Bitcoin pops off, plus immigration labor force trends and Fidelity's retirement analysis

The Sandbox Daily (2.28.2024)

Welcome, Sandbox friends.

Today’s Daily discusses:

Bitcoin hits $64k, trade volume soars

immigration: slower but still above trend

Fidelity retirement analysis

Let’s dig in.

Markets in review

EQUITIES: Dow -0.06% | S&P 500 -0.17% | Nasdaq 100 -0.54% | Russell 2000 -0.77%

FIXED INCOME: Barclays Agg Bond +0.20% | High Yield -0.01% | 2yr UST 4.648% | 10yr UST 4.268%

COMMODITIES: Brent Crude -0.22% to $83.47/barrel. Gold -0.06% to $2,042.9/oz.

BITCOIN: +9.57% to $62,534

US DOLLAR INDEX: +0.11% to 103.946

CBOE EQUITY PUT/CALL RATIO: 0.61

VIX: +3.05% to 13.84

Quote of the day

“Life never moves in one single direction. There’s no perfect state of mind. Even though many people desire to have equilibrium, that’s not the nature of life.”

- Darius Foroux

Bitcoin hits $64k, trade volume soars

Flows into the new spot bitcoin ETFs have accelerated this week, culminating in today’s monster trading session – a record by a country mile.

Many thought the launch of these products last month might be a red-hot start as investors buy the new shiny object, then quickly settle down as demand would mature into a slow burn – but that doesn’t seem to be the case at all.

Today was another intense volume day for the basket of “New Nine” in which roughly $6 billion dollars was traded on the public exchanges, with Blackrock’s iShares Bitcoin Trust leading the way ($3.3B). AND, keep in mind, this trading activity is without the options market since those derivatives don’t exist yet.

Another way to put this fervor into perspective is measuring the transaction volume and comparing crypto to legacy markets.

Jim Bianco’s chart below shows that there were more individual trades yesterday in the bitcoin ETFs (orange line, 241k trades) than there were in SPY (blue line, 185k) or QQQ (green line, 138k).

Keep in mind the collective assets under management (AUM) for the New Nine bitcoin ETFs is $44B, while SPY is the largest ETF in the market with $497B AUM and QQQ is 5th largest with $253B AUM – so this trading volume is truly staggering in the context of size.

Bitcoin briefly topped $64,000 today, having returned ~34% year-to-date and now sits roughly 10% away from its record peak of $68,800 reached in November 2021.

It’s always hard psychologically for investors to determine the right time to invest in markets, and the last few days in crypto are a perfect reminder of that truism.

When reviewing bitcoin’s history, if you miss the 10 best days of bitcoins return each year, you often miss all the return. Unfortunately, we don’t know when those days will be.

Source: Jim Bianco (Bianco Research), Eric Balchunas (Bloomberg), Sean Farrell (Fundstrat), Hunter Horsley (Bitwise)

Immigration: slower but still above trend

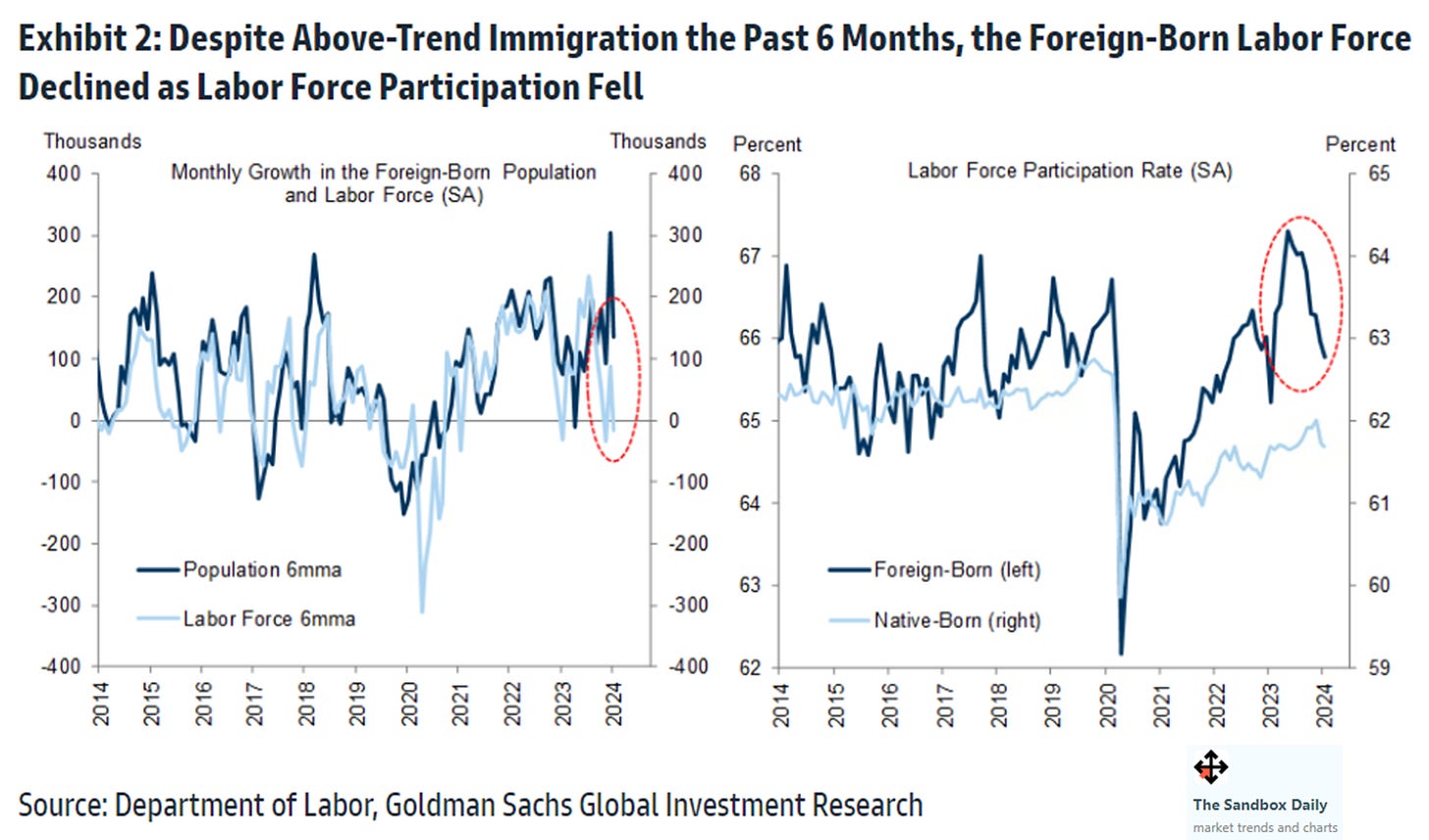

The immigration rebound that helped rebalance the tightest labor market in U.S. history continued in 2023, but appears likely to moderate in 2024.

The foreign-born labor force grew a rapid 110k/month in 2023 – about 70k/month faster than in 2010-2019 – but recently pulled back to trend levels as the foreign-born participation rate fell.

Despite continued growth in the foreign-born population, the foreign-born labor force has recently shrunk (chart below, left side) on sharply lower labor force participation (chart below, right side)

In 2023, the foreign-born labor force jumped in the 1st half but declined in 2nd half as labor force participation reverted to its pre-pandemic baseline – a rate more likely to be roughly sustained going forward.

Source: Goldman Sachs Global Investment Research

Fidelity retirement analysis

Consistent, dedicated savings plans might not be glamorous, but it will give you far more freedom and control over your lifestyle down the road. And most Americans accomplish their financial independence through their retirement accounts.

On the back of a strong recovery in market performance AND steady savings rates, Fidelity Investments – one of the largest administrators of workplace retirement plans – announced it had 422,000 401(k) millionaires at the end of 2023, representing a 41% jump from the prior year and coming just shy of the 442,000 record peak reached in 4Q21. Fidelity also said the number of 7-figure IRAs reached a record of 391,600 accounts.

Meanwhile, back on planet earth, the average 401(k)/IRA balance rose to $118,600/$116,600 at the end of 2024, up 14% for the year.

Other notable trends included 37% of workers who increased their retirement savings contribution rate at some point during 2023, as well as the retirement savings rate (employee + employer contributions) holding steady at 13.9% – consistent with recent measures.

Fidelity’s analysis considered data from 22 million participants.

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.