All-time highs in the stock market, plus the momentum factor and cocoa prices

The Sandbox Daily (4.1.2024)

Welcome, Sandbox friends.

Today’s Daily discusses:

all-time highs in the stock market

the momentum factor

cocoa prices soar

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 +0.21% | S&P 500 -0.20% | Dow -0.60% | Russell 2000 -1.02%

FIXED INCOME: Barclays Agg Bond -0.73% | High Yield -0.41% | 2yr UST 4.709% | 10yr UST 4.313%

COMMODITIES: Brent Crude +0.74% to $87.64/barrel. Gold +1.41% to $2,269.9/oz.

BITCOIN: -1.78% to $69,648

US DOLLAR INDEX: +0.40% to 104.969

CBOE EQUITY PUT/CALL RATIO: 0.56

VIX: +4.92% to 13.65

Quote of the day

“Money is only a tool. It will take you wherever you wish, but it will not replace you as the driver.”

- Ayn Rand

All-time highs in the stock market

The S&P 500 index has achieved 22 new all-time highs so far this year despite the brief market pullback during the first 2 weeks of the year.

While this is positive for investors, it is easy to worry that continued market growth may not be sustainable. Do new all-time highs mean that the market is due for a pullback?

While price swings are an unavoidable part of investing, and the market does experience pullbacks from time to time, history shows that markets also tend to rise over long periods of time.

During a bull market cycle, major stock market indices will naturally spend a significant amount of time near record levels, as shown in the chart below. For instance, 2021 experienced 70 days with the market closing at new all-time highs, adding to the hundreds that were achieved since 2013.

Taking a long-term perspective allows investors to benefit from these market trends without constantly worrying about when a pullback might occur. Holding an appropriately diversified portfolio can help investors to withstand market pullbacks without focusing too much on the exact level of the market.

Source: Clearnomics, Charlie Bilello

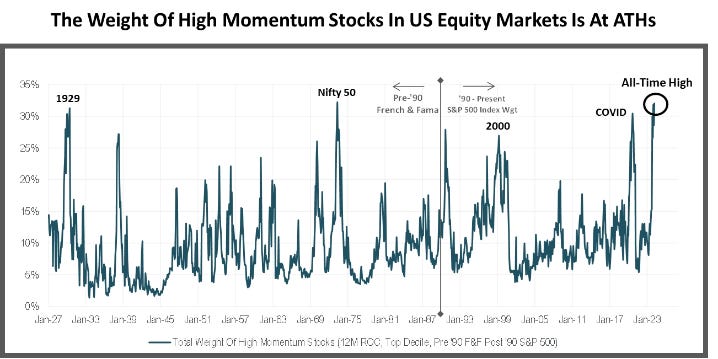

The momentum factor

Last week we had a resurgence in smaller and less profitable stocks. The strength in these names came at the expense of what had been this year’s best performers (i.e. momentum and secular winners).

The tug-of-war between these two groups is at the center of the positioning debate in 2024. Many investors find themselves in either the camp of “owning momentum and concerned it is going to reverse” or “owning small and hoping for a trend reversal”.

While the momentum trade’s index weight is at levels seldom seen in history, the composition of momentum today is much different than in 2000. Today momentum is highly concentrated in highly profitable stocks, while in 2000 it was concentrated in stocks with negative earnings.

Source: Piper Sandler

Chocolate prices soar

A steady rise in cocoa prices skyrocketed in March, with futures contracts more than doubling in 3 months to reach a level twice as high as the previous record (back in 1977).

The price of cocoa futures contracts on the Intercontinental Exchange (ICE) reached an all-time high last week – hitting an intraday record of $10,080 per metric ton on March 26 and have since been trading above $9,500. Before this rally, New York futures had largely remained below $3,500 since the 1980s.

Why are cocoa prices surging?

In 2023, West Africa experienced heavy rainfall that devastated cocoa fields. The reversal happened in 2024 with the presence of drought – courtesy of El Niño – that has dried out the Ivory Coast, where ~60-70% of the world’s cocoa supply is grown. Add in crop disease, an aging tree stock, and marketplace inefficiencies (most cocoa producers are small-scale farmers, not industrialized plantations) and you have soaring prices amidst falling production.

There is growing concern the current dry spell could leave a permanent mark on cocoa yields – with El Niño expected to persist through Spring 2024, the cocoa shortage could extend into 2025 and 2026.

That’s bad news for chocolate makers AND chocolate consumers.

Source: Torsten Slok, Bloomberg, Barron’s

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

chocolate prices 🤪