Attention deficit investing, plus 🧁 weekend sprinkles 🧁

The Sandbox Daily (8.22.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

markets have goldfish memories, too

🧁 weekend sprinkles 🧁

Let’s dig in.

Blake

Markets in review

EQUITIES: Russell 2000 +3.86% | Dow +1.89% | Nasdaq 100 +1.54% | S&P 500 +1.52%

FIXED INCOME: Barclays Agg Bond +0.56% | High Yield +0.81% | 2yr UST 3.694% | 10yr UST 4.254%

COMMODITIES: Brent Crude +0.27% to $67.85/barrel. Gold +1.04% to $3,416.6/oz.

BITCOIN: +4.12% to $116,928

US DOLLAR INDEX: -0.89% to 97.742

CBOE TOTAL PUT/CALL RATIO: 0.92

VIX: -14.34% to 14.22

Quote of the day

“Slow down and enjoy life. It's not only the scenery you miss by going too fast - you also miss the sense of where you are going and why.”

- Eddie Cantor

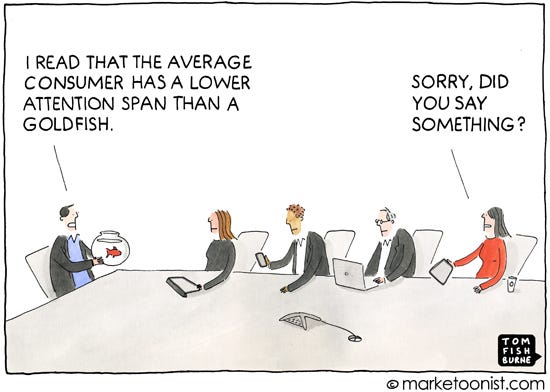

Markets have goldfish memories, too

With markets, there’s a lot we can learn from history.

But sometimes, current events can teach us just as much.

Back in June, Bloomberg noted that markets were exhibiting contradictory behavior:

“The never-ending back and forth on tariffs. An escalating war in Ukraine. Growing concern about the US’s mounting debt and deficits, and a congressional budget process that seems unlikely to address the problem. Sounds like a recipe for a bear market, and yet global stocks just hit an all-time high.”

This conundrum is coming up constantly in our daily conversations with clients.

Why are stocks printing new record highs despite pervasive negative headlines this spring and summer?

Let’s revisit an event earlier this year to help us understand why.

In late-January, a Chinese AI startup named DeepSeek took the market narrative by storm when it became the most downloaded application from Apple’s App Store – overnight.

What was notable, according to news reports, is DeepSeek required just a fraction of the compute needed to build AI services and platforms similar to OpenAI’s ChatGPT and Microsoft’s Copilot.

The market’s reaction to the news was swift: Nvidia, the primary supplier of semiconductor chips to the AI landscape, saw its stock sink 17% in one day.

If DeepSeek’s claims were true, Nvidia, its moat, and that impressive future stream of cash flows appeared to be in serious jeopardy.

Since then, however, Nvidia shares have roundtripped and traded to many new highs thereafter – but not because the DeepSeek threat has gone away.

In fact, there have been sparse updates on DeepSeek’s claim to be built on fewer chips and deliver the same high quality results.

Instead, Nvidia’s stock recovered for the same reason, I believe, that the overall market recovered, despite the risks that the aforementioned Bloomberg highlighted.

Investors simply have short memories.

It's hard to explain this phenomenon.

Perhaps it’s just because news cycles move quickly to the next target.

Or because social media has morphed our brains to only digest 30-second dopamine hits on TikTok, Instagram Reels, and YouTube Shorts. Or Tinder uprooted deeply interpersonal relationships with a quick swipe right. Even Major League Baseball instituted a pitch clock.

Whatever the reasons: it’s not necessarily rational, but it’s now our reality.

Perhaps investors and traders alike are best suited to maintain short attention spans. And it’s why investors are best served by never reacting too strongly to the news of the day. Get out of your own way.

As Tony Hsieh, founder of Zappos, used to say: “things are never as bad or as good as they seem.”

This maxim of life applies equally well to investing.

Source: Bloomberg, Safal Niveshak, Kiplinger

🧁 Weekend sprinkles 🧁

Here are the ideas, sights, and sounds that caught my attention this week – perfect for quiet time over the weekend.

Blogs

JPMorgan – JPM’s Asset Management 30 Pearls of Wisdom From 30 Years (Paul Zummo)

Axios – MIT Study on AI Profits Rattles Tech Investors (Madison Mills)

Bob Pisani – On Assholes and How to Deal with Them (Bob Pisani)

Odd Lots – AI, Orality, and the Golden Age of Grift (Joe Weisenthal, Cullen Roche)

Podcasts

The Compound and Friends with Tom Lee – It’s Still Early (Spotify, Apple Podcasts, YouTube)

The Unlock with Ben Carlson and Carl Richards – The Man Who Advises Your Financial Advisor (YouTube)

Movies/TV Shows

The Hunting Wives – Malin Akerman, Brittany Snow, Dermot Mulroney (Netflix, IMDB, YouTube)

Music

MGK – Starman (Spotify, Apple Music, YouTube)

Justin Bieber – Walking Away (Spotify, Apple Music, YouTube)

Books

Nick Maggiulli – The Wealth Ladder: Proven Strategies for Every Step of Your Financial Life (Amazon)

Fun

Umpire Hate 101 – Ump takes 3 to the nuts in 4 innings (Instagram)

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)