American exceptionalism in 2025

The Sandbox Daily (1.14.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

American exceptionalism in 2025

Let’s dig in.

Blake

Markets in review

EQUITIES: Russell 2000 +1.13% | Dow +0.52% | S&P 500 +0.11% | Nasdaq 100 -0.13%

FIXED INCOME: Barclays Agg Bond +0.03% | High Yield +0.13% | 2yr UST 4.367% | 10yr UST 4.788%

COMMODITIES: Brent Crude -1.09% to $80.13/barrel. Gold +0.41% to $2,689.5/oz.

BITCOIN: +3.28% to $96,672

US DOLLAR INDEX: -0.68% to 109.204

CBOE TOTAL PUT/CALL RATIO: 0.95

VIX: -2.50% to 18.71

Quote of the day

“Amateurs think about how much money they can make. Professionals think about how much money they could lose.”

- Jack Schwager

American exceptionalism in 2025

Like it or not, the broad and dominant theme for many macroeconomic and market outlooks remain the continuation of U.S. exceptionalism. In a world often shaped by shifting tides, the U.S. economy continues to stand out as a beacon of resilience and innovation.

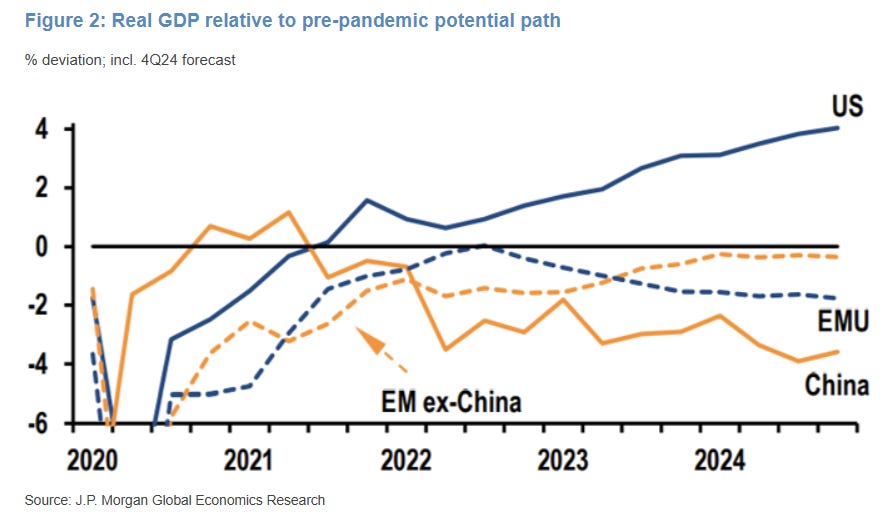

2024 marked another year of this refrain, with clear outperformance by the U.S. economy. The United States is the only major developed economy that has returned to its pre-pandemic growth path, while the gap between U.S. growth and the rest of world, most notably China, continues to drive the wedge wider.

The economic prowess of lady liberty rewarded its shareholders of U.S. stocks, which outperformed the rest of the world last year by the largest margin since 1997.

This strategic idea of U.S. exceptionalism should be reinforced again in 2025 by further research and development across the tech ecosystem, potential deregulation, and a myriad of changes in trade, fiscal, and drill-baby-drill energy policies.

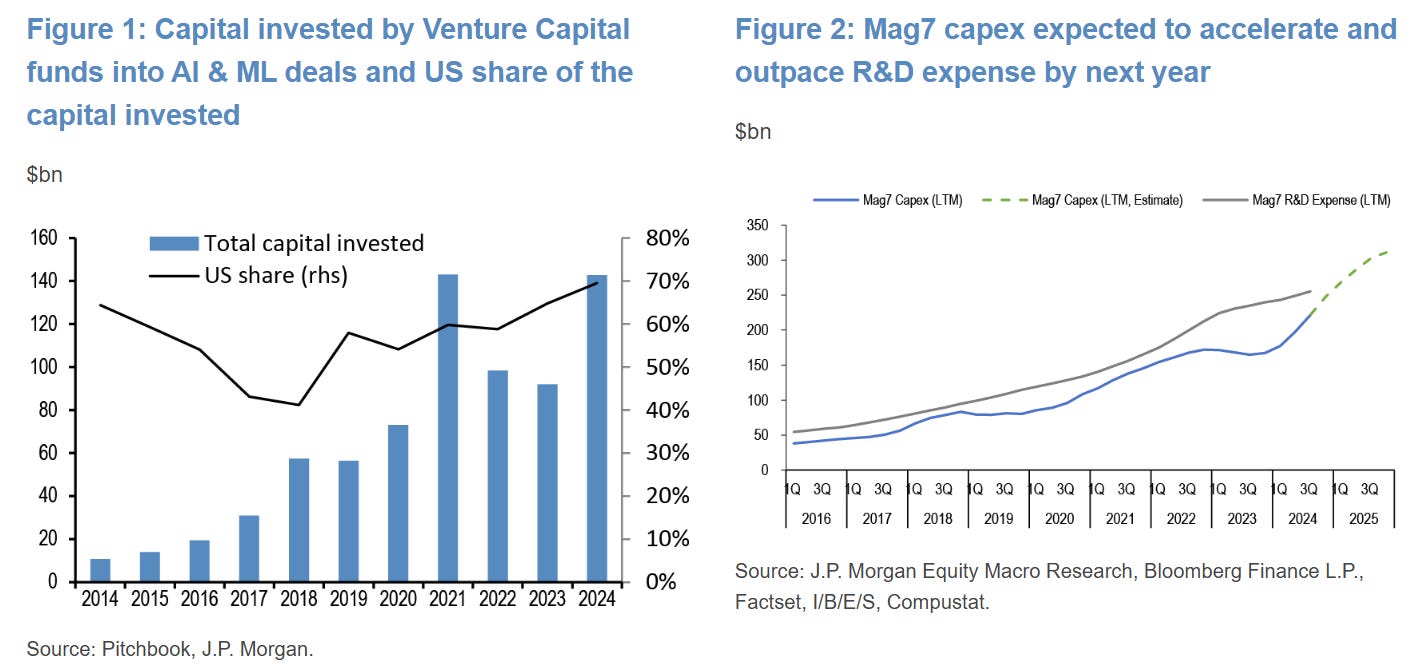

The latest crown jewel remains the AI boom and its looming impact as downstream products and services broaden out and numbers begin to populate onto the balance sheets and cash flows statements of publicly-traded companies.

Remember, the internet boom of the 1990s gave a one-time, ten-year plus structural shift to U.S. productivity growth. It’s too early to judge whether that will happen again, but based on capital outlays, the track record of these tech behemoths, and the short leash of shareholder patience, the boom is coming.

To appreciate the size/scope and divergence of investment, U.S. venture capital has poured an estimated $430B over the last decade into development of Artificial Intelligence and Machine Learning, while the U.S. share of this global investment cycle is tracking 70% vs. 23% for Asia and just 10% for Europe.

One other important fundamental basis why the U.S. should retain its role in the driver’s seat is due to the healthy balance sheets of businesses and consumers alike. It’s difficult to ignore the degree to which the U.S. has deleveraged and termed-out low interest rate date in recent years.

Lower debt loads reduce the burden of interest payments, freeing up resources for productive investment and consumer spending – further fostering sustainable economic growth patterns and minimizing downside risks.

The downside and risks to U.S. centric investors on the eve of the Trump 47 presidency and his America-first maxim?

The potential for sticky inflation, higher-for-longer on rates, divisive industrial policy, and the risk of trade war escalations – all that and more baked into the U.S. equity risk premium.

And, of course, (relative) valuation, where the U.S. is pushing history to its extremes across a score of asset classes.

Source: J.P Morgan Markets, Bloomberg, The Irrelevant Investor, Topdown Charts

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures at the Sandbox Financial Partners website: