America's strength in capital markets, plus retail sales, wages, election spending, and save+invest

The Sandbox Daily (2.15.2023)

Welcome, Sandbox friends.

Today’s Daily discusses why America dominates global markets, the surge in retail sales, wages struggle to keep pace with inflation, BIG time spending for national elections, and one simple graphic (save + invest).

Let’s dig in.

Markets in review

EQUITIES: Russell 2000 +1.09% | Nasdaq 100 +0.77% | S&P 500 +0.28% | Dow +0.11% | Dow +0.11%

FIXED INCOME: Barclays Agg Bond -0.19% | High Yield -0.16% | 2yr UST 4.635% | 10yr UST 3.809%

COMMODITIES: Brent Crude -0.40% to $85.24/barrel. Gold -0.99% to $1,846.9/oz.

BITCOIN: +9.87% to $24,387

US DOLLAR INDEX: +0.59% to 103.847

CBOE EQUITY PUT/CALL RATIO: 0.61

VIX: -3.60% to 18.23

Why America dominates the global market cap

It's interesting how dominant the United States position on the global stage remains. So, why does our strong capital position persist?

Here are a few engines driving our growth:

* global reserve currency status: the U.S. dollar is the world’s fiat currency and much of global trade is pegged to the dollar

* population demographics: hat tip to durable birth rates and immigration

* geography: protected by two oceans and friendly countries/treaties to the north and south

* consumer technology: internet and smart phones are the two biggest innovations of the last 50 years and we dominate both technologies

* energy independence: the Permian Basin and the Strategic Petroleum Reserve (SPR) are two major strategic assets

* people want to live here: immigration increases our labor stock and fosters innovation; many CEOs and founders of startups are born outside our borders

* a broadly diversified economy: America is not dependent on one commodity or industry

* powerful military: our defense budget and sprawling apparatus supports large-scale operations with cutting edge technology

* rule of law: a democratic system with checks and balances along with procedural authority granted to our judicial system

* pop culture: professional sports, Hollywood, music, celebrities

* no natural heirs to the throne: China is threatening but population growth is a headwind for them

* the American Dream: dreams pull with gravitational force

The United States is still a relatively young country, but our slice of the pie is growing, not shrinking.

Source: ChartBear, Credit Suisse

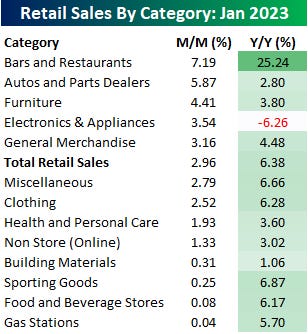

Retail sales surge

The strength of the U.S. consumer shined through in January. Retail sales surged +3.0%, more than erasing the declines in the prior two months. It was the biggest increase since March 2021, and well above the consensus of +1.9%. Excluding the pandemic recovery, this was the biggest jump in sales since October 2001.

The jump last month far exceeded the average January increase of +0.6% since 1990, suggesting that seasonal adjustment factors may have contributed to the outsized gain. Even so, the 3-month average of retail sales – which smoothes some of the volatility – also moved up last month, indicating an improvement in the near-term trend.

On a YoY trend basis, retail sales increased +6.1%, which is a moderation from the peak rate of growth earlier in this cycle, but exceeds the +4.2% gain per annum in the previous expansion.

Consumer demand is being supported by continued labor market strength and nominal wage gains, continued utilization of credit, and savings accumulated during the pandemic. It suggests that the economy is not close to recession, despite some leading indicators pointing in that direction. It also suggests that if the Fed wants to bring down inflation by slowing demand, it will have to keep monetary policy tighter for longer.

Source: Ned Davis Research, Axios, Bloomberg

Wages struggle to keep pace with inflation

Wages can be viewed through two lenses: nominal and real.

Nominal wages refer to the amount of money an employee is paid (literally the amount of money received in your bank account from your employer), while real wages refer to the purchasing power of that money (i.e. your salary adjusted for inflation).

Example. If an employee's nominal wages increase but the prices of goods and services also increase by the same amount, then their real wages have not changed. However, if an employee's nominal wages increase more than the rate of inflation, then their real wages have increased because they can now afford more goods and services than before.

So what is the current state of play?

The year-over-year change of private sector nominal wages remains positive, and it sits at +4.4% for all non-farm employees.

Meanwhile, real wages are negative due to the high inflationary environment suffocating many American households – down 2-4% over the last year. Because nominal wages are growing at a slower rate than inflation, workers on average are being paid less money in purchasing power terms for their work.

Source: The Pomp Letter

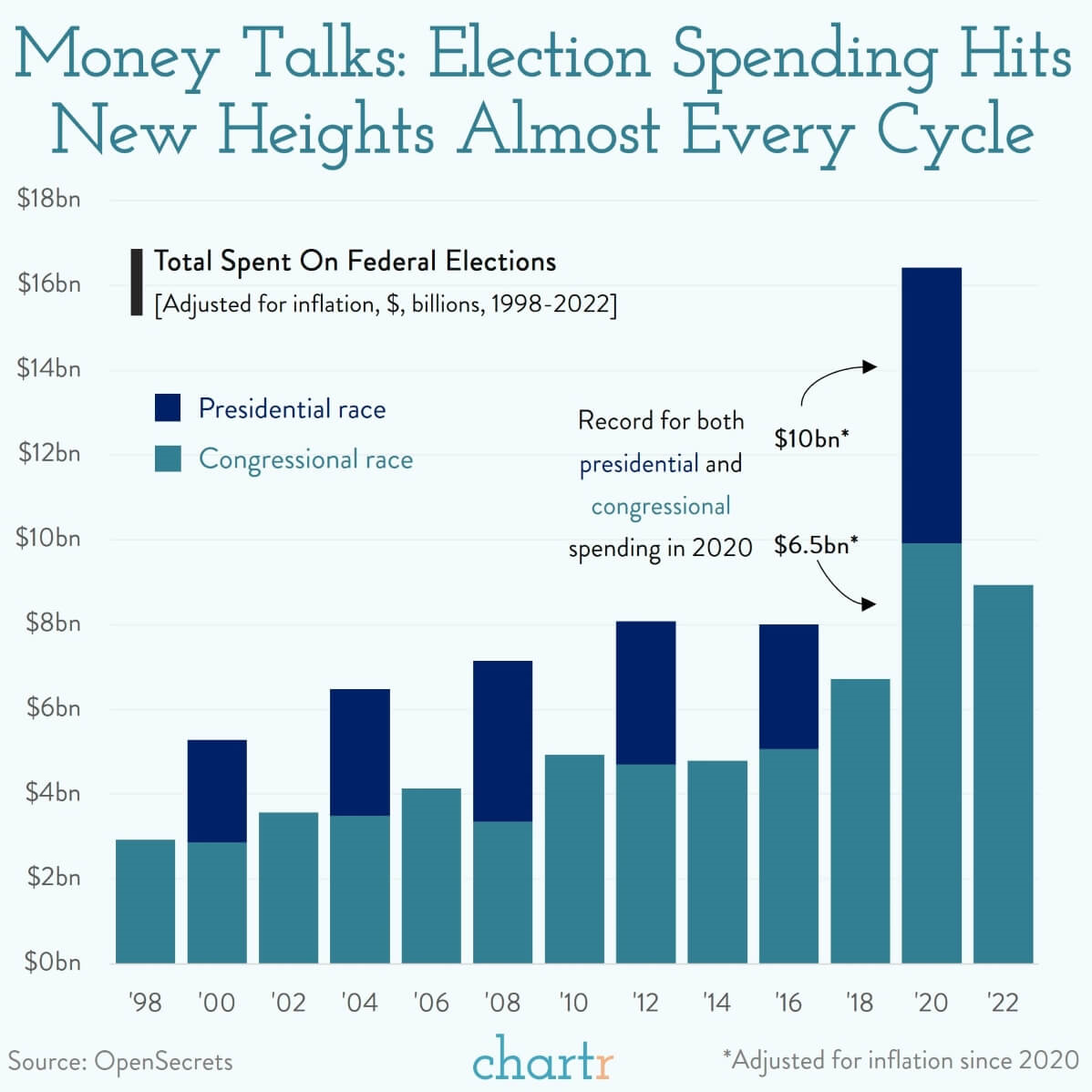

BIG time spending for national elections

The national election in the United States is Tuesday, November 5th, 2024 – that’s 629 days away.

In the coming months, we will witness announcements, advertisements, and the rest of the election cycle launch into full-swing. As such, fundraising, canvassing, organizing volunteers, hiring staff, polling the public, producing media assets, filming commercials, running social media accounts, and mobilizing your campaign all amount to BIG time spending. After all, political campaigns in the United States are very expensive.

The Supreme Court's 2010 decision in Citizens United v. Federal Election Commission allowed unlimited spending by corporations and labor unions in support of political candidates, which has led to an increase in spending by outside groups, such as Super PACs.

Data from OpenSecrets reveals that the most recent presidential election was the most expensive election cycle in history, with political spending in 2020 totaling some $14.4bn, or more than $16bn once adjusted for inflation.

What will 2024 bring?

Source: Chartr, OpenSecrets

One simple graphic

In the beginning, your savings rate is all that matters.

Over time, your investment returns become all that matters.

Bada bing, bada boom!

Source: Brian Feroldi

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.