All that glitters is gold

The Sandbox Daily (10.16.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

all that glitters is gold

Let’s dig in.

Blake

Markets in review

EQUITIES: Nasdaq 100 -0.36% | S&P 500 -0.63% | Dow -0.65% | Russell 2000 -2.09%

FIXED INCOME: Barclays Agg Bond +0.36% | High Yield -0.36% | 2yr UST 3.420% | 10yr UST 4.971%

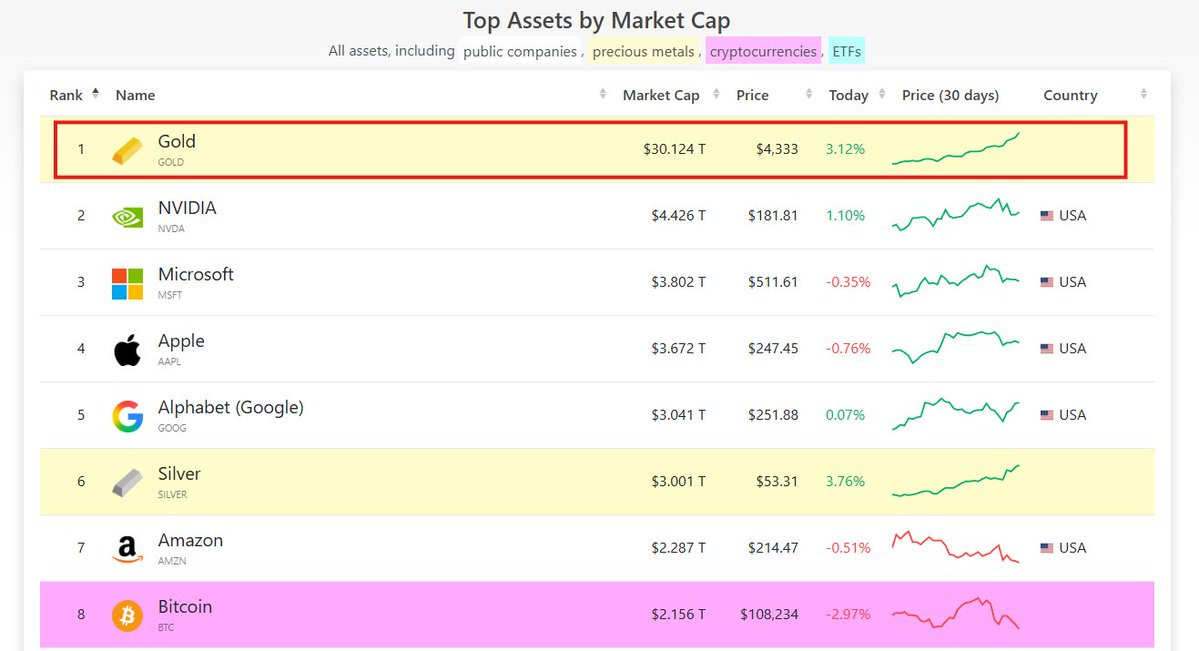

COMMODITIES: Brent Crude -1.44% to $61.02/barrel. Gold +3.09% to $4,331.6/oz.

BITCOIN: -3.04% to $108,234

US DOLLAR INDEX: -0.46% to 98.336

CBOE TOTAL PUT/CALL RATIO: 0.78

VIX: +22.63% to 25.31

Quote of the day

“All the returns in life, whether in wealth, relationships, or knowledge, come from compound interest.”

- Naval Ravikant

All that glitters is gold

Gold’s on fire this year, with the shiny rock higher by more than 50% and easily smashing through $4,000 an ounce – leaving most other assets in the dust.

Gold is officially the first asset in history to clear the $30 trillion dollar threshold.

Yet for all the talk of new highs, this move isn’t new at all. It’s just the latest chapter in a story that’s been building for years.

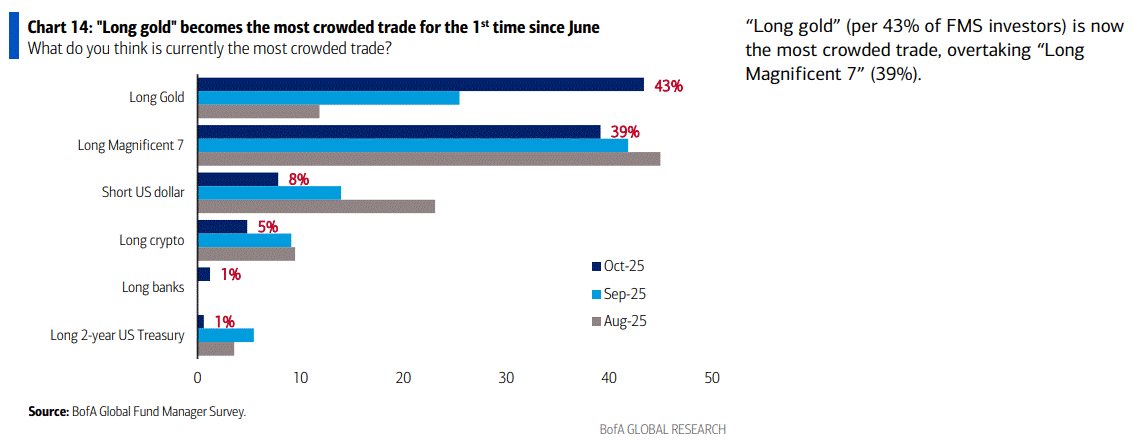

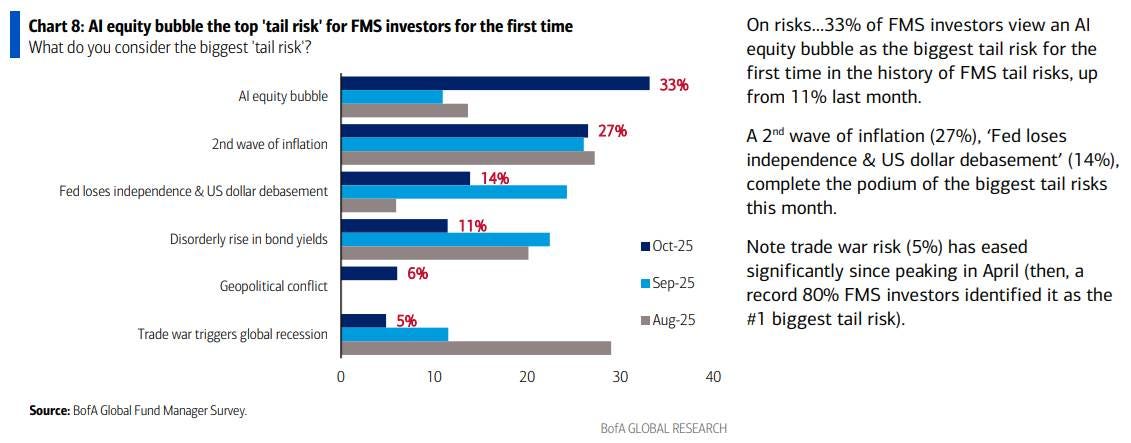

According to Bank of America’s latest Fund Manager Survey – a weekly poll of global portfolio managers overseeing nearly $500 billion in AUM and asking questions about their investment sentiment, asset allocation, and economic outlook – institutional investors now see “long gold” as the most crowded trade, overtaking the once-dominant “long Magnificent 7.”

After years of chasing growth and innovation, portfolio managers are rotating into gold (and bitcoin).

The debasement trade is in vogue as momentum builds for hedges against monetary excesses, sovereign credit, and currency erosion.

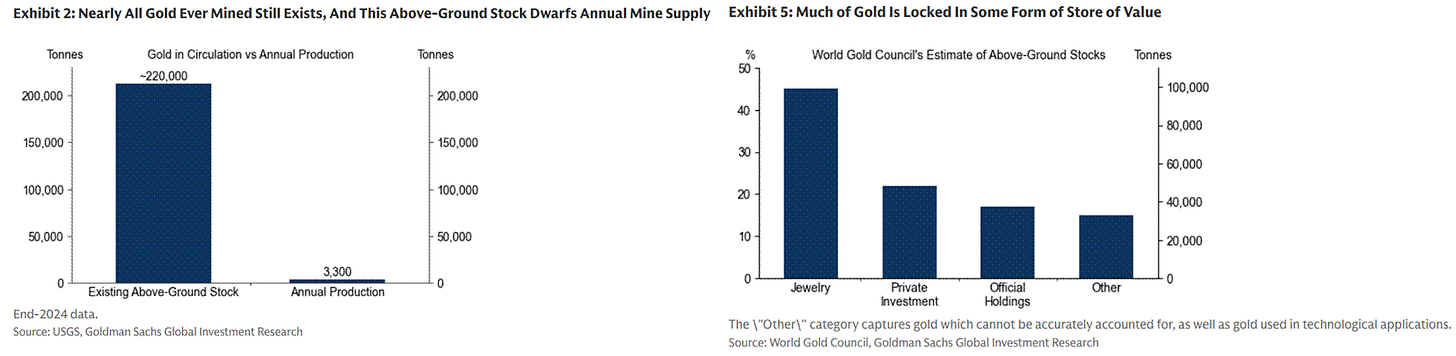

Unlike most commodities, like oil or copper, gold isn’t consumed – it’s accumulated.

Every ounce ever mined still exists. The market clears not through production and consumption, but through changes in ownership.

Price is determined by who’s more willing to hold it, versus who’s ready to sell.

Two key buyer groups drive that dynamic: 1) conviction buyers – think central banks, macro funds, and sovereign wealth funds – who buy based on long-term theses and 2) opportunistic buyers – such as individual households – who step in on dips.

Per Goldman Sachs, conviction flows from institutions explain roughly 70% of gold’s price movements.

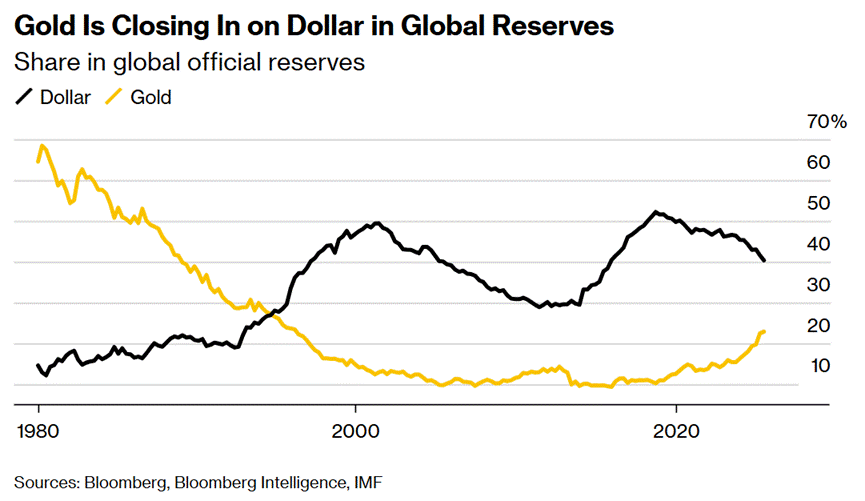

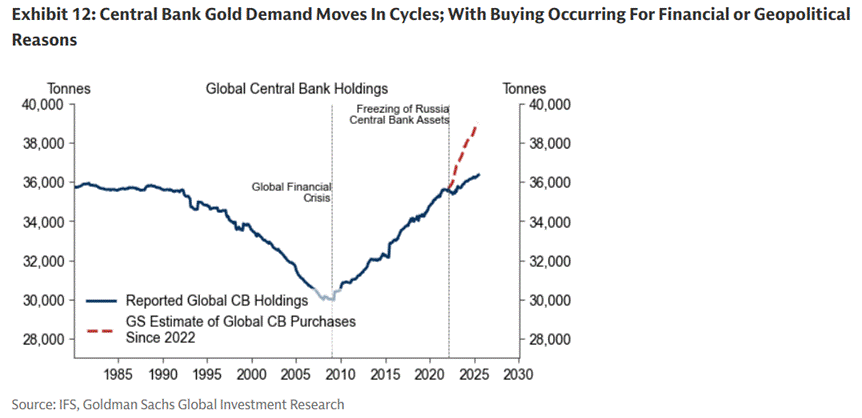

Central banks, in particular, have been consistent net buyers this cycle, responding to concerns about fiscal sustainability, geopolitical sanctions risk, and the resurgence of sovereign security and national interests.

2025’s surge rests on three main pillars:

Falling real interest rates: Fed rate cuts and sticky inflation have driven real yields to their lowest since 2022, eroding the appeal of cash and bonds

Appetite is very strong: Central banks are on pace to match or even exceed last year’s record accumulation, while ETF holdings remain near historic highs

Fiscal and political uncertainties: Gold has outperformed all other major asset classes, reflecting its role as a hedge against economic, political, and geopolitical risks. At the same time, the precious metal’s low correlation with equities and bonds, especially during periods of market stress, also makes it a valuable diversifier.

Gold’s ascent isn’t some sudden awakening. It’s a continuation of a five-year global revaluation of money itself.

Across Europe, Asia, and Latin America, gold has been outperforming local currencies for years. The dollar was simply the last to fall.

For investors, that means gold’s value lies not in short-term speculation but in strategic allocation. While Ray Dalio advocates for 15% – a bit rich for perhaps many investors – a mid-single digit position should suffice to hedge against inflation, currency debasement, and policy missteps.

Maybe even the AI bubble.

Sources: Bank of America, Bloomberg, Goldman Sachs

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)