All 👀 on a key recession indicator, plus 🧁 weekend sprinkles 🧁

The Sandbox Daily (9.6.2024)

Welcome, Sandbox friends.

Woof, not a great week for risk assets. Thankfully… today is Friday and the weekend is here.

Today’s Daily discusses:

U.S. yield curve dis-inverts, achieves positive slope

🧁 weekend sprinkles 🧁

Let’s dig in.

Markets in review

EQUITIES: Dow -1.01% | S&P 500 -1.73% | Russell 2000 -1.91% | Nasdaq 100 -2.69%

FIXED INCOME: Barclays Agg Bond +0.13% | High Yield -0.13% | 2yr UST 3.654% | 10yr UST 3.716%

COMMODITIES: Brent Crude -1.62% to $71.51/barrel. Gold -0.64% to $2,526.9/oz.

BITCOIN: -5.13% to $53,197

US DOLLAR INDEX: +0.08% to 101.184

CBOE EQUITY PUT/CALL RATIO: 0.98

VIX: +12.46% to 22.38

Quote of the day

“It’s only after we’ve lost everything that we’re free to do anything.”

- Tyler Durden, Fight Club

Key segment of U.S. yield curve dis-inverts, positive slope returns

Following today’s weaker-than-expected U.S. jobs report and those tough prior month revisions…

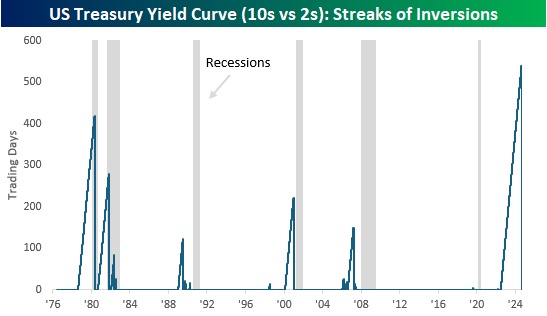

The historic streak for the number of consecutive trading days with an inverted yield curve has officially ended at 545.

The 2022-24 yield curve inversion easily eclipses the previous record of 419 trading days in the late 1970s to early 80s.

The 10-yr U.S. Treasury first dipped below the 2-yr Treasury yield back on July 6, 2022.

Today – September 6, 2024 – this key segment of the U.S. Treasury yield curve has achieved positive slope once again.**

Throughout August, U.S. Treasury yields have declined across the curve, but the short end has seen the steepest declines.

This bull steepening is what led to today’s un-inverting of the yield curve.

An inverted yield curve – when short-term yields (like the 2-year U.S. Treasury bill) are higher than long-term yields (10-year U.S. Treasury bond) – typically indicates of a looming economic downturn on the horizon.

The TL:DR explanation is the economy slows from tightening credit conditions (high front-end borrowing costs) which manifests into weaker future growth and inflation expectations. Corporate profits slow, job losses mount, and asset prices soften.

In the traditional sense, bond yield curves should slope upward with investors seeking higher yield, or return, for the uncertainty of stashing their capital into longer-maturity Treasuries.

Since World War II, nearly every recession started after the yield curve re-steepens and/or turns positive again. It also usually indicates uncertainty in equity markets. For these reasons, when this signal triggers, markets pay attention.

A restoration of the normal upward slope of the yield curve following a long period of inversion has typically happened when the Fed starts to lower interest rates. Since the Fed tends to ease policy when the economy hits a roadblock, such dis-inversion has heightened investors’ concerns about a pending recession.

The curve dis-inverting has investors anxious today because it signals that macro lags from tighter monetary policy are white-knuckling the U.S. economy into a stagnant (or worse, negative) growth mode.

Yet, if we’ve learned anything this cycle, it’s that traditional indicators have not behaved according to traditional theory. Many have thrown out the textbooks because the post-covid economy is proving to be somewhat unique.

Bulls are hoping this time is different.

Sources: Matt Topley, Bespoke Investment Group, New York Times

**We are ignoring temporary intra-day breaches from August and earlier this week – only closing values matter.

🧁 Weekend sprinkles 🧁

Here are the ideas, sights, and sounds that caught my attention this week – perfect for quiet time over the weekend.

Blogs

Morningstar – 3 Investment Fallacies I’ve Had to Unlearn (John Rekenthaler)

OptimistiCallie – Running the Numbers (Callie Cox)

Can I Retire Yet – 5 Reasons to Simplify Your Investment Portfolio (Chris Mamula)

Humble Dollar – What We Believed (Jonathan Clements)

No Mercy / No Malice - Misdirects (Scott Galloway)

Podcasts

Odd Lots with Joe Weisenthal and Tracy Alloway – How Hedge Funds Discover the Next Superstar Trader (Spotify, Apple Podcasts)

Masters in Business with Barry Ritholtz – From Investment Banker to CIO with JPM’s Mike Wilson (Spotify, Apple Podcasts)

Up and Vanished – The Disappearance of Tara Grinstead (Podcast Website, Spotify, Apple Podcasts)

Movies

Knox Goes Away – Michael Keaton, Al Pacino, James Marsden (IMDB, YouTube)

The Bikeriders – Tom Hardy, Austin Butler, Jodie Comer (IMDB, YouTube)

Music

Lil Durk feat. Morgan Wallen – Broadway Girls (Spotify, Apple Music)

Zach Bryan – The Great American Bar Scene (Spotify, Apple Music)

Books

Josh Brown – You Weren’t Supposed To See That (Amazon)

Pop Culture

Untold: Sign Stealer – The Story of Michigan’s Connor Stalions (Netflix)

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.