Bitcoin pushes higher to $30k

The Sandbox Daily (6.22.2023)

Welcome, Sandbox friends.

Today’s Daily discusses:

Bitcoin pushes higher to $30k

new absolute and relative highs for the homebuilders

5 reasons to consider hedging today

fewest homes for sale since Redfin began tracking supply in 2012

Bank of England steps up inflation fight taking benchmark rate to 5%

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 +1.18% | S&P 500 +0.37% | Dow -0.01% | Russell 2000 -0.80%

FIXED INCOME: Barclays Agg Bond -0.52% | High Yield -0.30% | 2yr UST 4.791% | 10yr UST 3.797%

COMMODITIES: Brent Crude -3.77% to $74.21/barrel. Gold -1.08% to $1,923.9/oz.

BITCOIN: +0.82% to $30,158

US DOLLAR INDEX: +0.32% to 102.399

CBOE EQUITY PUT/CALL RATIO: 0.53

VIX: -2.20% to 12.91

Quote of the day

“One market paradigm that I take exception to is: Buy low and sell high. I believe far more money is made by buying high and selling at even higher prices.”

- Richard Driehaus

Bitcoin pushes higher

Cryptocurrencies and crypto-related equities have lagged meaningfully in the shadow of technology stocks over the past 3 months. Here’s the price of Bitcoin (yellow line) against the Nasdaq 100 index (black line), with the lower panel showing the reversal in correlation recently:

What drove some of this decoupling? The regulatory environment, for one.

One June 5th and 6th, the Securities and Exchange Commission (SEC) went on a regulatory rampage against the crypto ecosystem, first suing the exchange Binance, then filing a lawsuit against Coinbase, Binance’s U.S. competitor. The SEC’s complaints alleged 1) failure to register as an exchange, brokerage, and clearing agency while 2) offering trading in crypto assets it considers unregistered securities, as well as 3) misappropriating customer funds in the case of Binance.

Well, fast forward just a few short weeks and the landscape has shifted meaningfully.

The launch of digital asset platform EDX and the filing of a spot bitcoin ETF from legacy investment manager powerhouse BlackRock have reversed crypto’s short-term misfortunes, as Bitcoin reclaimed $30k yesterday after rallying +20% over the past week. The BlackRock news cannot be understated because their historical record of ETF approvals by the SEC is 575-1.

Buyers stepped in last week at a critical ~$25k polarity level (green support line in chart below), before rallying strongly into $30k – a logical level where Bitcoin should consolidate its recent gains and digest overhead supply from the April highs (red line). $30k also coincides with the anchored-VWAP from its all-time highs.

If price action resolves higher from here, risk is to the upside for the entire crypto ecosystem, however it would be logical to see some short-term digestion after Bitcoin’s recent monster move.

Source: All Star Charts, Hostile Charts, Eric Balchunas

New absolute and relative highs for the homebuilders

The S&P 500 Homebuilder group recently took out their December 2021 highs. Just over a year ago in mid-June, the Homebuilder group was in the midst of a 42% drawdown. Since its lows in June 2022, the group is up +88%.

And on a relative basis, the homebuilders are hitting 15-year highest relative to the S&P 500.

According to Bill Smead, Smead Capital Management’s CIO, fears of a repeat of the Great Financial Crisis led many Wall Street analysts to underestimate the strength of the housing sector and provided bearish projections for the sector in 2022 and 2023.

“With the Fed tightening credit, many automatically assumed this was going to be a total disaster, the next 2006, the next total Waterloo for the industry,” said Bill Smead. “That led to microscopic price-to-earnings ratios nine months ago. It laid the groundwork for [builders] to perform better this year once people realized how incredibly profitable this business is even when things go against them.”

Source: Bespoke Investment Group, Grindstone Intelligence

Five reasons to consider hedging today, per GS

The baseline view from Goldman Sachs chief U.S. equity strategist, David Kostin, for the S&P 500 index is 4500 by 2023 year-end and 4700 in 12 months.

However, given many expect a recession to begin within the next year, Goldman’s equity team offered 5 reasons why investors should consider adding downside protection to their equity portfolio today to hedge the S&P 500:

put-call skew indicates that upside positioning is crowded and downside protection is attractively priced

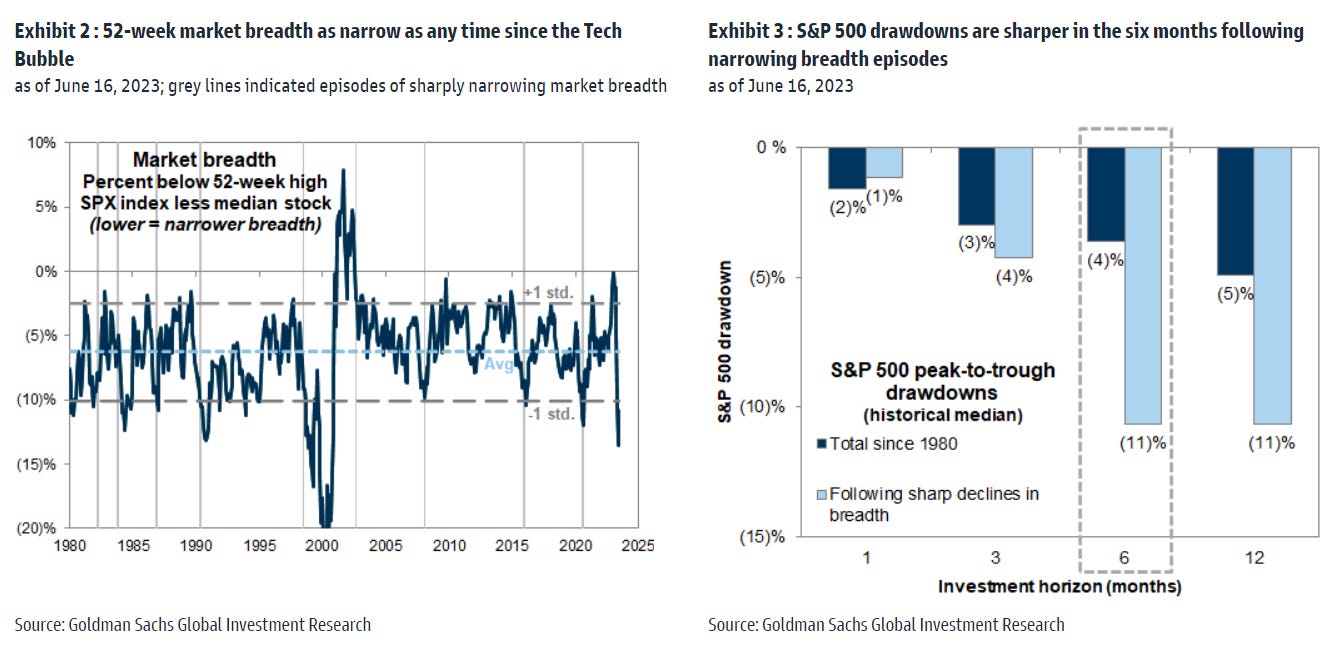

narrow market rallies are typically followed by sharper drawdowns (charts below)

equity valuations are elevated vs. history; some of this is due to the Super 7 (AAPL, MSFT, AMZN, GOOGL, NVDA, TSLA, META)

equities already priced an optimistic economic growth outlook

positioning is no longer a tailwind

Source: Goldman Sachs Global Investment Research

Fewest homes for sale since Redfin began tracking supply in 2012

Redfin reported the number of homes for sale in the United States during the month of May was the lowest level in their records which date back to 2012.

The number of active listings in May fell -7.1% year-over-year to 1.37 million, versus 2.24 million units in May 2019 – right before the pandemic rocked the housing market. That means the U.S. housing supply was 38.6% below its pre-pandemic levels.

Source: Redfin

BOE steps up inflation fight taking benchmark rate to 5%

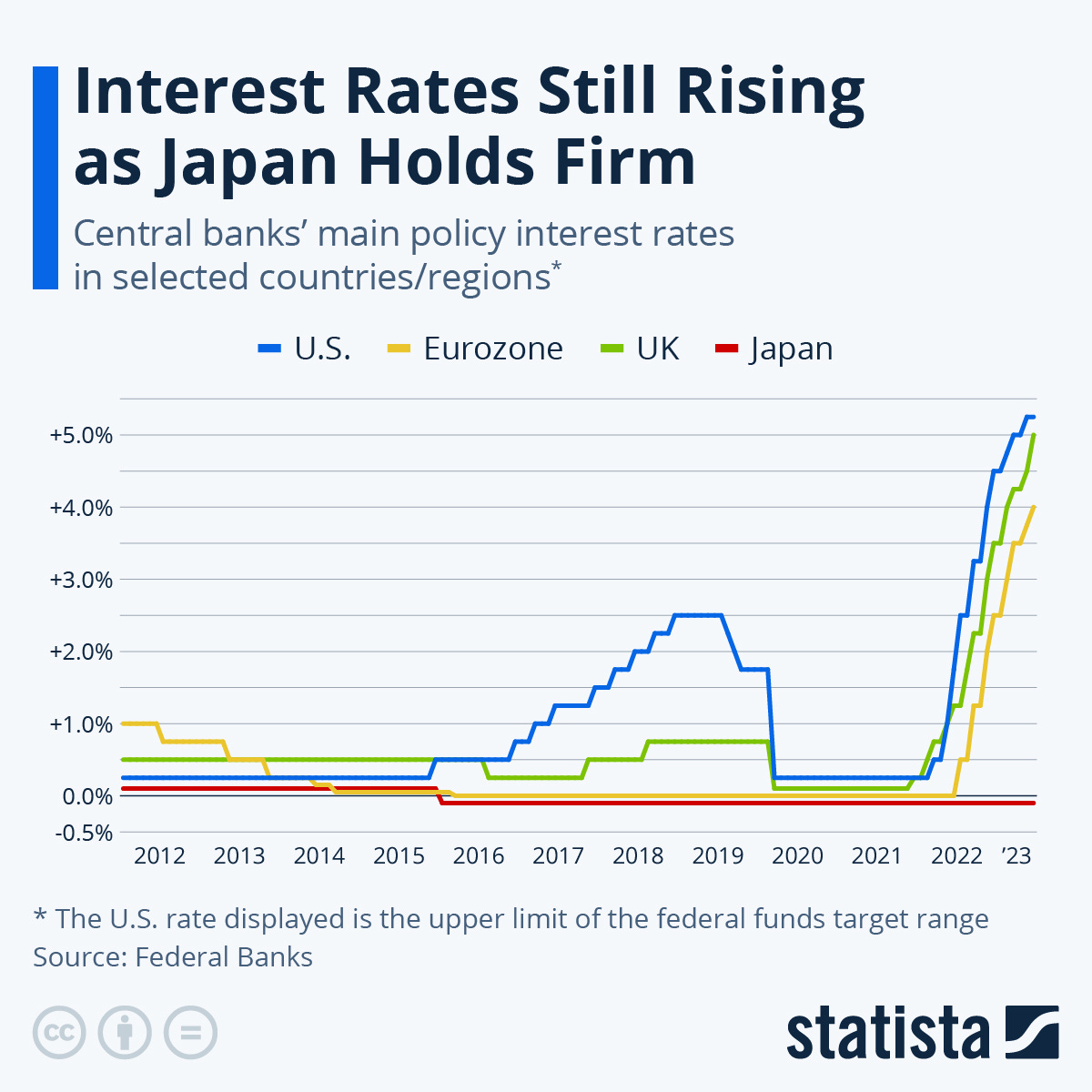

The Bank of England (BoE) unexpectedly announced today that it is continuing its now 13-long streak of increasing its benchmark interest rate, raising by 0.50% to 5.00%. This is the highest level in 15 years and the biggest move since February.

Governor Andrew Bailey had this to say: “The economy is doing better than expected, but inflation is still too high and we’ve got to deal with it.”

The BoE’s move follows the suit of the European Central Bank (ECB), which declared another rise last week, moving from 3.75% to 4.00%. The ECB's decision is the latest in a string of increases following its historical rate hike last July, which ended its 6-year adherence to a zero-interest policy.

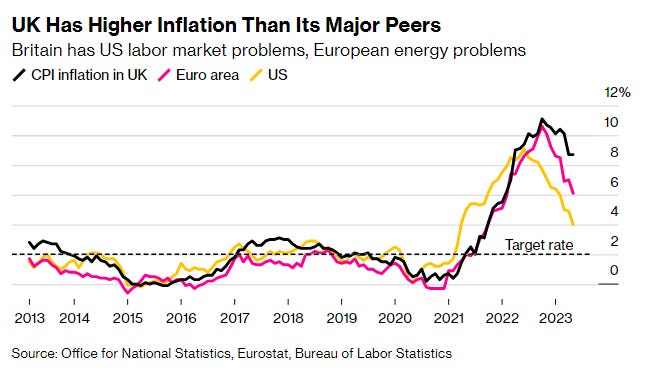

Britain remains an outlier in the Group of Seven nations, with consumer prices rising 8.7% in May, 4x the BOE’s 2% target and more than double the rate in the United States.

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.