Brent Crude -0.07% to $84.96/barrel. Gold -0.30% to $1,988.3/oz.

BITCOIN: +1.23% to $35,354

US DOLLAR INDEX: -0.02% to 106.660

CBOE EQUITY PUT/CALL RATIO: 0.82

VIX: -7.00% to 16.87

Quote of the day

“To build wealth it didn’t matter when you bought U.S. stocks, just that you bought them and kept buying them. It didn’t matter if valuations were high or low. It didn’t matter if you were in a bull market or a bear market. All that mattered was that you kept buying.”

- Nick Maggiulli, Just Keep Buying

Aligning your financial priorities

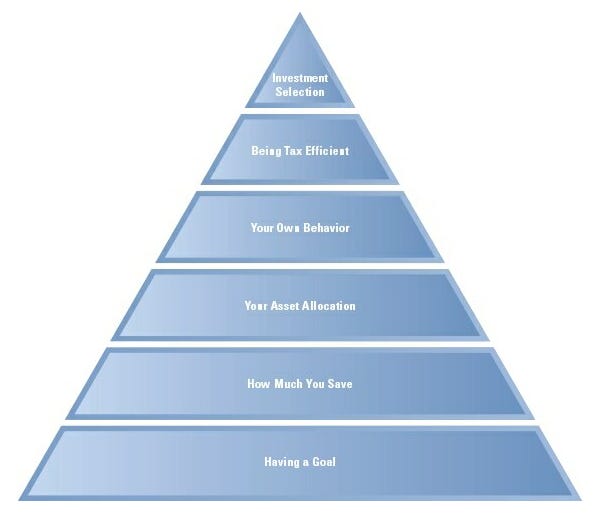

"Make sure you're not geeking out about small-bore investment problems while giving short shrift to the game-changers."

Morningstar’s Christine Benz makes a good point. There are so many facets to personal finance that it can be easy to end up focusing on decisions that, at the end of the day, won't have a significant impact, while simultaneously overlooking topics that carry much more weight.

That's why it’s important to review a pyramid such as the one below to illustrate the relative importance of personal finance topics, with the foundation being of greatest importance.

Perhaps your financial pyramid assumes a different order and that’s ok – prioritize what works best for you because every household and situation is different.

Source: Morningstar

Savings account rates remain abysmal

In October, the average U.S. savings account interest rate was 0.46% (sample of banks are listed below).

This interest rate falls significantly short of the 5.5% Fed Funds rate – causing savers to look elsewhere to take advantage of higher rates.

Many savers have moved cash into money market funds, a popular alternative to CDs and bank accounts that invest in various low-risk, interest-paying assets like U.S. Treasury, corporate, and mortgage-backed security bonds.

In fact, total assets sitting in money market funds has reached a record $5.9T.

In October 2023, the 100 largest money market mutual funds averaged a yield of 5.19%. It was 4.05% just last December.

Here is the average Treasury yield paid inside Money Markets over the last few years:

If you are sitting on piles of cash in a savings account, do yourself a favor and review the interest rate you are getting paid.

If these dollars are not needed for living expenses, emergency funds, or goals within the next 6-12 months, please seek out an alternative that pays more than a 0 or 1 handle.

Source: Business Insider, Crane Data, St. Louis Fed

JOLTS show labor market still out of balance

Each month, we turn to the Labor Department's Job Openings and Labor Turnover Survey (JOLTS) to understand the ebbs and flows of what's really happening among businesses and their workers.

Job openings was little changed in September, rising by less than 1.0% from the prior month to 9.6 million. This measure has declined since hitting the cyclical peak of 12.0 million in March 2022 when the Federal Reserve initiated its tightening cycle, but the number of job openings still remains ~35% higher than pre-COVID. Despite the ongoing progress over the course of this cycle, the labor market is still out of balance.

The report showed that the ratio of job openings to unemployed Americans ticked up marginally to 1.50 from 1.49 in the prior month (orange line below) – well below the cycle peak of 2.1 but still significantly higher than the general pre-pandemic levels and the 1.23 level in February 2020.

Elsewhere, the Quits Rate was unchanged at 2.3%, down from a peak of 3.0% earlier in this cycle and in line with the pre-pandemic rate.

The Fed is closely watching the progress of labor demand/supply rebalancing. Persistent strength in the job market, however, could lead the Federal Open Market Committee to pursue another rate hike at their next meeting in 41 days on December 13th.

Source: U.S. Bureau of Labor Statistics, Ned Davis Research, Bloomberg

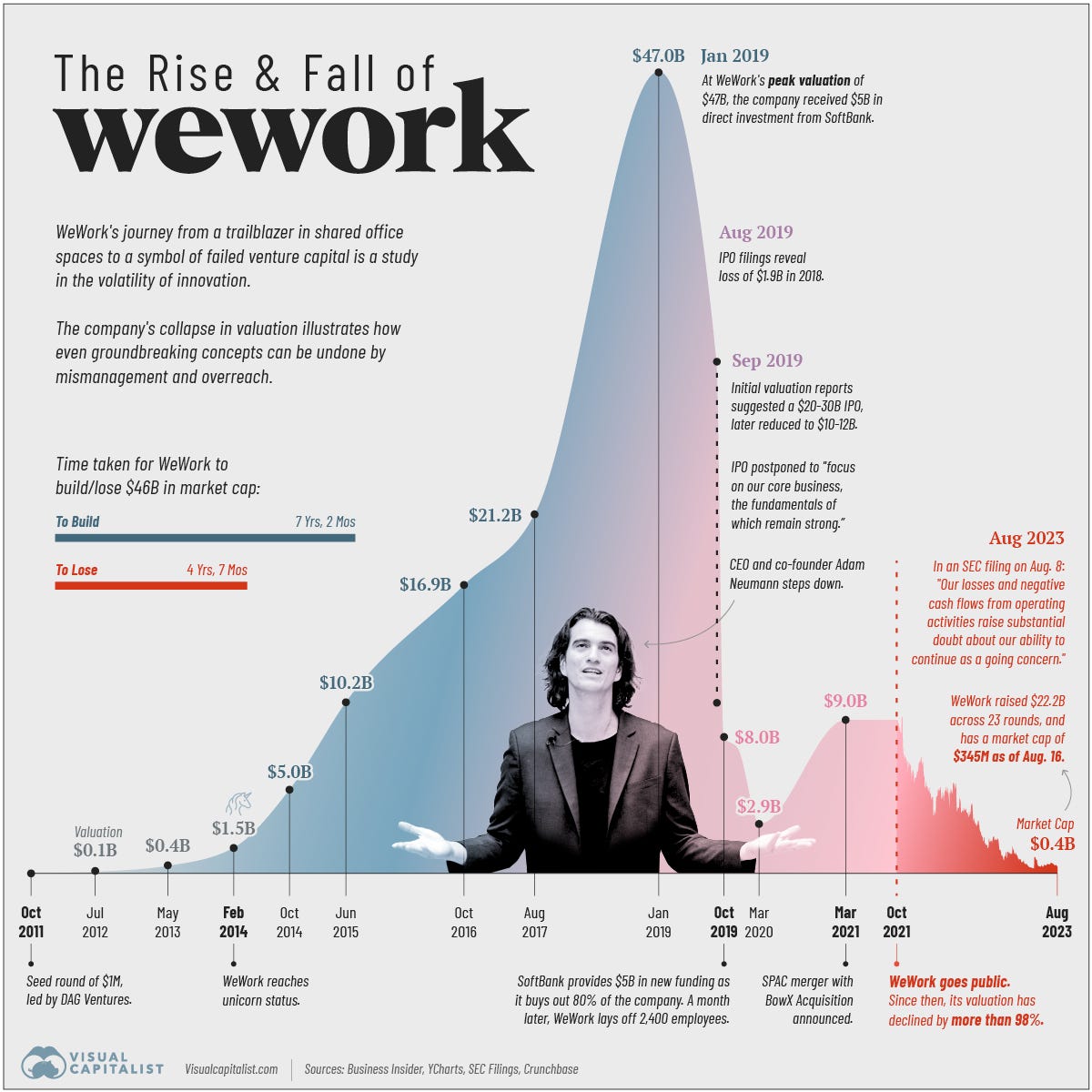

We(NoLonger)Work

WeWork plans to file for Chapter 11 bankruptcy as early as next week, a stunning reversal for the flexible workspace company that was once a darling of the venture-capital community.

As of June, WeWork maintained 777 locations across 39 countries, including 229 locations in the United States.

At its pinnacle, WeWork was valued at $47 billion.

Roughly $13 billion of investor capital has been invested in WeWork since inception, mostly by Softbank who has taken a major credibility hit with this massive writedown.

Note the table below excludes an additional $3 billion in Softbank secondary transactions and $1.8 in debt financing.

WeWork stock is down from over $500 to $1 since 2021, with a current market cap of ~$60 million.

Source: TechCrunch, Washington Post, Reuters, Visual Capitalist, Ian Hathaway

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

cheers