Bitcoin tops $73,000 (eyes ATHs), plus an important labor market report

The Sandbox Daily (10.29.2024)

Welcome, Sandbox friends.

Today’s Daily discusses:

bitcoin tops $73,000

job openings fall to lowest level since January 2021

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 +0.98% | S&P 500 +0.16% | Russell 2000 -0.27% | Dow -0.36%

FIXED INCOME: Barclays Agg Bond +0.11% | High Yield +0.03% | 2yr UST 4.101% | 10yr UST 4.256%

COMMODITIES: Brent Crude -0.08% to $71.36/barrel. Gold +1.04% to $2,784.6/oz.

BITCOIN: +4.08% to $72,232

US DOLLAR INDEX: -0.02% to 104.294

CBOE EQUITY PUT/CALL RATIO: 0.58

VIX: -2.32% to 19.34

Quote of the day

“People only saw the decisions I made, not the choices I had.”

- Itachi Uchiha

Bitcoin tops $73,000

The boys are back in town!

After a quiet seven-month bear market, the cryptos are back. Bitcoin and its various derivatives/surrogates have been breaking out recently.

Today, bitcoin itself nearly kissed its former all-time high price set back in March ($73,798), with only a few ticks on the tape separating the digital currency from blue skies above.

Bitcoin has been a range bound mess since the spring, consolidating its January to March 2024 monster gains after the SEC approval of spot bitcoin trading.

Widening the aperture, bitcoin has been forming this monster base for the better part of three years.

Could this multi-year consolidation phase be the rocket fuel to launch bitcoin on its next major leg higher?

Maybe, maybe not.

But, as we’ve seen in past cycles, once prices get going, they really get going. In fact, all-time highs become a regular occurrence for this volatile and speculative asset class.

To the moon, the YOLO-ers often say.

Some out there are calling for $100,000 as the next target.

Others are watching the ambitious long-term target of $175,000 using Fibonacci extensions.*

If this current pre-election move sticks, many investors and traders expect the momentum to continue.

Following the crypto washout of 2022 and the introduction of spot bitcoin ETFs in early 2024, many new investors are experiencing their first wave of bitcoin euphoria price discovery.

Some prefer to invest/trade the blue chips. Others will be seeking catch-up trades in Ethereum, the miners, and crypto-linked equities that haven’t made their moves just yet.

No matter how investors feel about bitcoin and crypto in general, it’s impossible to ignore the animal spirits in crypto that are confirming the adjacent bullish price action that’s been occurring in other traditional asset classes for the better part of the last year.

*Because crypto doesn’t trade on traditional fundamental metrics, many turn to technical analysis and the use of Fibonacci extensions. These tools help technicians achieve better forecasts, recognize key support and resistance levels, and identify risk management levels.

Source: Alfonso Depablos, CMT

Job openings fall to lowest level since January 2021, reflects labor market in better balance

Each month, we turn to the Labor Department's Job Openings and Labor Turnover Survey (JOLTS) to understand the ebbs and flows of what's really happening among businesses and their workers.

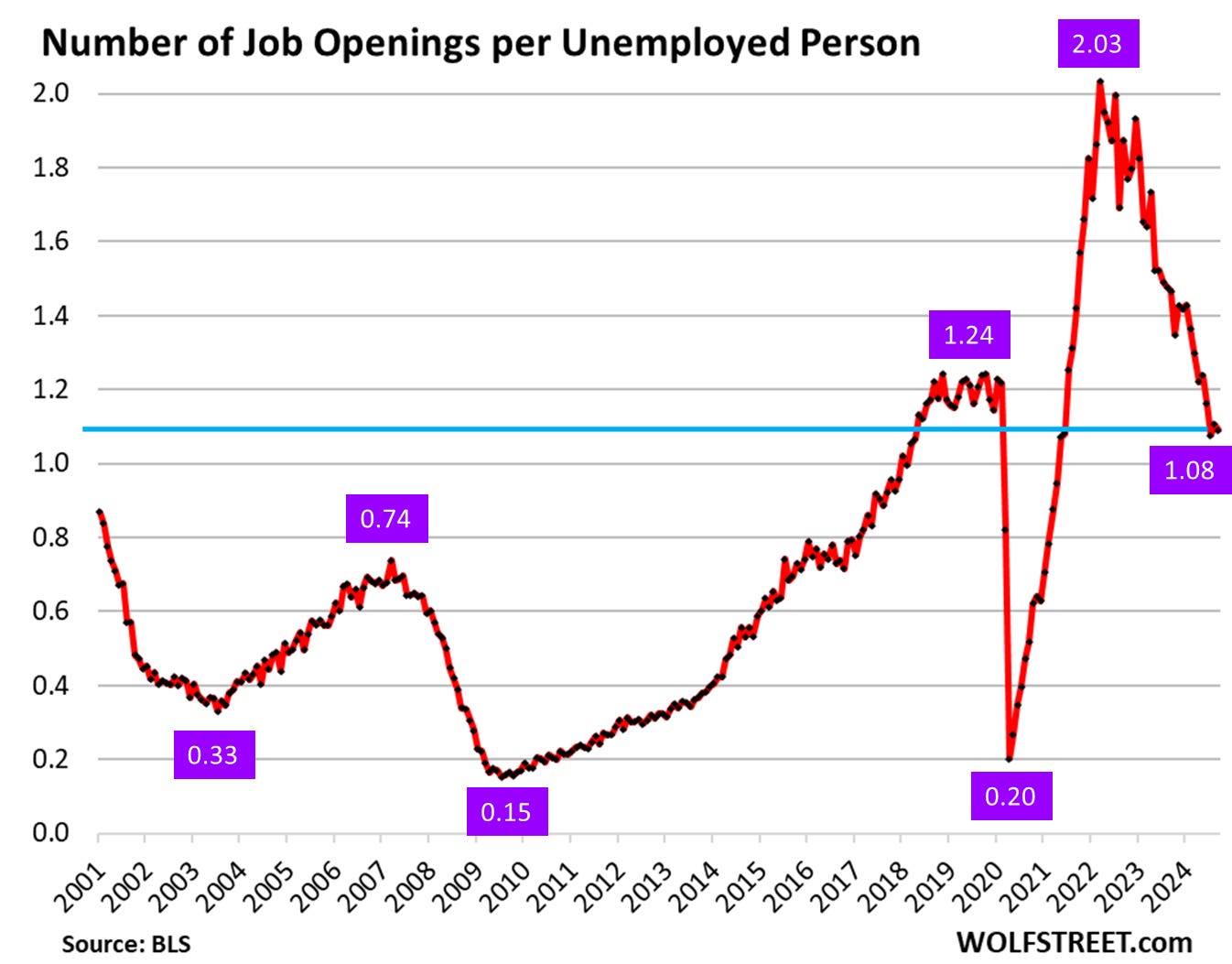

Job openings across America decreased -5.3% to 7.44 million in September from August’s downwardly revised 7.86 million reading, falling to the lowest level since January 2021 (7.19M). Job openings are down -20% from one year ago (9.31M) and down -39% from the peak level in March 2022 (12.18M).

Broadly speaking, the number of job openings has steadily declined since hitting the cyclical peak of 12.18 million vacancies in March 2022 when the Federal Reserve initiated its tightening cycle, but the number of job openings still remains ~11% higher than the 5-year period average pre-COVID (6.69M).

That’s a lot of math, so let’s repeat the salient points with brevity: job openings are down 5% from last month, 20% from one year ago, and down 40% from the peak 2.5 years ago; however, the post-covid number remains higher than the pre-covid number by 10%.

So, when you hear the term “labor market rebalancing,” that’s essentially it in a nutshell – the jobs market is normalizing off extremely tight conditions created by the pandemic.

Meanwhile, the number of layoffs rose to 1.83 million, the highest since January 2023.

The other key metric in today’s report, the ratio of job-openings-to-unemployed-Americans, has been cut in half from its record high in 2022 to 1.08 now – well below the cycle peak of 2.03 and more or less in line with the general pre-pandemic levels and the 1.24 level in February 2020.

In simpler terms, this means there are 7.44 million job openings and 6.83 million unemployed workers.

The Fed is closely watching the progress of normalization between labor supply and labor demand, and today’s report shows the jobs market has certainly continued to move toward better balance. It’s yet another data point of confirmation that labor market conditions have eased, allowing the Fed to stay on its rate cutting course at their next policy meeting on November 7th.

More importantly, these monthly JOLTS reports illustrate the kind of cooling that the Federal Reserve has hoped to see, with demand for workers slowing through fewer openings rather than spikes in outright job losses.

Source: U.S. Bureau of Labor Statistics, Ned Davis Research, Bloomberg, Advisor Perspectives, Wolf Street

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures at the Sandbox Financial Partners website: