Average household net worth soars, plus market momentum into 2024 year-end, Fed balance sheet, and bullish sentiment

The Sandbox Daily (4.4.2024)

Welcome, Sandbox friends.

Today’s Daily discusses:

average household net worth soars to new highs

an object in motion stays in motion

Fed balance sheet amidst ongoing Quantitative Tightening (QT)

bulls outweigh bears for 22nd straight week

Let’s dig in.

Markets in review

EQUITIES: Russell 2000 -1.08% | S&P 500 -1.23% | Dow -1.35% | Nasdaq 100 -1.55%

FIXED INCOME: Barclays Agg Bond +0.24% | High Yield -0.08% | 2yr UST 4.647% | 10yr UST 4.307%

COMMODITIES: Brent Crude +1.73% to $90.91/barrel. Gold -0.34% to $2,307.5/oz.

BITCOIN: +3.41% to $68,518

US DOLLAR INDEX: -0.03% to 104.217

CBOE EQUITY PUT/CALL RATIO: 0.69

VIX: +14.10% to 16.35

Quote of the day

“Risk doesn’t simply increase the likelihood of unpleasant outcomes; risk is just a lack of guaranteed outcomes.”

- Jack Raines in Rethinking Risk

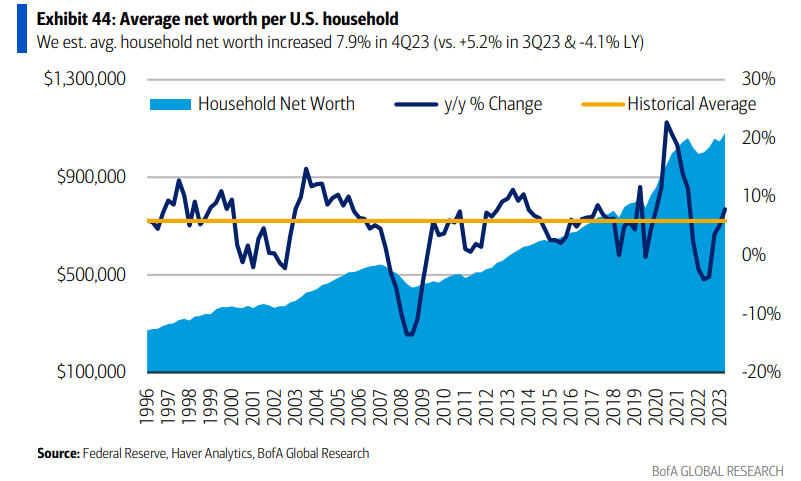

Average household net worth soars to new highs

Bank of America research estimates the average household net worth increased 7.9% in the 4th quarter.

Higher home and stock prices combined with static debt loads have sent net household worth to a new high.

J.P. Morgan illustrates how the consumer balance sheet is broken down across various categories, with the home occupying the largest asset and liability for the average household:

Source: Bank of America Global Research, J.P. Morgan Guide to the Markets

An object in motion stays in motion

The 1st quarter is a closely watched signal for the rest of the year.

Historically, when the S&P 500 gains more than 10% in the 1st quarter, the index finished the year green all 11 instances with a median gain of +23.1% for the year.

Strong market breadth has underpinned the rally across stocks in 2024, pushing the indexes higher despite higher inflation prints in Q1 and the bond market pricing out a large number of interest rate cuts that were expected as early as March.

For the past 103 days, we have seen the S&P 500 with more new highs than new lows – the 5th longest stretch in the past two decades.

Source: Grant Hawkridge

Fed balance sheet amidst ongoing Quantitative Tightening (QT)

Since June 2022, the Federal Reserve has been engaging in Quantitative Tightening (QT) to reduce the size of their balance sheet.

Alongside the interest rate hikes that everyone mentions, the Fed has utilized this 2nd monetary policy tool to shrink its footprint on markets – any maturing security on their balance sheet is “rolled off” without being replaced.

The caps currently in place are $60 billion in U.S. Treasuries per month and $35 billion in MBS, effectively reducing liquidity by $95B per month – although the actual amounts have been less than the caps (mainly on the MBS side).

The Fed's balance sheet is now at its lowest level since February 2021, down $1.5 trillion from its peak in April 2022.

How much more Quantitative Tightening (QT) is needed to unwind the massive Quantitative Easing (QE) from March 2020 – April 2022?

$3.3 trillion.

Source: YCharts

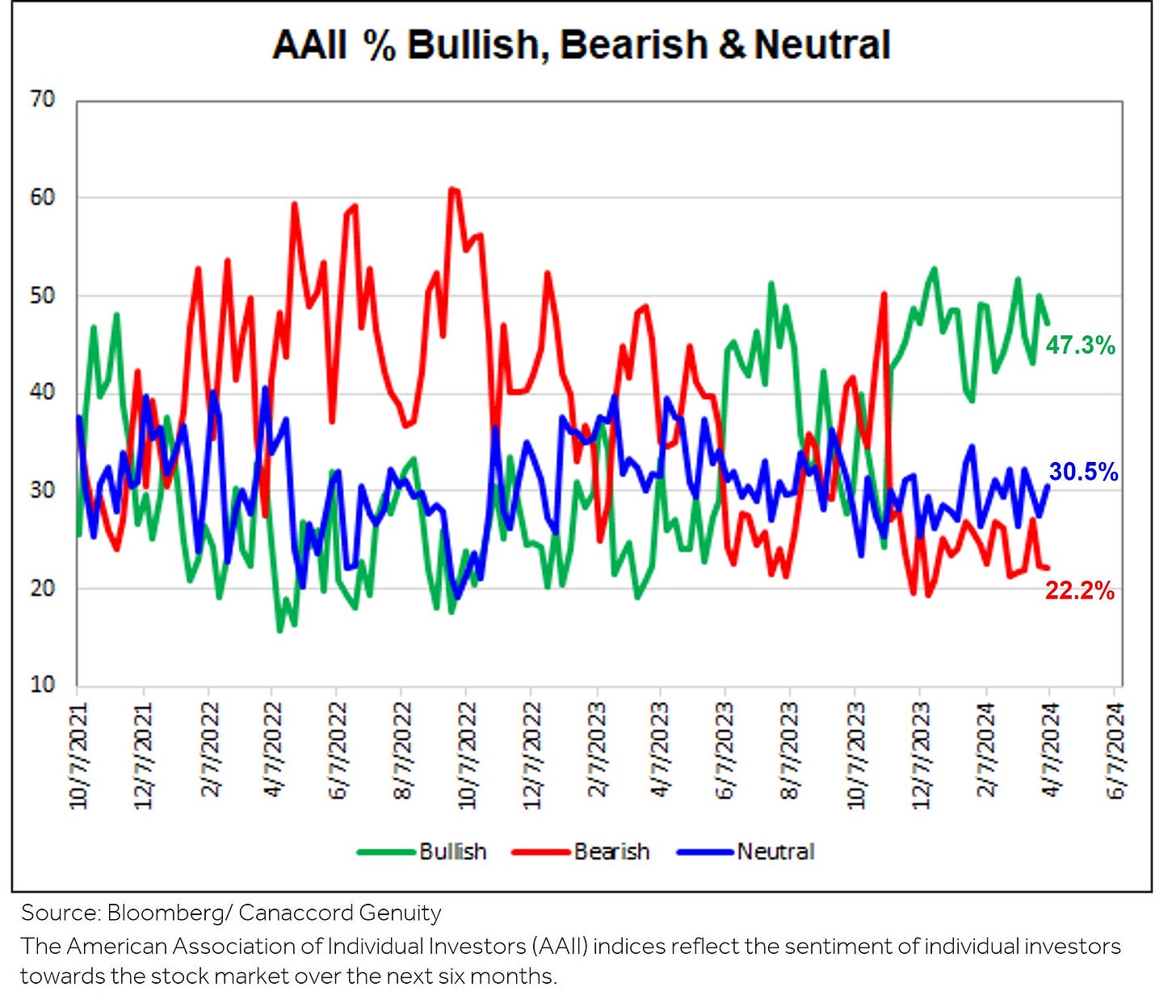

Bulls outweigh bears for 22nd straight week

Retail investor sentiment held relatively steady in the latest survey, as the major U.S. equity averages remain near/at record highs and financial conditions have eased over the last several months.

The American Association of Individual Investors (AAII) reported that bullish sentiment slipped from 50.0% to 47.3%, while bearish sentiment was almost unchanged at ~22%.

Since November 2nd, bullish sentiment has outweighed bearish sentiment for 22 consecutive weeks.

Source: AAII Investor Sentiment Survey, Dwyer Strategy

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

that quote 🔥🔥🔥