Bitcoin volatility regimes, plus CHIPS/IRA capex, equity allocations, and Retail Sales

The Sandbox Daily (2.15.2024)

Welcome, Sandbox friends.

Today’s Daily discusses:

tracking bitcoin volatility over time

CHIPS/IRA Capex tailwind

equity allocations near top-end of post-GFC period

Retail Sales stumble, miss expectations

Let’s dig in.

Markets in review

EQUITIES: Russell 2000 +2.45% | Dow +0.91% | S&P 500 +0.58% | Nasdaq 100 +0.21%

FIXED INCOME: Barclays Agg Bond +0.24% | High Yield +0.35% | 2yr UST 4.582% | 10yr UST 4.244%

COMMODITIES: Brent Crude +1.61% to $82.91/barrel. Gold +0.59% to $2,016.2/oz.

BITCOIN: +0.52% to $51,810

US DOLLAR INDEX: -0.42% to 104.285

CBOE EQUITY PUT/CALL RATIO: 0.57

VIX: -2.57% to 14.01

Quote of the day

“However beautiful the strategy, you should occasionally look at the results.”

- Winston Churchill

Tracking bitcoin volatility over time

The bitcoin market has been maturing, prices and market cap have been rising, and more participants are trading and investing crypto than ever, which have all brought down the volatility.

With each subsequent cycle, the 90-day annualized volatility of bitcoin is hitting lower peaks (y-axis) as the size of the market expands (x-axis).

As bitcoin’s presence expands with the adoption of the newly launched suit of spot ETFs, expect the blue-chip cryptocurrency to continue maturing in the same way other asset classes and strategies have over time:

Source: Spectra Markets, WisdomTree, Bloomberg, Bitcoin Magazine

CHIPS/IRA Capex tailwind

It is well understood by now that the CHIPS Act and the Inflation Reduction Act (IRA) are driving manufacturing structures investment higher. The capital outlays – concentrated in manufacturing construction – is showing a boom across the computer, electronics, and electrical sector (CEE) which includes both semiconductor and EV battery manufacturing plants.

But, there is less focus on the eventual shift towards equipment investment. As structures are built out, a natural tailwind for equipment investment is coming – beginning in earnest in 2024Q1 and peaking in 2024Q4.

Billions in subsidies for R&D, financial assistance for manufacturing, and the creation of tax credits have all been prioritized at the federal level to build, expand, or modernize domestic facilities and equipment – largely to protect national interests, technological advancement, and onshore critical infrastructure.

Source: Piper Sandler

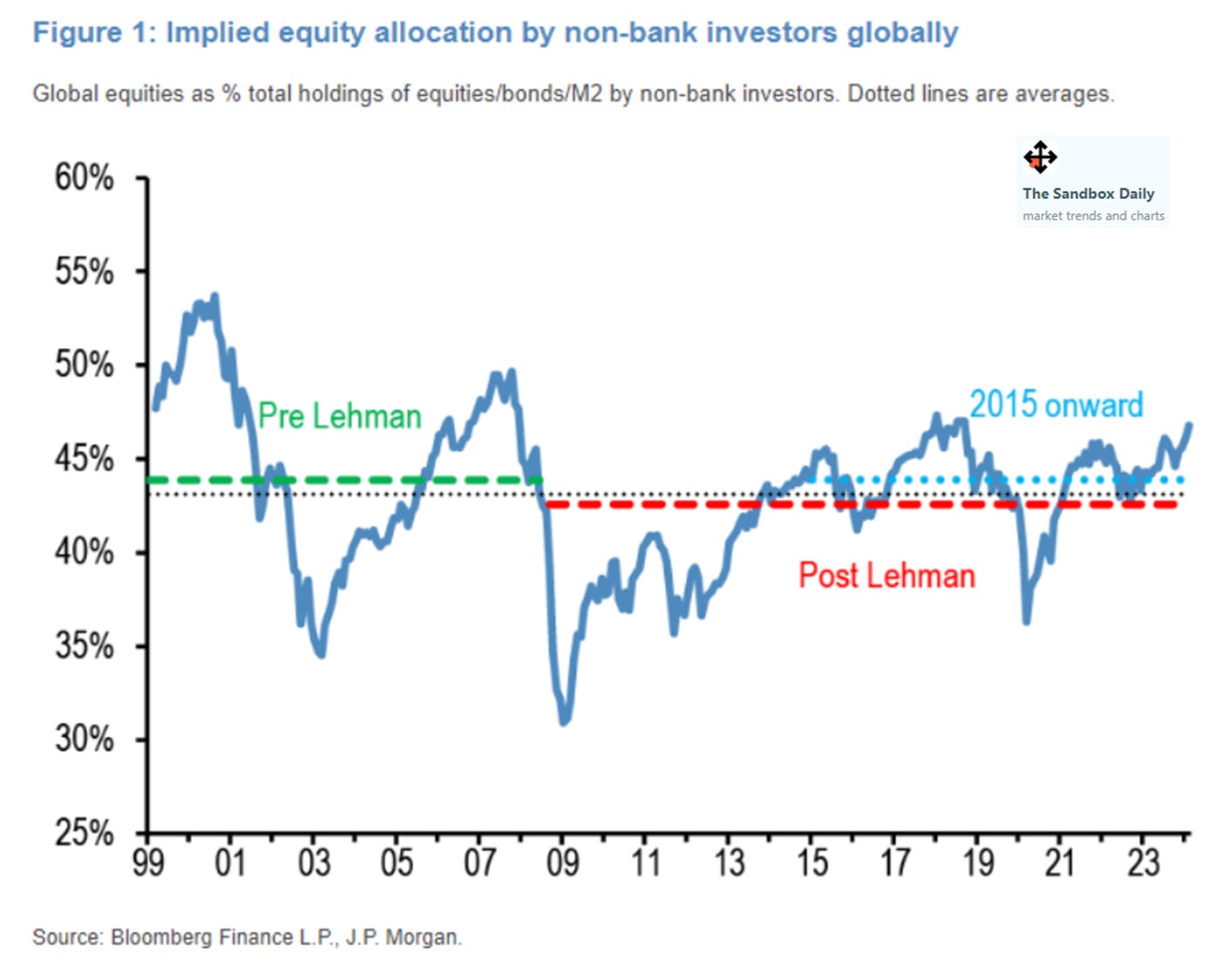

Equity allocations near top-end of post-GFC period

The chart below shows the implied allocations of non-bank investors to equities.

At 47%, equity allocations are at the top-end of the post-GFC range but have still never reclaimed the levels of ≥50% reached prior to the Global Financial Crisis, dubbed below as “Pre-Lehman.”

Source: J.P. Morgan Markets

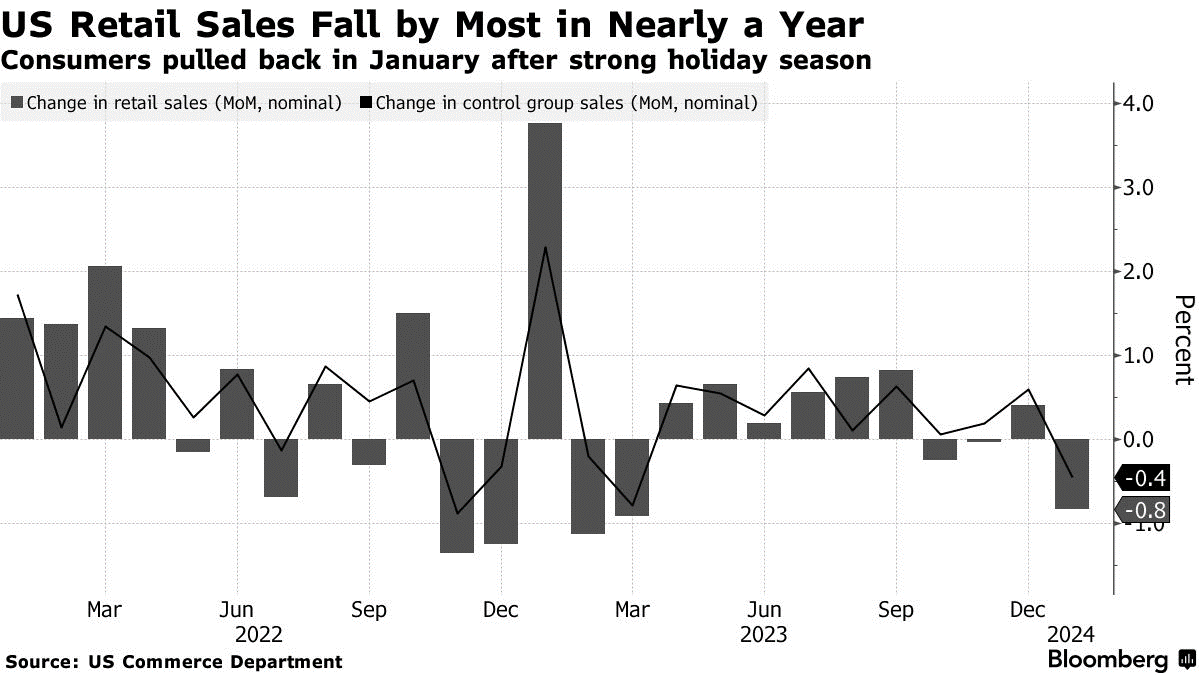

Retail Sales data shows U.S. shoppers cut back in January

Today, bad news is good news. When a big macro report misses to the downside, it means the Fed is one small step closer toward achieving its goals, which in turn relieves pressure on interest rates and puts a bid under the stock market.

Spending at U.S. retailers tumbled more than expected in January as cold weather across the United States kept shoppers at home after a robust holiday spending season.

Retail Sales – an important and closely watched economic metric that tracks consumer demand for goods – dropped 0.8% in January after a downward revision to the prior month and came in well below the consensus estimate of -0.2%. This was the biggest monthly drop in nearly a year.

On a non-seasonally adjusted basis, Retail Sales typically decline at the start of each year. But despite colder-than-normal winter weather, last month’s

drop was smaller than the average January decline since 1993. This suggests that seasonal adjustment factors played a role in the outsized drop in the headline number last month.

9 of 13 categories posted decreases in the report.

Despite the miss, continued labor market strength, gradual disinflation, and a pickup in consumer sentiment remain supportive of consumer spending growth in the near-term.

Over the past year, equities have become increasingly correlated with the direction of bond yields. Today, the weak Retail Sales report pushed yields lower and allowed for equity breadth to improve.

Source: Bloomberg, Ned Davis Research, Mike Zaccardi

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.