America's economic data disaster is bad and getting worse, plus 🧁 weekend sprinkles 🧁

The Sandbox Daily (8.1.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

America’s economic data disaster is bad and getting worse

🧁 weekend sprinkles 🧁

Let’s dig in.

Blake

Markets in review

EQUITIES: Dow -1.23% | S&P 500 -1.60% | Nasdaq 100 -1.96% | Russell 2000 -2.03%

FIXED INCOME: Barclays Agg Bond +0.86% | High Yield +0.01% | 2yr UST 3.691% | 10yr UST 4.220%

COMMODITIES: Brent Crude -3.04% to $69.52/barrel. Gold +1.94% to $3,413.5/oz.

BITCOIN: -2.87% to $113,359

US DOLLAR INDEX: -1.26% to 98.709

CBOE TOTAL PUT/CALL RATIO: 1.03

VIX: +21.89% to 20.38

Quote of the day

“Never desire the success of another person without first finding out what they gave up for it.”

- Elijah Elvis Kraftzmann

America’s economic data disaster is bad and getting worse

Confidence in economic data is deteriorating, going from bad to worse.

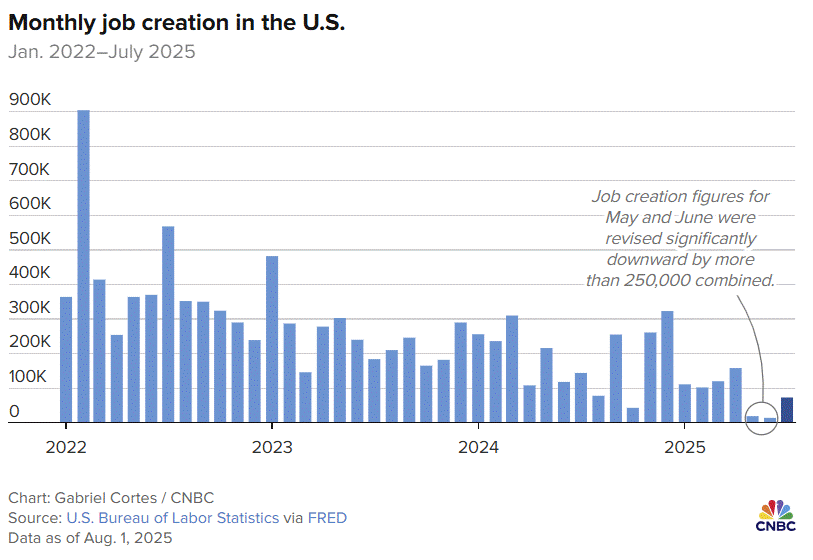

This morning we received the July nonfarm payrolls report which itself wasn’t much of a headline, as job growth last month of 73k came in lighter than expectations of 104k. Meanwhile, the unemployment rate ticked higher from 4.1% to 4.2% as expected.

Ho hum, no big deal.

But, the HAMMER absolutely dropped on prior month’s revisions, showing the initial May and June job prints were vastly overstated.

May’s jobs report was revised lower from +144k to +19k.

June’s jobs report was revised lower from +147k to +14k.

258,000 jobs gone.

Vanished from the ether.

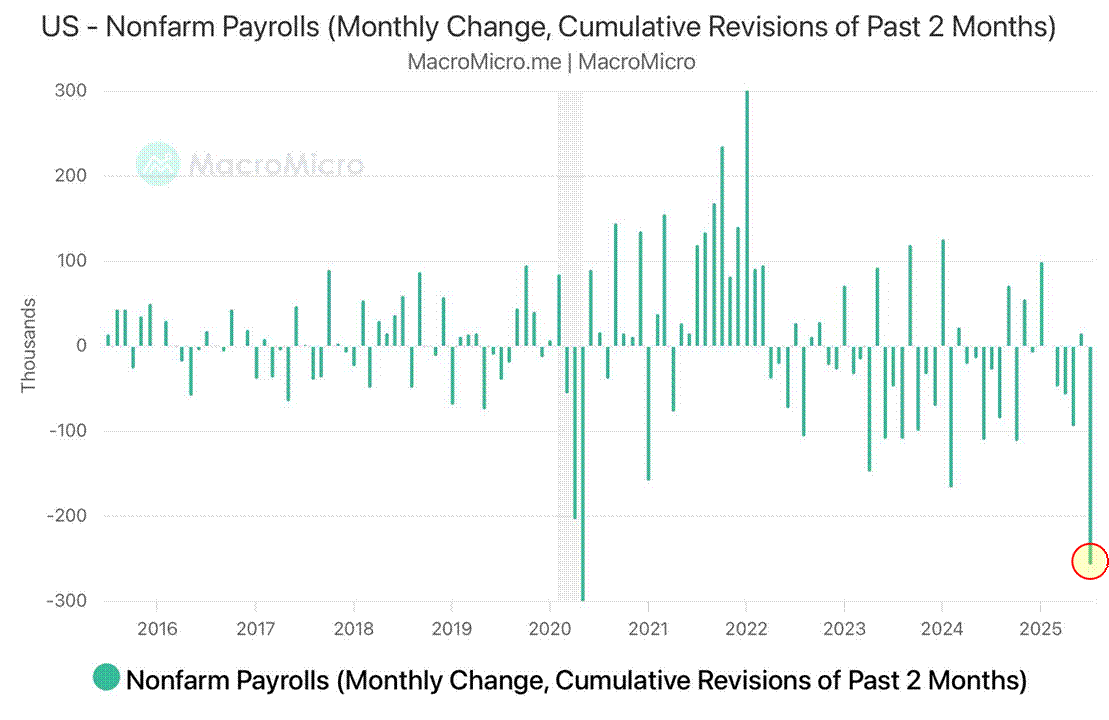

The massive downward revisions are as puzzling as they are disconcerting.

Even though we all expect some error rate in collection and reporting methods, these revisions in particular are abnormally large outside seasonal or weather-related events.

The pandemic notwithstanding, we’re looking at the largest two-month revision in recent history.

Once a pillar of strength, the labor market suddenly looks fragile. This summer has featured the weakest 3-month job creation period in years.

In response, the swells of public criticism were growing on both traditional and social media networks calling on Jerome Powell and the Federal Reserve to cut interest rates in September.

The Bureau of Labor Statistics (BLS) – the agency tasked with collecting official U.S. economic statistics – is clearly having some issues with its methods.

But, the agency’s problems don’t end there, unfortunately.

The BLS is also responsible for measuring inflation as experienced by consumers in their day-to-day living expenses.

The monthly CPI report plays a crucial role in providing accurate and timely information about price changes across the U.S. economy, which among many other things, directly impacts monetary policy decisions.

To calculate CPI inflation, the BLS agency collects over 90,000 price quotes across 200 different categories from 75 different urban areas.

However, when data is unavailable, the agency develops estimates – and the share of estimated data has been growing fast in recent months.

Per Apollo’s Torsten Sløk, “almost a third of the prices going into the CPI [calculation] at the moment are guesses based on other data collections in the CPI.”

Budget cuts, declines in survey responses, and federal job freezes/layoffs are to blame, of course.

Together, these issues have made data collection and reporting increasingly difficult, inaccurate, and volatile.

Some economists are sounding the alarm bells, while others remain more even-keeled about the ramifications.

Bottom line, GIGO, or “garbage in, garbage out,” has significant implications for investors: the quality of your investment decisions is directly proportional to the quality of the information you use to make them.

The important takeaway here is how you respond to economic data, especially those data series that are subject to subsequent releases and revisions.

Underweight the initial print and overweight the direction of travel.

Trend over level will always provide better perspective.

Sources: MacroMicro, CNBC, New York Times, Torsten Sløk

🧁 Weekend sprinkles 🧁

Here are the ideas, sights, and sounds that caught my attention this week – perfect for quiet time over the weekend.

Blogs

OptimistiCallie – The Seven Rules of Stock Market Bubbles (Callie Cox)

No Mercy/No Malice – Last Laugh (Scott Galloway)

We’re Gonna Get Those Bastards – Putting Yourself Out There (Jared Dillian)

TrendLabs – Betting on Average Returns? You’re Doing it Wrong. (JC Parets)

Podcasts

Eye on the Market – Summer Mailbag with Michael Cembalest (JPMorgan, Spotify, Apple Podcasts)

The Unlock with Ben Carlson – The One Thing Everyone Gets Wrong About the 4% Rule (YouTube, A Wealth of Common Sense)

RenMac Off-Script – Summer Soft-Patch (YouTube, Spotify, Apple Podcasts)

Movies/TV Shows

Happy Gilmore 2 – Adam Sandler, Christopher McDonald (Netflix, IMDB, YouTube)

Music

BLOND:ISH – Never Walk Alone (YouTube, Spotify, Apple Music)

Books

Nick Maggiulli – The Wealth Ladder: Proven Strategies for Every Step of Your Financial Life (Amazon)

Fun

Frank Caliendo – Morgan Freeman Voicemail Message (Instagram)

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)