America's semiconductor export restrictions inflame tensions with China, plus Exxon and the week in review

The Sandbox Daily (10.21.2022)

Welcome, Sandbox friends.

Today’s Daily discusses the inflamed U.S.–China tensions over semiconductors, Exxon completes a base, and a brief recap to snapshot the week in markets.

Let’s dig in.

Markets in review

EQUITIES: Dow +2.47% | Nasdaq 100 +2.39% | S&P 500 +2.37% | Russell 2000 +2.22%

FIXED INCOME: Barclays Agg Bond +0.16% | High Yield +0.96% | 2yr UST 4.483% | 10yr UST 4.219%

COMMODITIES: Brent Crude +1.27% to $93.60/barrel. Gold +1.19% to $1,656.3/oz.

BITCOIN: +0.55% to $19,174

US DOLLAR INDEX: -1.02% to 111.876

CBOE EQUITY PUT/CALL RATIO: 0.70

VIX: -0.97%

U.S.–China semiconductor battle

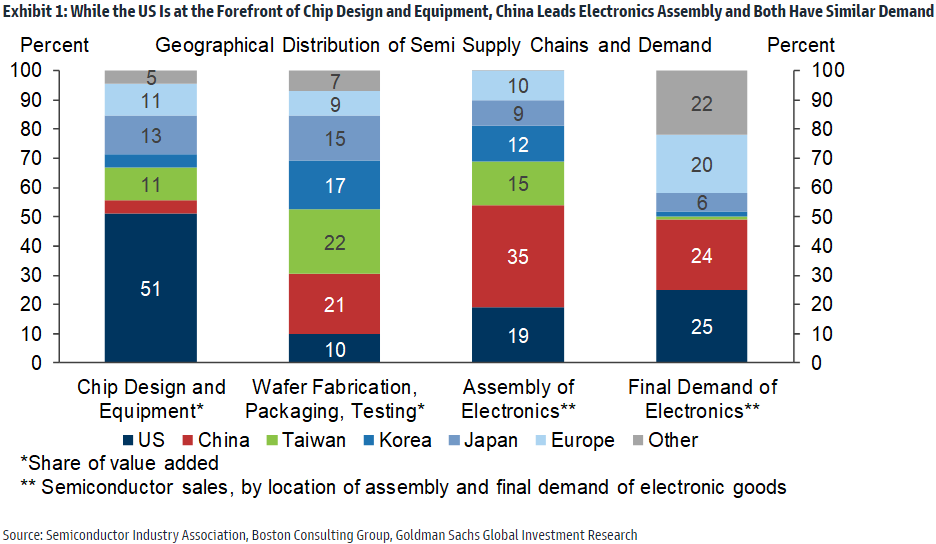

The U.S. Department of Commerce has announced substantially tighter restrictions on exports of semiconductors, semiconductor equipment, and related components and services to China. While some of these apply to specific companies in China, others apply regardless of the importing entity and even apply to exports from third countries where U.S. technology has been used to produce the product or service. From a U.S. perspective, the new rules pose three potential risks.

They are very likely to reduce exports of semiconductor equipment and related goods and services to China, though estimates suggest the impact will be well under 0.1% of GDP.

The rules raise the risk of disruptions in imports of semiconductors to U.S. manufacturers. The risks here are harder to quantify but also appear manageable as China accounts for only 6% of chip imports and these are unlikely to include the types of advanced chips the new rules focus on.

There is a risk that Chinese export controls tighten in response to the U.S. This is likely to be the most important but hardest to quantify risk, as no category of Chinese exports to the U.S. is clearly comparable to U.S. exports of advanced semiconductor-related technology to China. The most comparable category of exports might be rare earth minerals and goods manufactured from them, which have strategic but also important commercial uses. Imports of certain chemicals and pharmaceutical ingredients and a few categories of auto parts are also sourced predominantly from China, though restricting exports of these would have little strategic rationale.

Source: Goldman Sachs Global Investment Research

Exxon completes a base

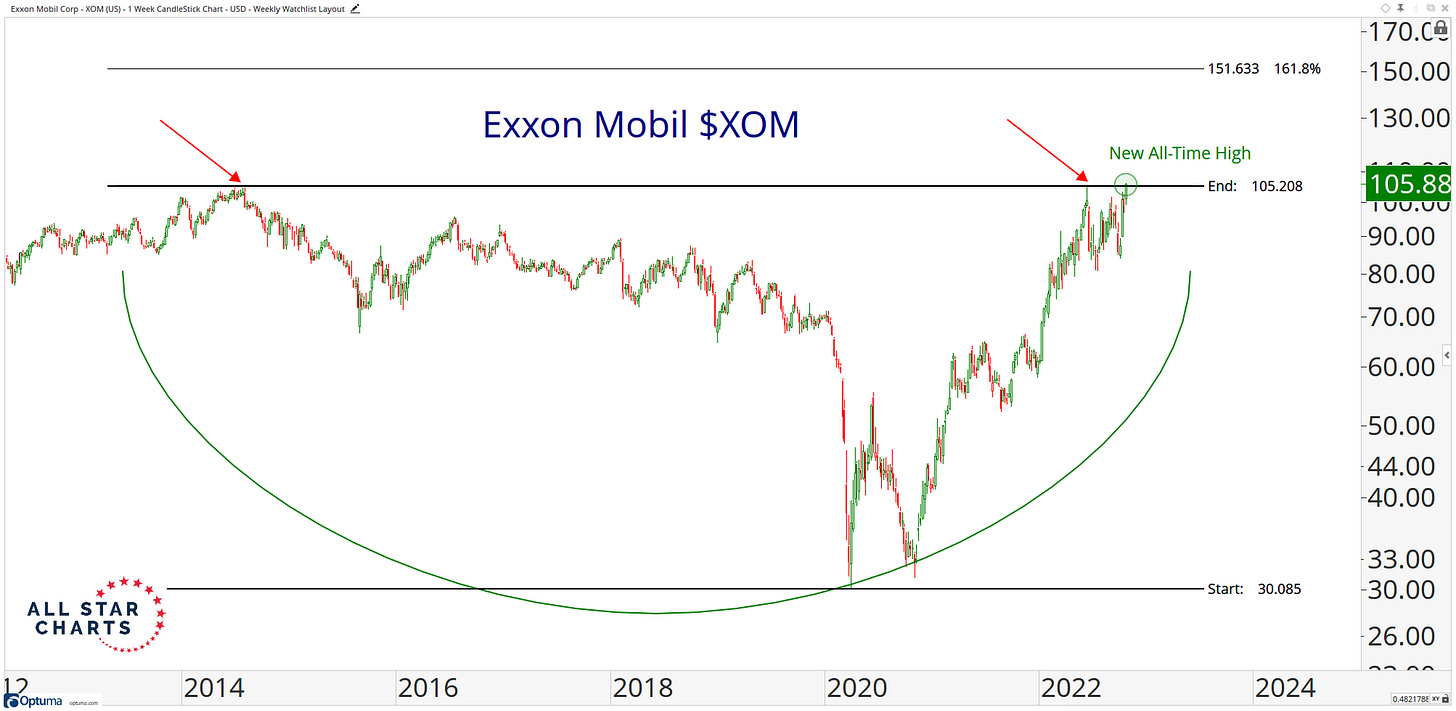

We often use the largest companies from various sectors to glean information on the entire group and the overall market. We refer to these stocks as "bellwethers" as they are imperative to the global economy and indicative of how their broader sector or industry is faring.

When it comes to energy stocks, one bellwether is Exxon Mobil (XOM). It is the largest energy company in the United States and has the largest weighting in most energy indexes. Today, Exxon achieved new all-time highs on both a daily and weekly closing basis. The stock has been consolidating in a constructive manner, digesting gains and absorbing overhead supply at its 2014 highs since June.

If these new highs are here to stay, we could be in for a fresh leg higher. The “bigger the base, the higher in space” comes to mind when we see these patterns.

Source: All Star Charts

The week in review

Stocks: Stocks finished higher as Q3 earnings, so far, have come in better-than-feared by market participants. As of today, 20% of S&P 500 companies have reported results with earnings growth tracking roughly in line with prior expectations at just 1.5% year-over-year (source: FactSet). As of right now, Netflix-driven communication services and healthcare are early winners with the biggest average upside earnings surprises at +10.4% and +6.9%, respectively. That being said, companies that are more-economically sensitive are seeing challenges amid the inflationary environment. For example, Whirlpool cut its earnings outlook for the year amid softening demand and rising inflation, while Union Pacific lowered its outlook for 2022 volume, even as earnings and revenue came in higher vs. last year.

Bonds: The Bloomberg Aggregate Bond Index finished the week lower as yields increased following continuation of the Fed’s hawkish posturing. High-yield corporate bonds, as tracked by the Bloomberg High Yield index, gained ground for the week, mirroring their equity counterparts.

Commodities: Natural gas prices declined precipitously this week, as weather expectations for November are warmer than previously anticipated, causing demand for the commodity to be less than expected amid a backdrop of increased supply. Still up on a monthly basis following the OPEC announcement of production cuts two weeks ago, oil did lose marginal ground this week as the Biden Administration announced plans for another Strategic Petroleum Reserve release. The major metals, gold, silver, and copper, finished higher this week.

Source: LPL Research

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.