Are we really in a market bubble?

The Sandbox Daily (9.22.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

fears of a bubble are growing

Let’s dig in.

Blake

Markets in review

EQUITIES: Russell 2000 +0.59% | Nasdaq 100 +0.55% | S&P 500 +0.44% | Dow +0.14%

FIXED INCOME: Barclays Agg Bond -0.12% | High Yield +0.07% | 2yr UST 3.605% | 10yr UST 4.149%

COMMODITIES: Brent Crude -0.10% to $66.60/barrel. Gold +2.06% to $3,782.3/oz.

BITCOIN: -2.31% to $112,789

US DOLLAR INDEX: -0.33% to 97.317

CBOE TOTAL PUT/CALL RATIO: 0.77

VIX: +4.21% to 16.10

Quote of the day

“Resentment is like drinking poison and then hoping it will kill your enemies.”

- Nelson Mandela

Are we really in a market bubble?

As markets reach new highs and AI stocks drive much of the rally, I continue to see the same question over and over: "are we in a bubble?"

The truth is, the idea of a “bubble” is as much about investor psychology as it is about valuations.

While it’s normal to worry about bubbles, focusing too much on them can lead to counter-productive portfolio decisions that prioritize timing and short-term trading rather than long-term financial goals.

Markets move in cycles, and risk perception shifts with them.

History is full of big bubbles: Japan in the late 80s, the dot-com era, the mid-2000s housing boom. The Dutch Tulip Bulb mania dates all the way back to the 1630s.

And yet, there are countless other situations when investor concerns never materialized.

For example, investors constantly worried about additional bubbles after the 2008 global financial crisis, only for this period to become the longest bull market on record.

So, the question of whether there is a bubble should be distinguished from "will the stock market experience a setback?"

Valuations remain elevated versus its historical average

To distinguish between short-term pullbacks and the fear of a potential bubble, it's important to consider the concept of value.

As with everything in life, what matters in investing isn't just what price you pay but what you get for your money.

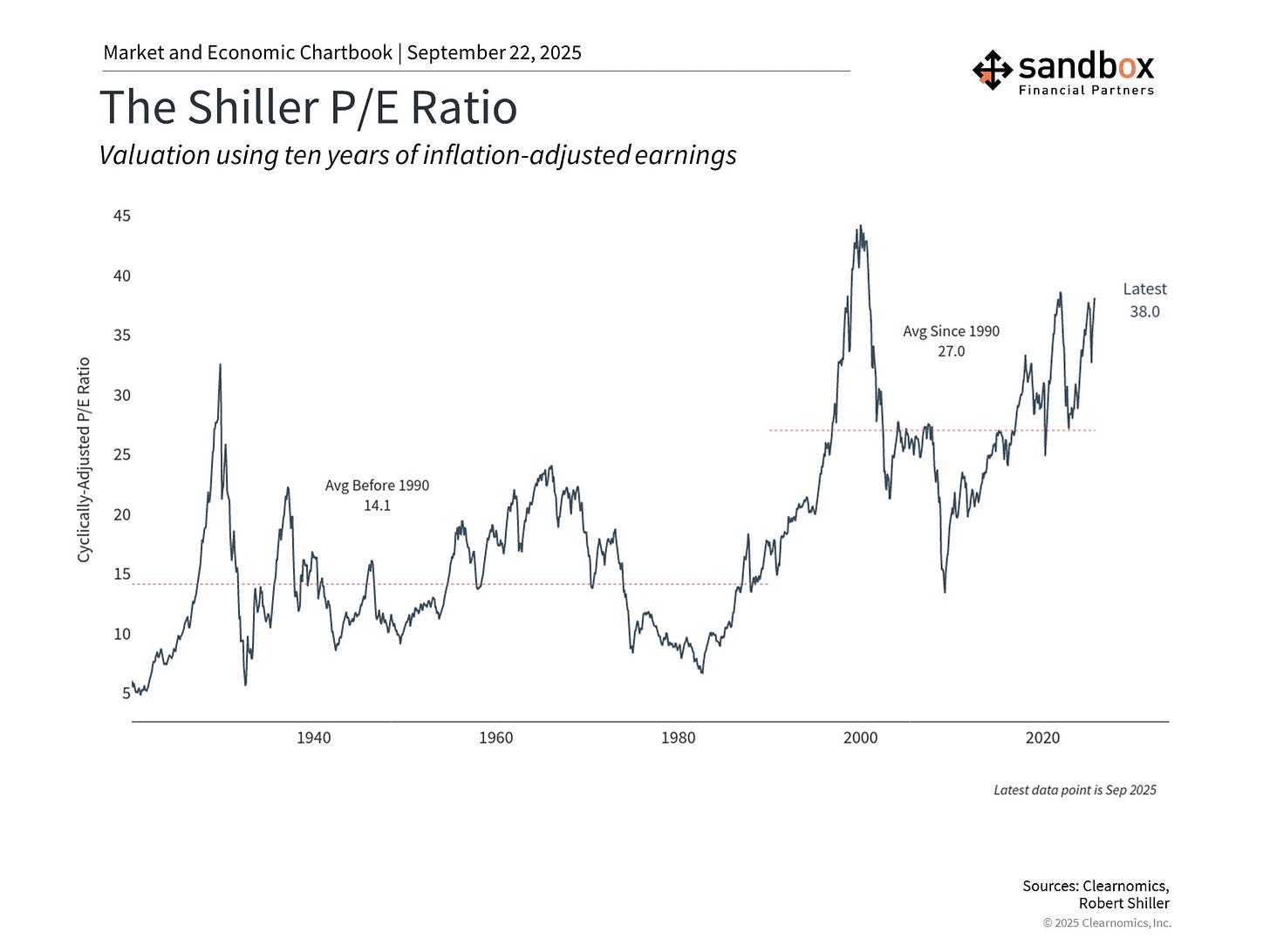

The chart below shows the Shiller price-to-earnings ratio which provides perspective on long-term valuation trends by using inflation-adjusted earnings over the past ten years.

The current level of 38x, which means that investors are paying $38 for each dollar of historical earnings today, is well above the average of 27x. This has fluctuated over the past few years as markets have navigated inflation, policy uncertainty, and volatility in technology stocks.

With many measures (like Shiller) showing that the stock market is expensive by historical standards, there are a few key points for investors to keep in mind.

First, it's important to emphasize that valuations do not reliably predict stock market returns in the near term. Instead, they tell us how much investors are willing to pay based on their expectations about the future. Even when stocks appear expensive, markets can continue rising for months or years if business fundamentals remain strong. This is why trying to time the market can often be counterproductive.

Second, while there are parallels to the 1990s tech boom since both periods feature high valuations and excitement around new technologies, there are some key differences. Unlike the unprofitable dot-com companies of the past, current market leaders are well established, print free cash flow, and hold healthy balance sheets.

Third, not all bubbles “pop.” While valuations can come back to Earth if prices fall, they can also improve if earnings and other fundamentals remain strong. Some of the enthusiasm experienced by the market today is in anticipation of higher future earnings. Corporate performance has justified some of these expectations in recent quarters with earnings growth coming in stronger than many had anticipated.

Time remains one of the most powerful investment tools

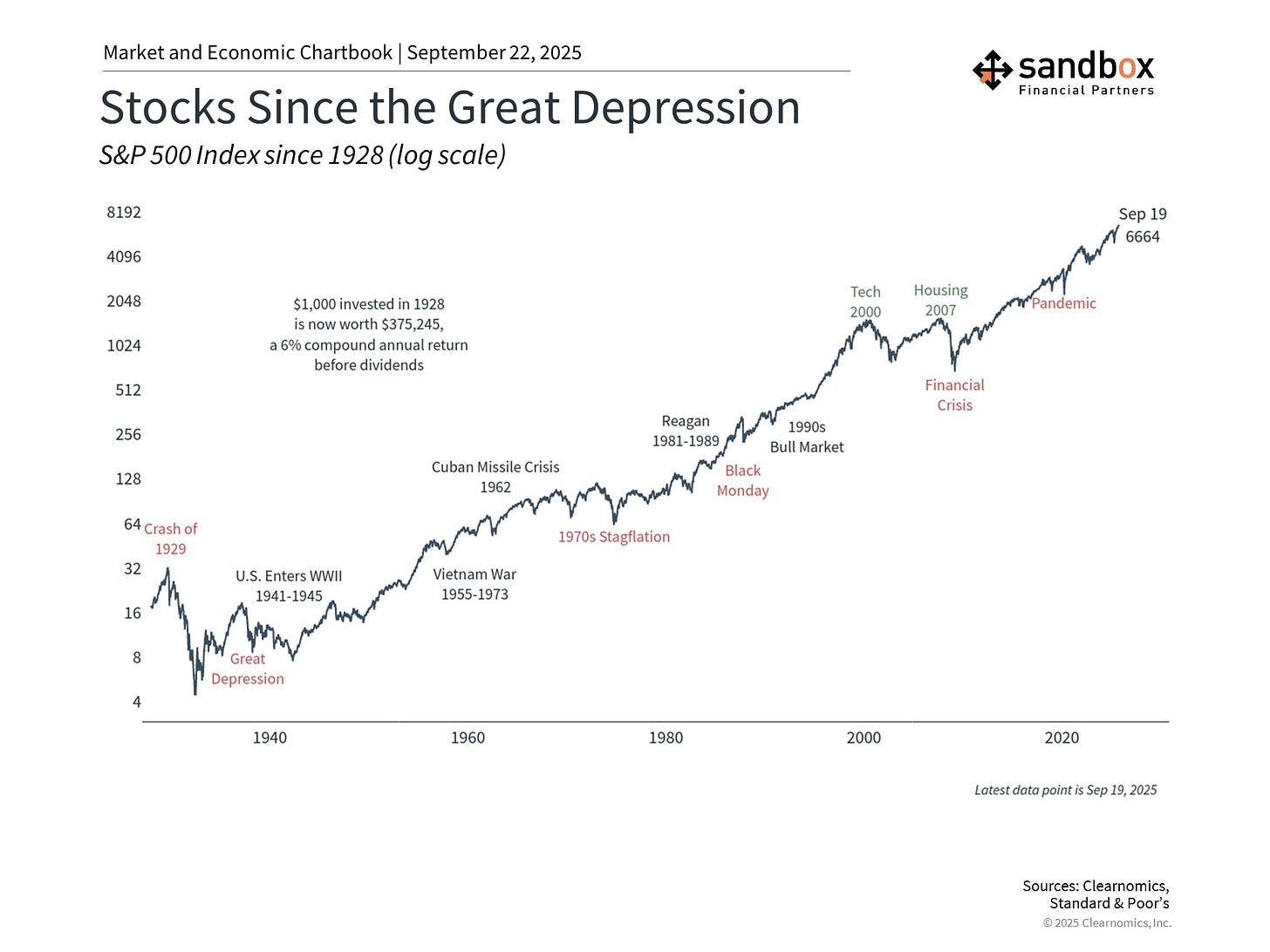

Perhaps the most important lesson from market history is that time tends to reward patient investors, even those who invest throughout periods of high valuations.

Some of the most impactful market events appear less dramatic when zooming out over years and decades – time horizons that are appropriate for many investors’ financial goals.

This emphasizes the importance of not only portfolio positioning, but investment concepts that take advantage of longer timeframes such as dollar cost averaging.

Even those who invested at the worst points in history, such as the 1929 market peak before the Great Depression, achieved positive returns over time. Starting during lower valuations generally produces better returns, but this advantage diminishes over extended time horizons.

Concerns over a “bubble” have grown as the market continues to reach new all-time highs, and technology stocks continue to grow in importance.

Rather than focusing on what this means for the market in the short run, investors should consider lessons from history and how they impact their own goals.

Bottom line?

As investors know from the past several years, short-term stock market declines are normal and can occur without notice.

Just earlier this year, the S&P 500 declined nearly 20% but bounced back in less than three months. Many who tried to time the market during this period likely found themselves on the sidelines as the market recovered.

While the past is no guarantee of the future, the stock market has demonstrated the ability to climb the wall of worry and make significant gains over history despite periodic challenges.

Source: Clearnomics

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)