As volatility contracts, what to make of the recent bounce...

The Sandbox Daily (4.15.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

volatility is contracting

Let’s dig in.

Blake

Markets in review

EQUITIES: Nasdaq 100 +0.18% | Russell 2000 +0.11% | S&P 500 -0.17% | Dow -0.38%

FIXED INCOME: Barclays Agg Bond +0.20% | High Yield +0.27% | 2yr UST 3.847% | 10yr UST 4.331%

COMMODITIES: Brent Crude -0.06% to $64.84/barrel. Gold +0.61% to $3,246.1/oz.

BITCOIN: -0.85% to $84,076

US DOLLAR INDEX: +0.54% to 100.179

CBOE TOTAL PUT/CALL RATIO: 1.01

VIX: -2.49% to 30.12

Quote of the day

“As long as you are held captive by the opinions of others, your identity will be dominantly shaped by what other people say and think about you. To know yourself, you must come to a place where what other people say is irrelevant to your identity. This is a lifelong journey, I am not saying it is easy. When you decide to pursue authenticity, you are freed from a life of image management. You do not have to live worried or concerned or shaped by other people's judgment.”

- Erwin McManus, Seven Frequencies of Communication

As volatility contracts, what to make of the recent bounce

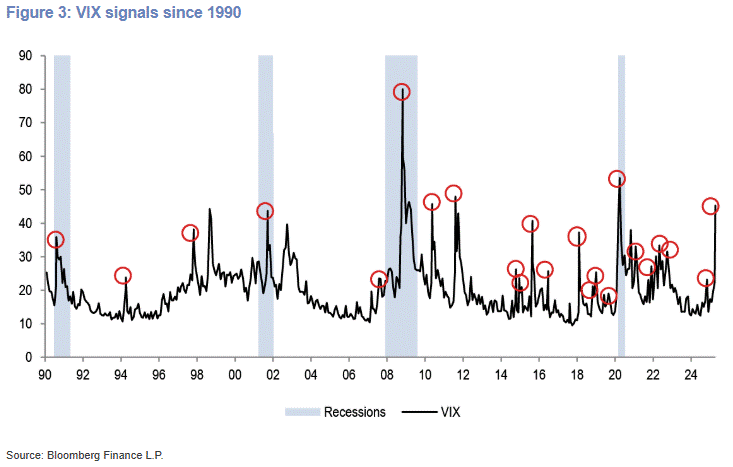

With the S&P 500 index down -12.2% since the February 19 high and the volatility index spiking to 60 over the last week, a lot of repricing from the complacent market setup at the start of the year (Fed put, Trump put, animal spirits, deregulation, tax cut extensions, etc.) has led to a dramatically different macro outlook going forward.

The volatility index, or “VIX,” which is often described as the market’s “fear gauge,” has surged to levels only witnessed during the Global Financial Crisis and Covid-19 pandemic, this side of the millennium. For most investors, this recent bout of instability and uncertainty is about as bad as they’ve ever experienced.

Weekly realized S&P 500 volatility has risen to its highest level since covid-19 and currently ranks in the 99th percentile vs. the past 50 years.

A 30 VIX implies a one-day move in the S&P 500 of roughly +/-2%. Last week, when the VIX skyrocketed to 60, implied a one-day move of roughly +/-4%.

These levels of daily price movements – not to mention the day-to-day tariff and trade war announcements – are not for the faint of heart.

The upshot to this madness?

Historically speaking, following major market tantrums and the corresponding sharp spikes in the VIX, equities have tended to reward patient investors – especially in the context of historic breadth capitulation and porous sentiment that currently plagues the market.

When looking at 3-month forward returns after the VIX has jumped higher by more than 50%, the S&P 500 has subsequently traded higher roughly 70% of the time over the next three months, absent a recession.

And yet, there remains some consternation that this recent bounce is your classic bear market rally.

As you can see in the table above, the forward-return data shows stronger 3-month median and average returns inside recessions than outside recessions. In other words, this market remains guilty until proven innocent and there is still work to be done and levels to reclaim to validate the bullish thesis.

One final point on this extremely volatile trading environment.

Jason Goepfert of SentimenTrader shared historical data of what happens to the market after the VIX drops from above the 50 level to below 30, as it has over the last week or so.

While the sample size is very small and thus statistically not significant, each previous signal has shown the market to be stronger, especially over longer time frames. As Jason writes, this indicator is a “bear killer.”

“Liberation day” might have marked the peak of trade uncertainty, but certainly not the end, especially as trade negotiations dominate the headlines over the coming months.

Investors should stay disciplined as markets adjust to tariffs, inflation, corporate earnings revisions, and more. Stock market volatility is a normal part of investing. Those who can stay balanced and focused have historically been in a better position to achieve financial success.

Sources: YCharts, JPMorgan, Jason Goepfert

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures at the Sandbox Financial Partners website: