Are the arguments against breadth misplaced? 📈, plus record air travel ✈️ and housing supply shortage 🏠

The Sandbox Daily (6.25.2024)

Welcome, Sandbox friends.

A rally in the world’s largest tech companies lifted stocks today, private equity continues its buying spree of residential properties, and a new poll from the NY Times shows a very close race nationally and in critical battleground states ahead of Thursday’s first presidential debate.

Today’s Daily discusses:

are arguments against breadth misplaced?

record air travel numbers

housing supply shortage

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 +1.16% | S&P 500 +0.39% | Russell 2000 -0.42% | Dow -0.76%

FIXED INCOME: Barclays Agg Bond -0.01% | High Yield +0.13% | 2yr UST 4.742% | 10yr UST 4.246%

COMMODITIES: Brent Crude -1.22% to $84.96/barrel. Gold -0.60% to $2,330.4/oz.

BITCOIN: +6.12% to $61,978

US DOLLAR INDEX: +0.15% to 105.635

CBOE EQUITY PUT/CALL RATIO: 0.58

VIX: -3.68% to 12.84

Quote of the day

“Dreams without goals are just dreams. And ultimately, they fuel disappointment. On the road to achieving your dreams, you must apply discipline, but more importantly, consistency. Because without commitment you'll never start, and without consistency you'll never finish.”

- Denzel Washington

Are arguments against breadth misplaced?

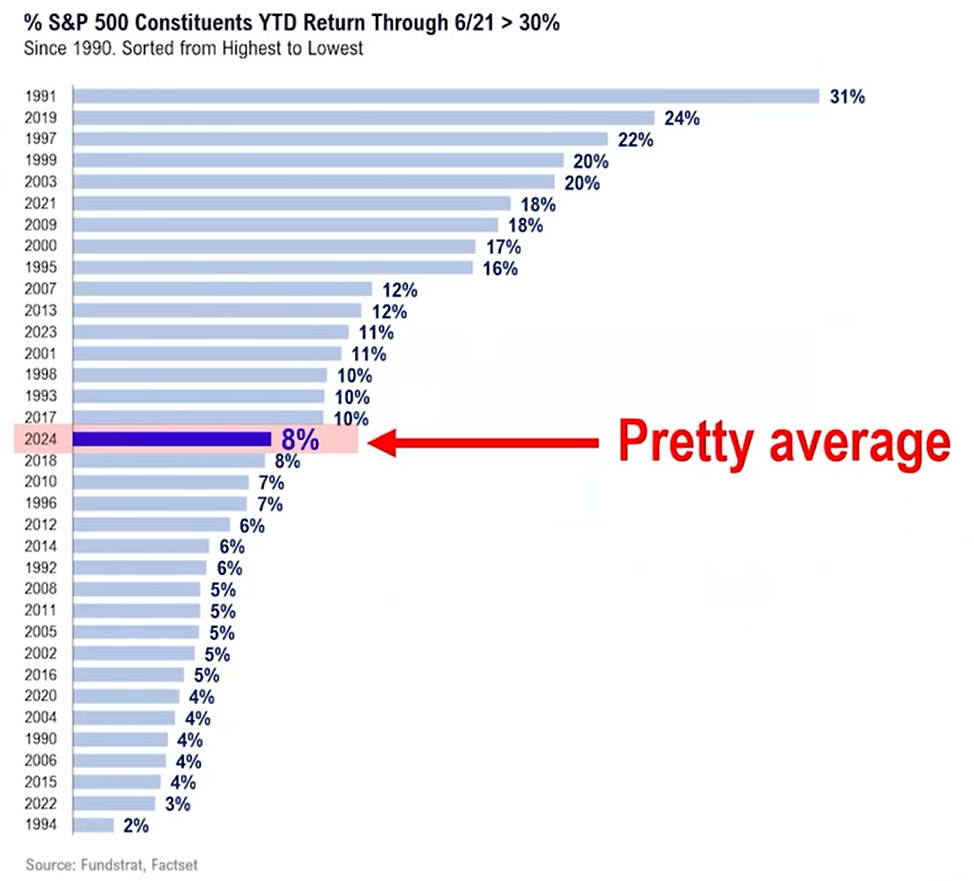

Much has been made about market breadth since the bull market began in October 2022.

Candidly, one of the key themes dogging the market this year has been narrow leadership, and yet, one-third of S&P 500 index constituents are currently higher by 10% or more for the year.

Focusing at the top end, 8% of the index is returning 30% or more – that’s 40 stocks, not just the 7 being reported in mainstream media.

The current 8% share of S&P 500 index constituents returning 30% or more through June is roughly in line with the 10% historical average since 1990, implying 2024 is fairly typical of past years.

In fact, the market leaders of 2024 sit right in the middle over the last 35 years.

Source: Fundstrat

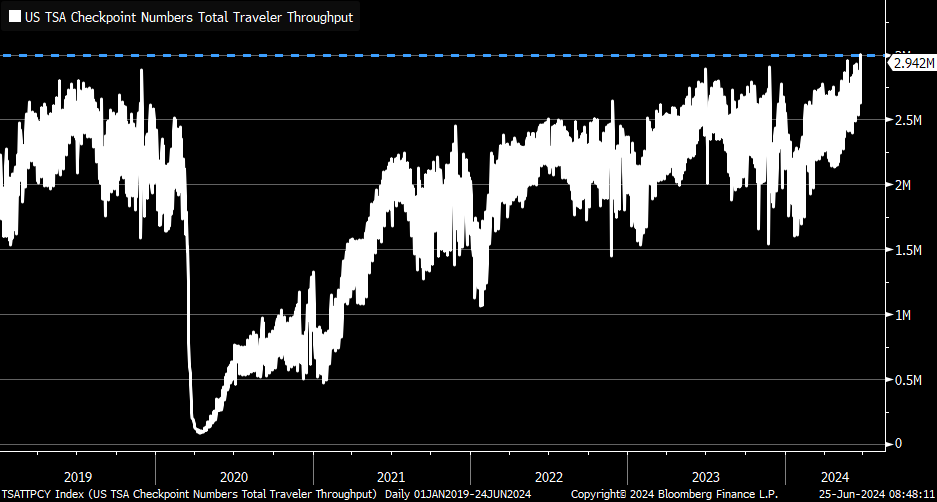

Record air travel numbers

The U.S. Transportation Security Administration (TSA) said it had screened 2.99 million airline passengers on Sunday, the highest-ever number in a single day.

Sunday's record broke the prior high of 2.942 million set in late May, while 7 of the 10 busiest travel days ever have occurred over the past month.

TSA expects this Friday will be the 1st time it screens more than 3 million people, the peak travel day during the upcoming holiday period (Thursday, June 27 through Monday, July 8).

TSA is expecting to screen more than 32 million travelers during this 2024 Independence Day travel period, which is 5.4% higher than 2023 levels.

Below is a chart showing the average daily passenger throughput for 2024 as of May month-end, where passenger counts since the pandemic-era slowdown have rebounded strongly.

Nothing is more discretionary for the consumer than personal travel. When the economy rolls over, it’s one of the 1st things to be cut.

The TSA data continues to show no signs of the economy slowing down.

Source: Transportation Security Administration, Kevin Gordon, Yahoo! News, Sherwood

Housing supply shortage

Many economists have been warning about a chronic housing shortage since the Global Financial Crisis in 2008-2009, leading to a material supply/demand imbalance as fewer units come on line and demand from Millennials increases.

On the heels of the GFC, new residential construction effectively came to a screeching halt after years of explosive expansion and the sharpest increase for home prices in recorded history. We have been trying to catch up ever since.

Ned Davis Research has run the numbers and it appears the United States housing market is currently short 2.2 million housing units.

Source: Ned Davis Research, Federal Reserve

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.