Balancing time horizons (and your emotions), plus 1-yr anniversary of the bull, bankruptcies, Consumer Prices, and the UAW strike

The Sandbox Daily (10.12.2023)

Welcome, Sandbox friends.

Today’s Daily discusses:

balancing time horizons (and your sanity)

bull market turns 1 years old!

bankruptcies pick up steam in September

Consumer Prices (CPI) data for September follows PPI report, inflects slightly higher

UAW strikes at the heart of Ford

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 -0.37% | Dow -0.51% | S&P 500 -0.62% | Russell 2000 -2.20%

FIXED INCOME: Barclays Agg Bond -0.86% | High Yield -0.53% | 2yr UST 5.069% | 10yr UST 4.703%

COMMODITIES: Brent Crude +0.68% to $86.38/barrel. Gold -0.31% to $1,867.0/oz.

BITCOIN: -0.23% to $26,717

US DOLLAR INDEX: +0.71% to 106.575

CBOE EQUITY PUT/CALL RATIO: 1.04

VIX: +3.73% to 16.69

Quote of the day

“Savor the joy of others. It is abundant and free and it will lift your spirits and boost your wellbeing even as you add positive energy to the world..”

- Phil Pearlman, Pearl Institute

Balancing time horizons (and your sanity)

Short-term thinking is the root of most investing problems. Human emotion is one element of this, perhaps short attention spans are another (hat tip Tik Tok, Reels, Shorts, etc.).

Identifying your time horizon should help set the proper expectations for your investments and the overall portfolio. Many of us fall into the trap of short-term biases because, collectively as a society, we expect results yesterday. But, sometimes we all need to take a moment and widen the aperture to see the bigger picture.

Below is a chart comparing S&P 500 calendar year returns (orange bars) against rolling 30-year returns (blue line) since 1950.

While market returns gyrate from year to year, long-term returns don’t budge.

As Ben Carlson, CFA writes, “Long-term returns are the only one that matter, but you have to get through a series of short-term emotions to get there.”

And this “behavior gap” is how we arrive at the large disparity we all see between investment results and investor returns:

The average investor annualized a paltry 3.6% over a 20-year period from 2002-2021, beating only commodities and cash over that time frame. Of course, this exercise leaves out important considerations like taxes, investor flows, risk tolerance, etc, but the results are startling and quite informative.

This brings up the idea of the status quo bias, which refers to our tendency to stick with things as they are. Much of the time, that actually turns out to be the best move. Making changes to our investments too frequently, for example, has been shown to result in this underperformance. However, at the other extreme, it's not productive to sit on your hands and avoid ever implementing a change.

Identifying time horizons and understanding our biases is so crucial to your probability of success, keeping market movements in perspective and managing risk (and your emotions) along the way.

Source: A Wealth of Common Sense, J.P. Morgan, Coert Visser

Bull market turns 1 years old!

October 12th, 2022 marked the bottom for the S&P 500 index and the end of the bear market. Hard to believe it’s been one year!

Large-cap Technology and tech-adjacent groups have been the obvious winner since that moment in time (hat tip AI), while bonds are the laggard of the major averages (surprisingly positive despite 2023’s relentless march higher in rates):

Below is a table showing the 25 best and worst performing stocks in the large-cap Russell 1000 index.

While the average stock in the index is up ~15% over the last year, the winners are all up 90%+ or much more, while the losers are all down more than 40%.

In historical context, the current bull – up +22% for the S&P 500 – is one of the weakest first year recoveries on record, with only 2 prior recoveries weaker since 1950 (1976-78, 1987).

The median gain over the 16 instances below is +33.5%.

Source: Bespoke Investment Group, Carson Group (Ryan Detrick, CMT)

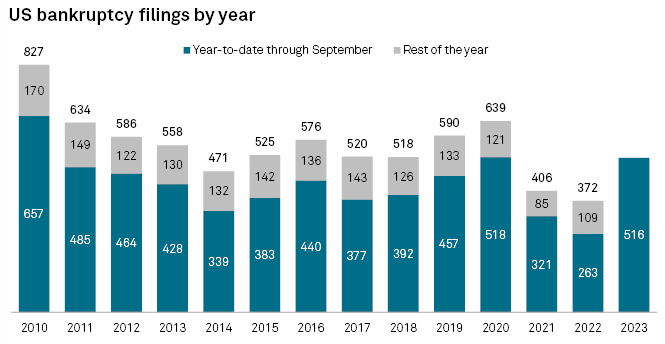

Bankruptcies pick up steam in September

U.S. corporate bankruptcies showed no signs of slowing in September, closing out the quarter with the most bankruptcies so far in 2023 – 182 in total.

2023’s total of 516 bankruptcies already surpasses the total filings seen in calendar year’s 2021 and 2022. 516 is also the highest number as of September month-end since 2010 (besides the 518 in 2020).

62 bankruptcy filings were entered in September, slightly higher than the 56 in August as higher interest rates added to economic pressures.

The filings seem to be concentrated around more capital-intensive industries; no surprise, there:

Source: S&P Global Market Intelligence

CPI data for September follows PPI report, inflects higher

The inflation dragon has not been slayed, yet.

Consumer prices in the U.S. held steady in September, as the Consumer Price Index (CPI) increased by 3.7% YoY – that's unchanged from August’s reading and slightly above economists' expectations of 3.6%. Meanwhile, CPI increased +0.4% MoM, which marks an improvement over the +0.6% increase observed in August.

Core CPI, which excludes food and energy prices, eased to 4.1% YoY from 4.3% in the prior month.

While both CPI numbers remain above the Fed’s target, the 3-month annualized rate of 3.1% is not alarming either given where we’ve come. Although this doesn’t change expectations that the Fed will skip raising rates at the next FOMC meeting, it confirms that policy will remain restrictive for longer.

Source: U.S. Bureau of Labor Statistics, Ned Davis Research, LPL Research

UAW strikes at the heart of Ford

The United Auto Workers (UAW) launched an unexpected strike at Ford’s most profitable plant this morning, a major gut punch in the ongoing labor strike negotiations.

Let’s put into perspective just how valuable the Louisville, Kentucky plant is to Ford’s production:

approximately 8,700 UAW workers are now picketing in KY as a result of this decision

19.7% of U.S. production comes through this location, Ford’s largest plant not only in the United States but globally as well

13 nearby Ford upstream and downstream facilities gravely impacted

41% of U.S. production has now been stopped by UAW strikes

industry estimates suggest this Kentucky plant generates $25 billion in annual revenue, 1/6th of Ford’s annual topline sales number

By many estimates in the auto industry, this is the most profitable auto manufacturing plant in the United States – among all automakers – so expect contract talks between Ford and the union to pick up the pace quickly from here.

This latest UAW move greatly compromises Ford’s bargaining position, quarterly revenue, and near-term production output.

On that last point regarding output, expect the Ford outstanding days’ supply to start inflecting downward; current levels show Ford has 66 days of supply to meet demand, while the 10-yr average from 2010 to 2019 averaged ~64 days’ supply on dealer lots. Supply reduction should result in “reduced incentive spending and elevated net transaction prices across all OEMs” per J.P. Morgan.

So, how does the auto worker strike impact the U.S. economy?

If automobile production decreases, prices for vehicles – particularly used ones – may increase once again, unwinding some of the recent disinflation and putting renewed upward pressure on “super-core” CPI.

Source: Reuters, J.P. Morgan Markets

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.