Are investors holding too much cash?

The Sandbox Daily (10.27.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

are investors holding too much cash?

Let’s dig in.

Blake

Markets in review

EQUITIES: Nasdaq 100 +1.83% | S&P 500 +1.23% | Dow +0.71% | Russell 2000 +0.28%

FIXED INCOME: Barclays Agg Bond +0.07% | High Yield +0.25% | 2yr UST 3.501% | 10yr UST 3.989%

COMMODITIES: Brent Crude -0.06% to $65.90/barrel. Gold -3.06% to $4,011.1/oz.

BITCOIN: +1.23% to $114,765

US DOLLAR INDEX: -0.14% to 98.814

CBOE TOTAL PUT/CALL RATIO: 0.86

VIX: -3.54% to 15.79

Quote of the day

“Don’t cling to a mistake just because you spent a lot of time making it.”

- Aubrey de Grey

Are investors holding too much cash?

A growing challenge facing investors today is how to manage cash as short-term interest rates fall.

The Federal Reserve reduced its key benchmark interest rate last month by 25 basis points (0.25%), and it’s expected to cut another 25 bps this week. More cuts are expected over the coming year as well.

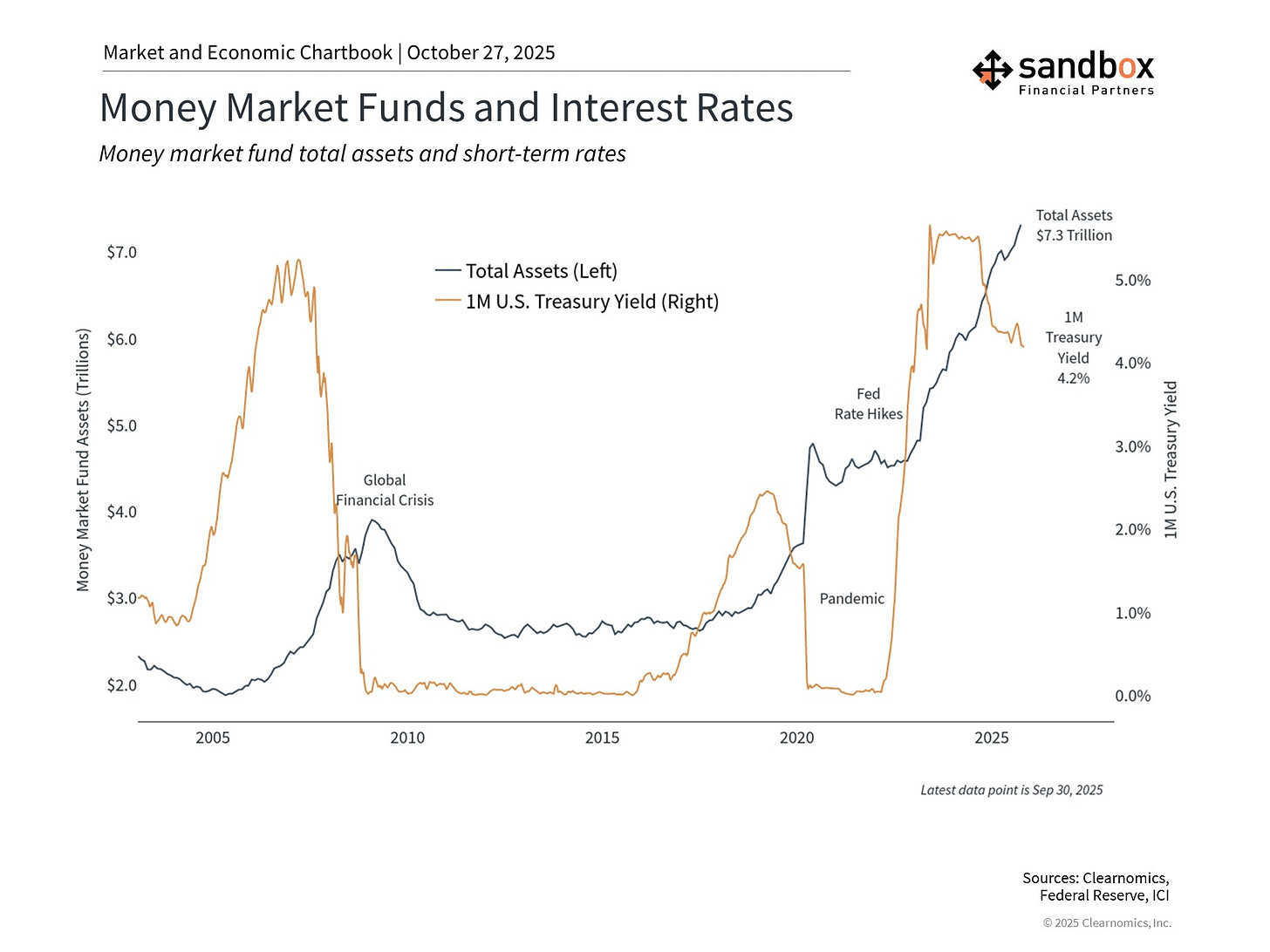

What appears safe actually carries hidden costs, since holding too much cash can quietly undermine long-term financial goals. This comes at an important time with many investors holding “cash on the sidelines,” including a record $7.3 trillion in money market funds.

Investing isn’t just about deciding between risky assets or cash – it’s about holding the right mix of assets that are aligned with your long-term needs. Cash does play important roles in these plans, especially when it comes to having enough liquidity to pay for expenses and emergencies.

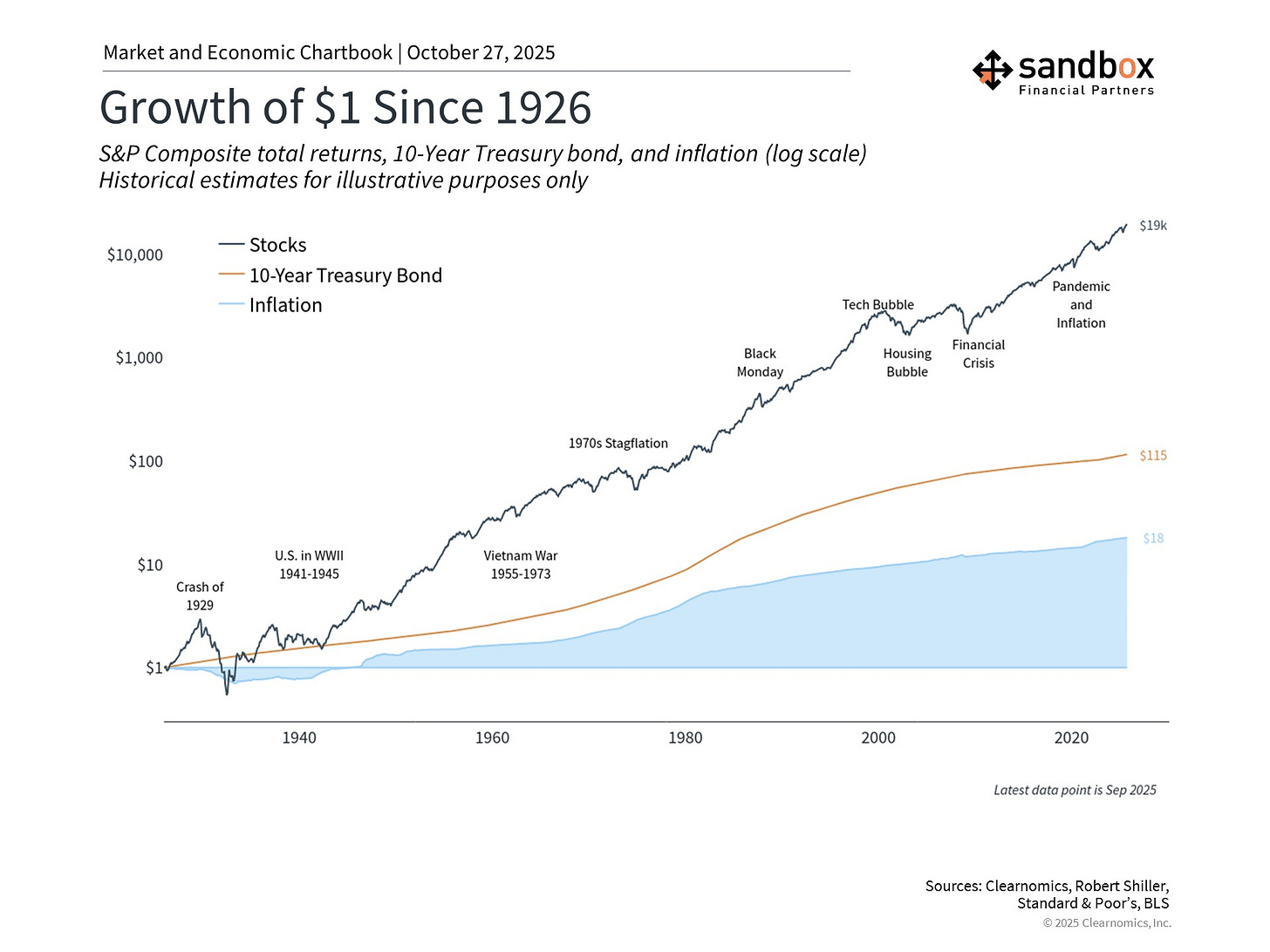

Stocks and bonds have outpaced inflation over the long run

The historical record is crystal clear: over time, stocks and bonds have risen magnitudes more than inflation.

What cost $1 in 1926 costs about $18 today – yet stocks and bonds have risen many multiples more, building real wealth over the decades. This is true despite periodic market pullbacks, financial crises, and recessions over the past century.

The past is no guarantee of the future, but this year’s market rebound shows how quickly market pessimism can give way to a market rebound. Even the high inflation rates of the past few years have paled when compared to the returns of a balanced portfolio. Over time, the compounding effect of even modest returns above inflation can create wealth.

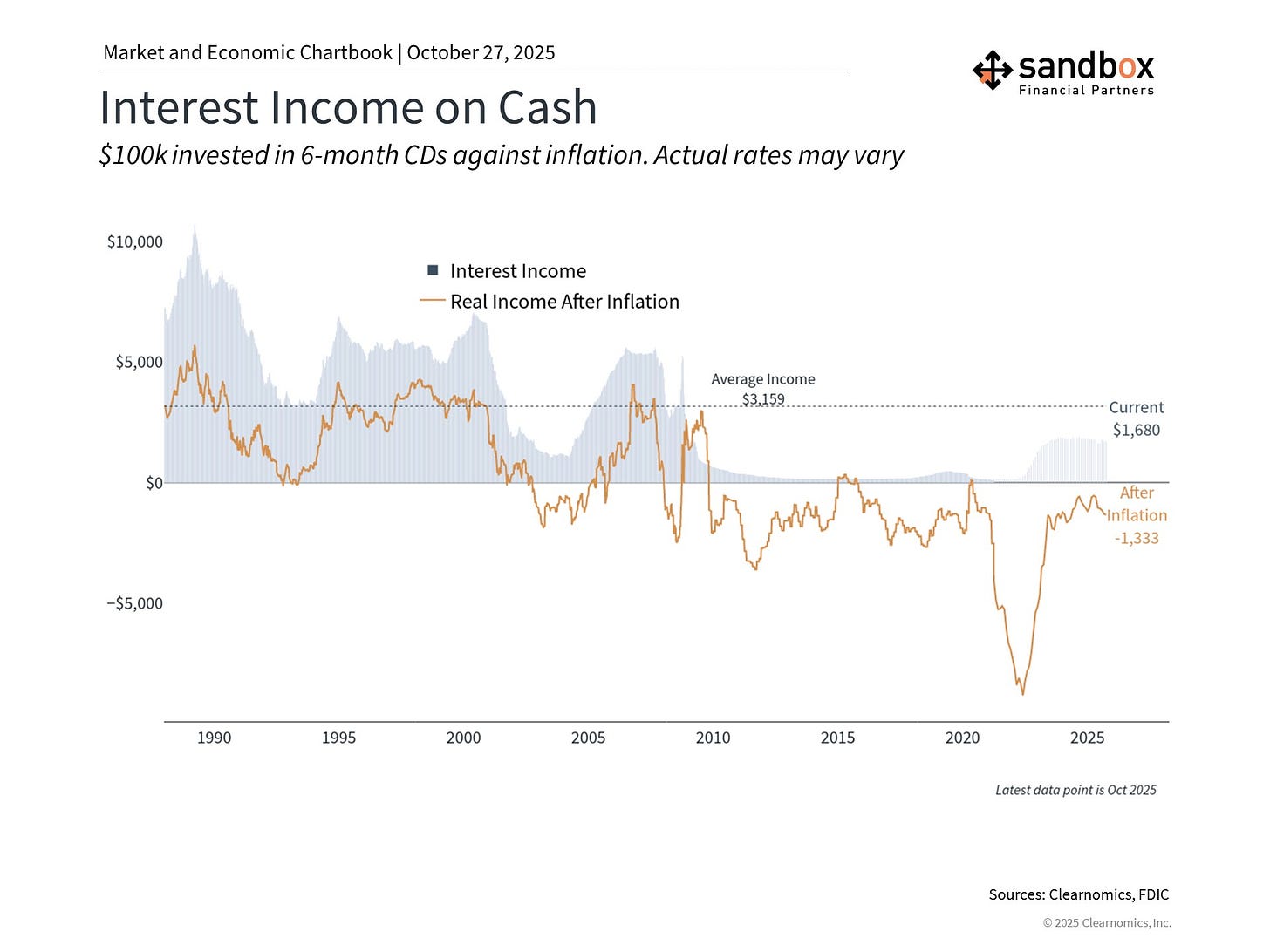

Holding excess cash quietly erodes purchasing power

Cash is essential for short-term needs and peace of mind. But holding more than necessary can be costly, even when high interest rates make cash seem appealing.

The first hidden cost is inflation. Yields on savings accounts or money market funds often fail to keep up with rising prices. Over the past two decades, real (inflation-adjusted) returns on cash have been negative most of the time.

The second cost is reinvestment risk. Cash yields change quickly. As the Fed cuts rates, today’s attractive yields may fade, forcing investors to reinvest at lower levels – often below the level of inflation. Meanwhile, those who remain in short-term instruments may miss gains from longer-term bonds or stocks, which tend to benefit when rates fall.

Cash feels safe because the number that shows up on your account statement is stable, especially when there is market uncertainty.

But it’s purchasing power – not the dollar amount – that’s what matters. If inflation runs at 3% and cash earns 2%, that’s a silent 1% loss each year. Over decades, those small differences can have a big impact, especially for retirees.

Cash on the sidelines is at record levels

Money market assets have nearly doubled since the pandemic, as investors chased higher short-term yields or waited out market volatility. But with rates set to decline further, that record cash hoard faces its own risks.

Many investors will eventually need to decide when – and how – to put that cash back to work. One approach is dollar-cost averaging, gradually reinvesting back into stocks and bonds over time.

Bottom line?

While cash serves many different purposes, holding too much can create material drag on future returns. Maintaining an appropriate cash buffer while staying invested is still best practice.

Sources: St. Louis Fed, Clearnomics

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)

Blake, What if you are going into your 70's and we can't afford a 20% correction that takes years to recover.