America's final inflation report for 2023, plus business travel and low volatility regimes

The Sandbox Daily (1.11.2024)

Welcome, Sandbox friends.

Today’s Daily discusses:

America’s final inflation report for 2023

airlines overcoming softness in corporate travel

low volatility is constructive

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 +0.17% | Dow +0.04% | S&P 500 -0.07% | Russell 2000 -0.75%

FIXED INCOME: Barclays Agg Bond +0.57% | High Yield +0.32% | 2yr UST 4.256% | 10yr UST 3.973%

COMMODITIES: Brent Crude +1.58% to $78.01/barrel. Gold +0.25% to $2,032.8/oz.

BITCOIN: +0.38% to $46,282

US DOLLAR INDEX: -0.02% to 102.345

CBOE EQUITY PUT/CALL RATIO: 1.55

VIX: -1.97% to 12.44

Quote of the day

“It's not whether you are right or wrong that's important. It's how much money you make when you're right & how much you lose when you're wrong.”

- Stanley Druckenmiller

America’s final inflation report for 2023

The path of softening price pressures – what’s known as disinflation – remains choppy and protracted, with certain categories proving stickier than most had anticipated.

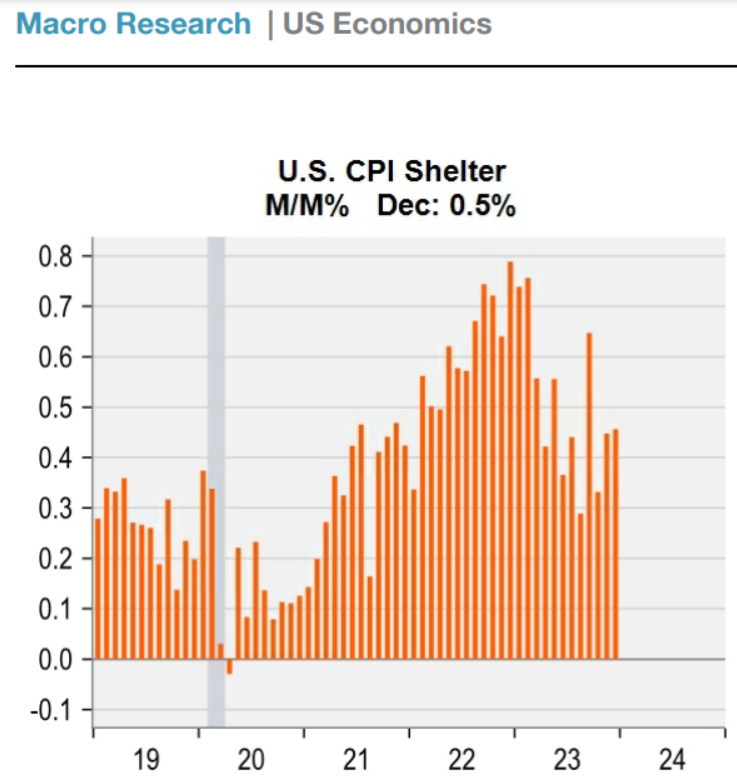

December’s Consumer Price index (CPI) report surprised to the upside, largely driven by persistent shelter price growth.

Here are the key numbers:

With the final CPI reading of the calendar year, inflation came in at 3.4% for the full year of 2023 – that’s down significantly from 6.5% in 2022 but still elevated versus the Federal Reserve’s 2.0% mandated target. Meanwhile, the “Core Inflation” metric the Fed watches closely fell to 3.9% in December —> lowest since May 2021.

Housing accounted for HALF of inflation in December. The shelter CPI increased 0.5%, slightly more than the 0.4% gain in the prior month. This is in line with its 12-month average, but about double the monthly price growth prior to the pandemic.

Inflation is largely about services now; goods have cooled off.

One thing frustrating Americans in this economy? Motor-vehicle insurance, which is up +20.3% in the past year – the biggest jump since 1976. Auto insurance is not some abstract price basket within CPI; quite the contrary, people are very aware of their car premiums.

Given some upside risks from a rebound in existing home prices, still-tight labor markets, and geopolitical conflicts that may raise transportation costs and disrupt supply chains, the disinflation path ahead will likely be slower and choppier. This is not conducive to a Fed rate cut in March.

Source: U.S. Bureau of Labor Statistics, Ned Davis Research, Bloomberg, Bloomberg, Wall Street Journal

Airlines overcoming softness in corporate travel

Airlines across Developed Markets have been able to offset much of the structural loss in business and corporate travel – which has stabilized at 75% of pre-pandemic levels – with 'premium leisure', as flexible post-pandemic work schedules and work-from-home arrangements permit more frequent travel.

Source: Goldman Sachs Global Investment Research

Low volatility is constructive

This next chart sure grabs your attention.

Historically, when the CBOE Market Volatility Index (VIX) is low, the S&P 500 produces its strongest forward returns.

Daily sub-13 VIX closes – such as those we’ve experienced on and off over the last 3 months – produce annualized returns of +47%, markedly higher than any other volatility environment.

Who would’ve thought when volatility was low – i.e. greater certainty around price – that market’s perform constructively on a go forward basis.

Source: Seth Golden

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.