Artemis I space launch, plus Walmart, credit cards, 2023 inflation, and yield curve inversion deepens

The Sandbox Daily (11.16.2022)

Welcome, Sandbox friends.

Today’s Daily discusses the Artemis I space launch, Walmart delivers on fundamentals, credit card balances are rising, Goldman Sachs expects prices to meaningfully roll over in 2023, the yield curve inversion deepens, and the New York Fed points to higher inflation expectations setting back in.

Let’s dig in.

Markets in review

EQUITIES: Dow -0.12% | S&P 500 -0.83% | Nasdaq 100 -1.45% | Russell 2000 -1.91%

FIXED INCOME: Barclays Agg Bond +0.62% | High Yield -0.21% | 2yr UST 4.376% | 10yr UST 3.723%

COMMODITIES: Brent Crude -1.99% to $91.97/barrel. Gold -0.69% to $1,769.8/oz.

BITCOIN: -1.82% to $16,573

US DOLLAR INDEX: +0.21% to 106.516

CBOE EQUITY PUT/CALL RATIO: 1.46

VIX: -1.75% to 24.11

Artemis I launch

“We rise together, back to the moon and beyond.“

NASA's Artemis I rocket successfully lifted off this morning in the agency's 4th attempt to launch the uncrewed spacecraft for a 1.3-million-mile mission around the moon and back to Earth.

Press play below - its INCREDIBLE !!

I felt 5 years old again.

The $4.1 billion dollar mission, a combination of the Space Launch System (SLS) and Orion spacecraft, was initially scheduled to launch in August but was delayed by technical issues and Hurricanes Ian and Nicole. It marks the first use of the SLS – see NASA’s visual representation here – and is seen as a precursor to possible human travel farther into space. The mission will take 25 days, primarily due to the moon's position—the solar-powered spacecraft cannot be in the moon's shadow for longer than 90 minutes or it risks losing power.

There aren’t any humans on board, but if this and subsequent test missions go well, the same rocket-capsule combo will be used to return people to the lunar surface as soon as 2025 in the 3rd phase of the Artemis space program.

Walmart delivers on fundamentals

Walmart, the largest retailer in the U.S. by revenue, announced yesterday annual sales growth of +8.2% and $153 billion in revenue for the 3rd quarter as Americans across income levels bought the company’s low-priced groceries.

The big-box retailer beat Wall Street’s expectations for the quarter and raised its full-year outlook to reflect that beat. In 2022, the earnings environment has been brutal: miss and guide down, and your headed to Chapter 11 — raise and beat, and the quarter is all mimosas.

Here is a look at what a Walmart shareholder receives in terms of yield (ignoring price appreciation/depreciation). Add them together and its good.

Walmart is slightly positive in 2022,+3.11% YTD, in one of the most difficult years in recent memory. Why? Because balance sheets matter. Cash flows matter. In this part of the cycle, fundamental metrics matter – a stark departure from recent memory.

Source: Sandbox Financial Partners, CNBC

Credit card balances are on the rise

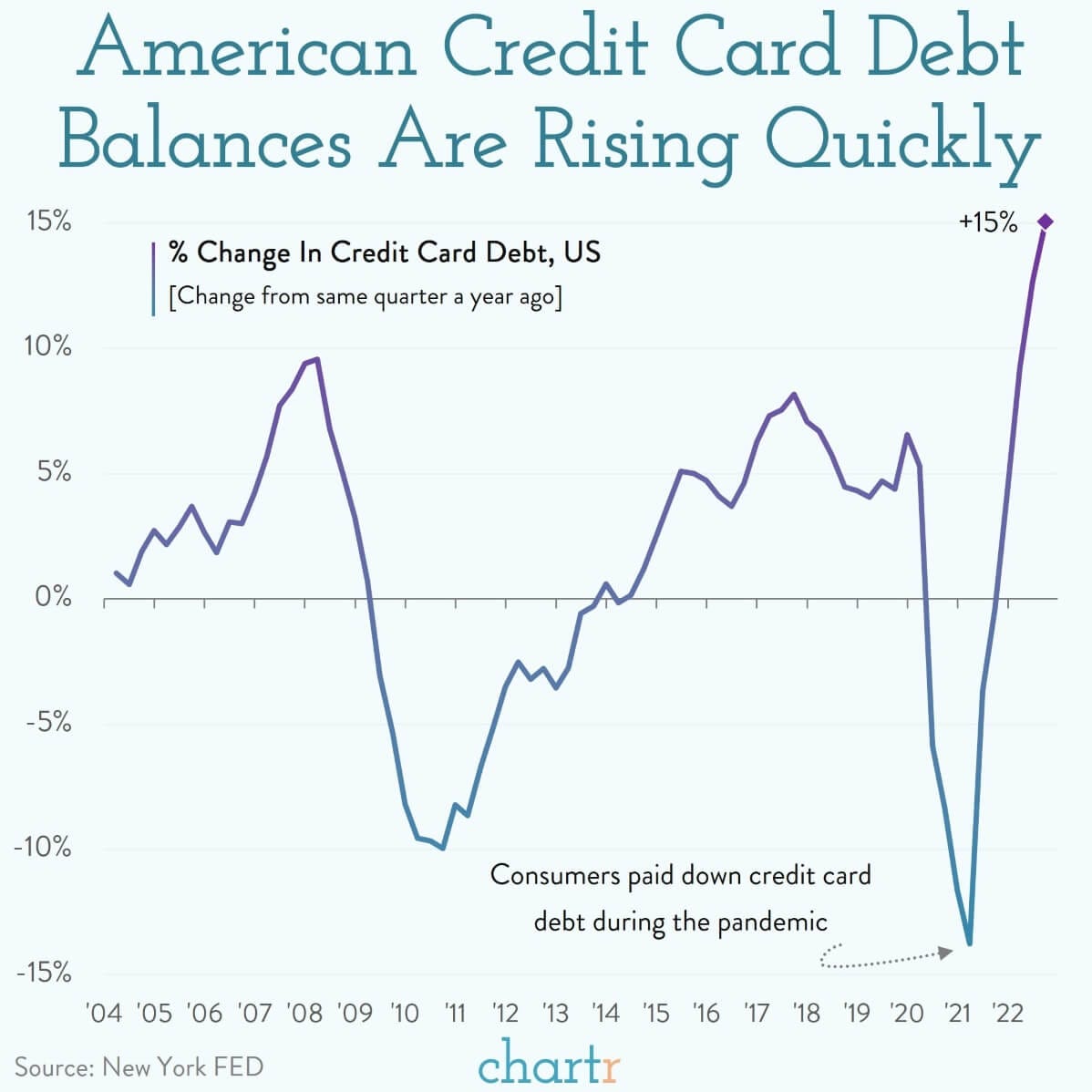

American household debt has hit a new high as the collective tab rose $351bn dollars in the 3rd quarter - largest nominal quarterly increase since 2007 - and takes the total owed by households to more than $16.5 trillion. That’s an increase of +2.2% from the previous quarter and +8.3% from a year ago.

Though mortgages are still by far the biggest source of debt, the collective credit card balance was the category that grew fastest on a relative basis. All told, household credit card debt grew +15% YoY, the largest annual jump for more than 20 years. A group of Federal Reserve researchers, hardly known for their sensationalist exaggeration, said that the increase “towers over the last 18 years of data.”

With over 500 million accounts open in the US, credit cards are a staple of consumer spending — more than 190 million Americans have at least one account, and 13% reported having five or more cards.

Goldman expects prices to meaningfully roll over in 2023

Jan Hatzuis and Goldman Sachs expect a significant decline in inflation next year, with the core PCE measure falling from 5.1% currently to 2.9% by December 2023. This expectation seems like a remarkable drop in prices. Headline inflation, now 7.75%, peaked in June at 9.06%.

The forecast of lower core inflation is predicated on three key factors:

1) the contribution of supply-constrained goods’ categories to core inflation will swing negative

2) peak in year-over-year shelter inflation expected this spring

3) slower wage growth driven by the ongoing rebalancing of the labor market (lower job openings, easing of wage growth, more layoffs)

Source: Goldman Sachs Global Investment Research

Yield curve inversion deepens

Several indicators get highlighted in financial media in which the market closely watches to gauge the risk of recession. The signal from the yield curve is one to which I always assign great value. In particular, the 2-10 year portion of the curve has the best track record in predicting business and economic cycles. Over the past 50 years, the curve has inverted 6 times, and 6 recessions followed. This signal never generated a false positive.

Today, the spread between short-dated Treasury maturities (2-year) and longer-dated Treasuries (10-year) continues to deepen, currently at -0.68%, which is its largest inversion in over 40 years.

Yield curve inversions spook investors because of what it portends for the economy in the coming months and years.

Source: All Star Charts, Sandbox Financial Partners

New York Fed points to higher inflation expectations

In addition to CPI, PPI, and PCE data, the Fed relies on consumer inflation expectations to guide its actions.

The most recent round of data from the New York Fed's Survey of Consumer Expectations should concern those who think the latest CPI and PPI reports warrant a change in the Fed's mindset. The New York Fed survey points to higher inflation expectations. Per the survey: "Median inflation expectations increased at both the 1- and 3-year-ahead horizons in October, by +0.5 and +0.2 percentage points, respectively, to 5.9% and 3.1%. Both increases were broad-based across age, education, and income groups." Equally concerning, the difference between the expectations of the top and bottom quartile of those surveyed decreased. There is less disagreement among consumers about higher inflation expectations.

The graph below shows the recent uptick in inflation expectations using New York Fed data. Further, consumers remain very uncertain of how much inflation to expect. Uncertainty, or fear that inflation remains high, will drive consumers to demand higher wages. The Fed remains fearful of a wage-price spiral, and the New York Fed survey data only heightens its concerns.

Source: Federal Reserve Bank of New York, Lance Roberts

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.