April CPI inflation report, plus divs/buybacks, Vanguard's new CEO, and earnings estimates

The Sandbox Daily (5.15.2024)

Welcome, Sandbox friends.

As inflation showed signs of ebbing for the 1st time in months, all three major averages – the S&P 500, the Nasdaq 100, and Down Jones Industrial Average – closed at record highs, adding to their strong 2024 performances.

Today’s Daily discusses:

Inflation’s bumpy ride: April CPI report shows inflation resumes downward trend

return of shareholder capitalism

Vanguard changing their tune on bitcoin?

the street is revising their earnings estimates higher

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 +1.49% | S&P 500 +1.17% | Russell 2000 +1.14% | Dow +0.88%

FIXED INCOME: Barclays Agg Bond +0.66% | High Yield +0.58% | 2yr UST 4.726% | 10yr UST 4.344%

COMMODITIES: Brent Crude +0.69% to $82.95/barrel. Gold +1.41% to $2,393.2/oz.

BITCOIN: +7.21% to $66,058

US DOLLAR INDEX: -0.67% to 104.313

CBOE EQUITY PUT/CALL RATIO: 0.53

VIX: -7.23% to 12.45

Quote of the day

“It's important to surround yourself with good people, interesting people, young people, young ideas. Go places, learn new stuff. Look at the world with wonder - don't be tired about it.”

- Angela Bassett

Inflation’s bumpy ride: April CPI report shows inflation resumes downward trend

The center of attention for this week’s eco data was today’s April consumer price index (CPI) report. It showed CPI inflation eased modestly in April, with core CPI inflation falling to +3.6% YoY – the lowest level in three years and a win for the bulls. U.S. stocks jumped on the report.

April’s CPI print came in largely as expected. Here are the key numbers:

The stickiness in the data continues to largely reside within the Shelter category, as you can see in the darker green bars below.

While the vast majority of categories contributing to inflation have receded, housing has not – although the trend is encouraging over the last 12 months.

Housing accounted for more than HALF of inflation, again. +0.4% is in line with its 12-month average, but roughly double the monthly price growth prior to the pandemic, which was sub 0.3% per month.

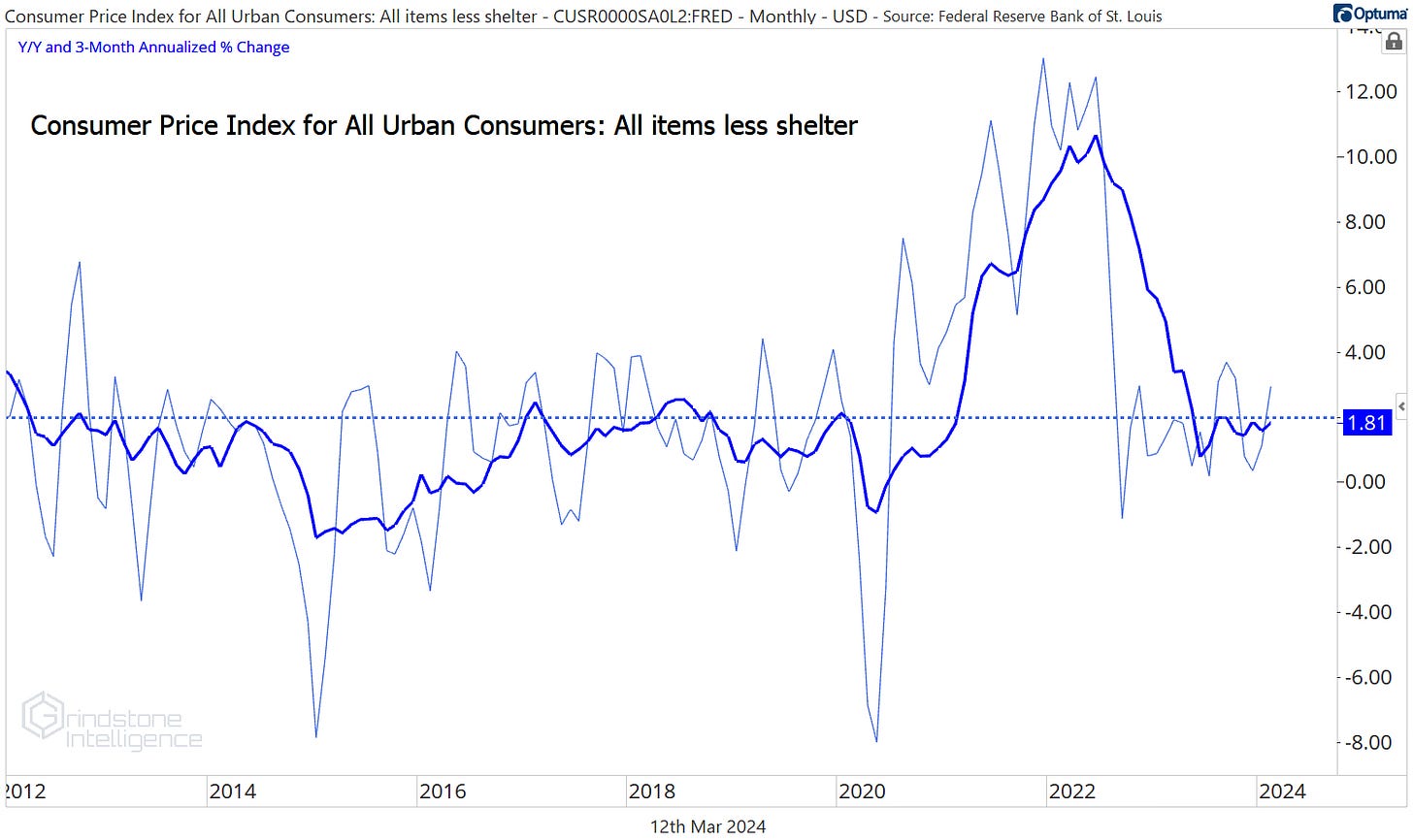

Remember, the Shelter component of official CPI is very out of step (strong) with what actual rents in the market are doing today (falling/steady) – due to lags in the collection and reporting of data – which is holding all CPI measures artificially higher.

So, if you remove the stale data from housing, inflation is already below the Fed’s desired 2% target.

While the Federal Reserve’s preferred measure of inflation is the core personal consumption expenditures (PCE) index, CPI is the next best thing. It certainly factors into Wall Street’s thinking about the Fed’s next move on interest rates.

Although market expectations still favor the next easing cycle to begin in September, the risk remains fewer and/or later rate cuts if inflation pressures persist. And yet, stocks have done remarkably well in 2024 despite higher rates.

What’s become clear to investors is the path of softening price pressures – what’s known as disinflation – remains choppy and protracted, with certain categories proving stickier than most had anticipated. In other words, the path towards inflation normalization is not a straight line down from 9% to 2%.

Source: U.S. Bureau of Labor Statistics, Walter Bloomberg, Ned Davis Research, J.P. Morgan Markets, Fundstrat, Piper Sandler, Bloomberg, CME Group, Sonu Varghese, Ph.D., Austin Harrison, CMT

Return of shareholder capitalism

A defining feature of Q1 earnings season is a surge in repurchase and dividend announcements, reversing a 2022-2023 decline.

Most notably, Alphabet ($GOOGL) declared its 1st-ever dividend in addition to a $70 billion stock buyback program. It may have taken its cue from Facebook Meta Platforms ($META), which introduced a dividend with its Q4 earnings release. Microsoft ($MSFT) and Amazon ($AMZN) also pledged multi-billion dollar increases to their buyback programs. According to the Wall Street Journal, S&P 500 companies are on track to buy back $925 billion of stock in 2024.

The rash of announcements comes after a pause in dividend growth (chart below, top panel) and 14% decline in net repurchases (2nd panel) in 2022-2023. Last year, S&P 500 companies focused more on slowing the pace of debt issuance amid higher interest rates (4th panel). All three levers of shareholder payments could move in the right direction for the 1st time since 2018, setting the stage for S&P 500 shareholder payments to make a run at the previous record of $1.4 trillion in Q1 2022 by next year (bottom panel).

The focus on shareholder returns provides a steady underlying bid in the market and should be viewed as bullish, provided that companies do not overextend their balance sheets.

Source: Ned Davis Research

Vanguard changing their tune on bitcoin?

A new leader is arriving at Vanguard.

Last night, Vanguard announced that it had found Tim Buckley's successor as Chief Executive Officer. Salim Ramji, a former executive at Blackrock, will take over.

Why is any of this relevant to you?

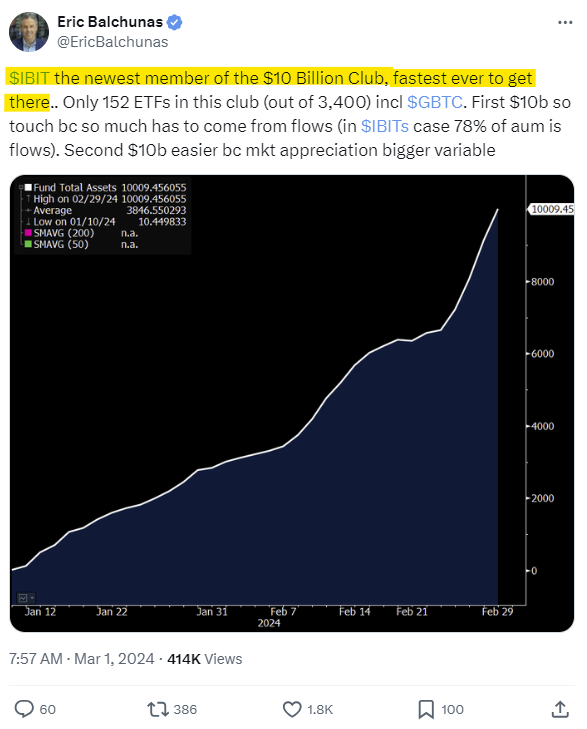

Salim Ramji led BlackRock’s iShares ETF business, but more specifically, helped launch BlackRock’s spot bitcoin product in January and oversaw its “filing and logistics.” The iShares Bitcoin Trust (IBIT) introduction to markets has been a smashing success.

Given Vanguard’s negative stance toward bitcoin, the appointment of an external, bitcoin-friendly candidate to the role of CEO is notable for Vanguard. In January, users with brokerage accounts at the firm were unable to buy U.S. spot Bitcoin ETFs, unlike many of its competitors. Vanguard said at the time that it would not offer the funds, arguing that high volatility is detrimental to generating long-term returns.

While nothing is certain at this point, the selection of Samil Ramji may represent a sea-change moment – a repositioning, if you will, of Vanguard’s sails.

It reminds me of last week’s conversation between Josh Brown and Michael Batnick on the Tuesday episode of What Are Your Thoughts where they discussed how certain defining moments in markets can alter the future path of an entire organization. In that context, the guys discussed how the late John Bogle, founder of Vanguard, disrupted the entire industry by offering low-cost index funds. While some asset managers followed suit, others did not. You can likely guess in the table below which businesses adapted to the changing landscape and those that missed out.

Perhaps we are witnessing that same leadership adjustment in real time with the appointment of Salim Ramji as CEO of Vanguard.

Amy Arnott, a portfolio strategist at Morningstar, had this to say: “The evolving list of dominant fund companies reflects some powerful positive trends over the past 35 years.”

Source: Vanguard, CoinDesk, AARP, Eric Balchunas, What Are Your Thoughts

The street is revising their earnings estimates higher

Wall Street has a rather strange habit of reducing earnings estimates ahead of the reporting quarter. They do so for several reasons: macroeconomic factors, market conditions, industry trends, company performance, and guidance from company management.

Overall, Wall Street adjusts earnings estimates up or down as part of an ongoing process to provide investors with the most accurate and up-to-date information about companies' financial performance and prospects. These revisions help investors make informed decisions and manage their investment portfolios effectively.

For the 1st time since 4Q21, analysts are actually revising their earnings estimates higher.

The bottom-up EPS estimate for Q2 increased by +0.7% from March 31 to April 30.

This contrasts to the past 20 years, where the average decline in the bottom-up ESP estimate during the 1st month of a quarter has been -1.8%.

Another feather in the cap for the bulls.

Source: FactSet

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.