Bond outflows, improving S&P 500 internals, banks prepare for loan losses

The Sandbox Daily (10.17.2022)

Welcome, Sandbox friends.

Today’s Daily discusses the total outflows hitting bond mutual funds, improving $SPX market internals, higher loan loss provisions are lowering Q3 earnings growth for banks, Empire State Manufacturing activity contracts, and the top trending Google searches of last year.

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 +3.46% | Russell 2000 +3.17% | S&P 500 +2.65% | Dow +1.86%

FIXED INCOME: Barclays Agg Bond +0.21% | High Yield +1.23% | 2yr UST 4.448% | 10yr UST 4.012%

COMMODITIES: Brent Crude +0.38% to $91.98/barrel. Gold -0.47% to $1,656.2/oz.

BITCOIN: +1.89% to $19,607

US DOLLAR INDEX: -1.11% to 112.051

CBOE EQUITY PUT/CALL RATIO: 0.63

VIX: -2.03% to 31.37

Investors dump their bond funds

Last week, bond mutual funds posted its worst week of outflows this year at -$25bn. That brings the year-to-date total bond outflows up to -$400bn. Total outflows for all mutual funds now total -$740bn and could be on pace to hit $1tr later this year, which would double the old record set in 2020. For context on size, March 2020 saw two consecutive weeks of -$90bn in outflows so last week is on the high end but still orderly.

No sector has been immune to the outflows, save for U.S. Government Bonds. When look at each sector’s category returns, it’s no surprise to see clients leaving bonds – traditionally, a source of inflows when equity markets are turbulent and deeply negative.

Source: Eric Balchunas, YCharts

Improving internals

Despite last week’s volatility, most individual stocks did not make new lows for the year, unlike the major averages. When we analyze what is happening beneath the surface, most individual stocks are not confirming the new lows seen at the index level these past few weeks. To illustrate this point, here is the S&P 500 along with the percentage of new 63-day lows (63 days = 3 months = 1 quarter) for S&P 500 constituents:

In early summer, well over half of all stocks fell to new lows as the broad market made new lows. In recent weeks, however, the reading didn’t even come close to the high-water mark from June. Not only has there been a bullish divergence since the summer, fewer stocks are falling to new year-to-date lows even as the major indexes do so. This type of breadth improvement is constructive and does not support new lows at the index level. However, as long as the largest stocks continue to fall, the indexes could remain under pressure.

Source: All Star Charts

Higher provisions for loan losses are lowering Q3 earnings growth for S&P 500 banks

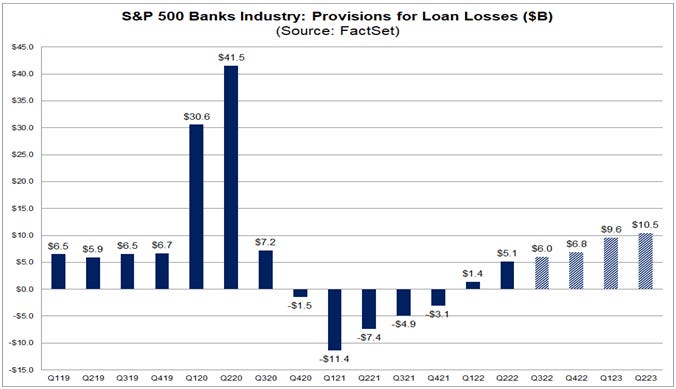

The Financials sector has been a sector in focus for the market during the past week, as 9 of the 16 companies in the S&P 500 that reported earnings for Q3 during the week were in this sector. Despite the recent rise in interest rates, this industry is reporting a year-over-year earnings decline of -13% for Q3. What is driving the decline in earnings for this industry?

One factor contributing to the decline is that companies in the Banks industry are expected to report significantly higher provisions for loan losses in Q3 2022 relative to Q3 2021. Provisions for loan losses have no impact on top-line growth, but do have an impact on bottom-line growth, as they are treated like an expense on a company’s income statement. Banks have been increasing these provisions again in 2022, but are facing difficult comparisons to the much lower (negative) numbers from 2021.

FactSet Estimates actively tracks this metric for all 18 companies in the Banks industry in the S&P 500. In aggregate, the blended (combines actual results for companies that have reported and estimated results for companies yet to report) provision for loan losses for these 18 banks is $6.0 billion for Q3 2022, compared to -$4.9 billion for Q3 2021. Based on current estimates, the aggregate provision for loan losses for these 18 banks is expected to rise above pre-pandemic levels in the first half of 2023.

Source: FactSet

Empire manufacturing activity contracts

The New York Empire State Manufacturing General Business Conditions Index fell 7.6 points in October to -9.1, below the consensus of -5.0. It has been in contraction territory for three consecutive months now and in seven of the past ten months. It is the first of six regional manufacturing indexes that markets follow to update for October, pointing to a weak start in national factory activity in the final quarter of the year.

The NY Empire State Index, a survey conducted by the Federal Reserve Bank of New York, summarizes the general business conditions in New York state and is widely watched for insight into the various stages of the manufacturing process, thus giving policymakers data in real time about what is happening in the economy.

Source: Federal Reserve Bank of New York, Ned Davis Research

Top trending Google searches of 2021

For decades, Google search has been a go-to source for many when looking up directions, keeping up with the news, or seeking information on new and unfamiliar topics. Today, Google processes about 3.5 billion searches per day. Because of its dominant market share, Google holds a vast archive of keyword searches that, when analyzed, provide an interesting glimpse into the key themes that have captured the world’s attention over the years.

Using data from Google Trends on 2021, we can track the people, events, and topics across various categories that consumed people around the world. Some searches align with popular historical themes (celebrity, sports, tv shows), while others capture more time-specific trends and content (COVID-19 vaccinations, diamond hands, Reddit-inspired short squeeze).

What do you think will make the 2022 top trending Google searches?

Source: Visual Capitalist

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.