Breadth in stock momentum, plus how America invests, goodbye extreme pessimism, and the U.S. recession

The Sandbox Daily (2.7.2023)

Welcome, Sandbox friends.

Today’s Daily discusses the breadth of momentum in U.S. stocks right now, Vanguard’s How America Invests report, reversing from extreme pessimism, a temperature check on the U.S. recession, and the importance of balancing of time, money, and energy.

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 +2.12% | S&P 500 +1.29% | Dow +0.78% | Russell 2000 +0.76%

FIXED INCOME: Barclays Agg Bond -0.17% | High Yield +0.36% | 2yr UST 4.466% | 10yr UST 3.679%

COMMODITIES: Brent Crude +3.83% to $84.09/barrel. Gold +0.24% to $1,884.0/oz.

BITCOIN: +1.22% to $23,168

US DOLLAR INDEX: -0.26% to 103.349

CBOE EQUITY PUT/CALL RATIO: 0.71

VIX: -3.96% to 18.66

The breadth of momentum

The stock market continues to move higher as we see an expansion in participation at the individual stock level.

Last week, the Russell 3000 index saw more new 52-week highs than at any other time over the trailing year, which we covered in detail yesterday.

Another way to measure market internals is by assessing the percentage of stocks that are overbought and oversold. When we look at how many stocks are seeing bullish momentum readings, we are analyzing the breadth of momentum for the broader market.

The chart above shows the highest reading of stocks hitting overbought conditions since the spring of 2020 for the NYSE Composite Index.

These bullish breadth thrusts mean buyers are becoming increasingly aggressive as prices advance, perhaps a reflection of the market being caught offsides in holding too much cash and/or short their positions. They are characteristics of uptrends and tend to occur at the early stages of new bull markets.

Source: All Star Charts

How America invests

Vanguard’s newly minted How America Invests gives a look behind the curtain at the personal investing behavior of Vanguard’s larger retail clients.*

Some of the broad-stroke takeaways about this clientele base include:

Vanguard affluent investors have a long-term risk orientation

Generally, investors take less risk with age

Affluent investors favor a mix of active and passive portfolios, with 75% of households holding a combination of both

Affluent investors favor domestic holdings although they also have a meaningful exposure to non-U.S. investments

Affluent household portfolios feature complexity at various levels, making them more complicated to manage

Traditional, long-term mutual funds are universally held in affluent household portfolios, as they have been since 2015

Target-date funds (TDFs) are not very prevalent in affluent households’ portfolios

The use of individual securities is popular among affluent investors, with nearly one-third of households having some exposure

Half of affluent households trade, but the proportion has been decreasing since 2015

Trading and product usage are correlated

During a turbulent start to 2020, most Vanguard affluent households stayed the course, as measured by trading activity

Perhaps more interesting is the asset allocation data showing the trends in how the *average* household is invested. From the traditional 60-40 mix, there is a general trend to overweight stocks (in hindsight, this benefitted risk takers during the greatest bull market of all time), held underweights to bonds (investors forced elsewhere during a zero-interest rate policy environment), and healthy levels of cash (for liquidity, tax payments, portfolio draws, tactical trading, etc.).

Digging one level deeper into the allocations by various demographics sheds even more light on how people truly invest their money.

*Detailed data from Vanguard’s 800,000 affluent retail investor households form the backbone of this research report. The cohort consists of households with account balances of $500,000 or greater, with a median balance of $1 million.

Source: Vanguard

Reversing from extreme pessimism

The bearish narrative has been around for several months. A 40-year high in inflation forced the Fed into its fastest tightening cycle since the early 1980s. Powell has repeatedly said that he’s willing to push the economy into a recession if that is the price to pay to put the inflation genie back in the bottle. Mortgage prices skyrocketed, portfolio values sank, and on and on.

The pervasive pessimism has been reflected in the Ned Davis Research Crowd Sentiment Poll, a proprietary weekly combination of seven sentiment indicators, ranging from polls of individual and institutional investors to market-derived gauges, like put/call ratios.

The NDR Crowd Sentiment Poll just exited its extreme pessimism zone for the first time since April 11, 2022, its second-longest stretch since data begins in 1995. The only longer run of pessimism was during the financial crisis, from 5/21/2008 – 5/6/2009.

Like most sentiment indicators, it is contrarian. Market returns have been higher during periods of extreme pessimism because most of the weak sellers have already sold. Each cycle is unique: one period’s extreme is the next one’s midpoint. Therefore, on average, strongest gains for the S&P 500 have come when pessimism has hit an extreme and then reversed.

This was only the 4th time the NDR Crowd Sentiment Poll has stayed in its extreme pessimism zone for more than 100 trading days. Returns afterwards have been strong, with the S&P 500 gaining a median of 9.1% three months later and 14.8% one year later.

Source: Ned Davis Research

Recession temperature check

Recessions are significant, prolonged downturn in economic activity that occurs after the economy has peaked for the cycle.

Economists at the National Bureau of Economic Research (NBER) – the official arbiters of declaring U.S. economic recessions – track the well-being of our economy by looking at six distinct indicators that go far beyond the simpler definition of two sequential quarters of negative GDP growth. Right now, just two of the variables are suggesting a slowdown: retail sales and industrial production.

The cause of recession is somewhat unique to each cycle, as well as the length of contraction. Since 1945, the average length of a recession is roughly 10 months. A potential recession this year will likely be shorter than the post-war average because consumers appear to be on better footing with access to a hot labor market and still holding onto a large amount of cash. Unemployment rates are at historic lows, job openings are still very high, and checkable deposits and money market accounts are flush with cash.

Using history as a guide, equity markets often fall before the recession is officially declared (NBER post dates their calls) and subsequently turn higher before the recession ends – so we may watch markets turn higher in the face of weakening economic data.

Source: JPMorgan Asset Management, LPL Research

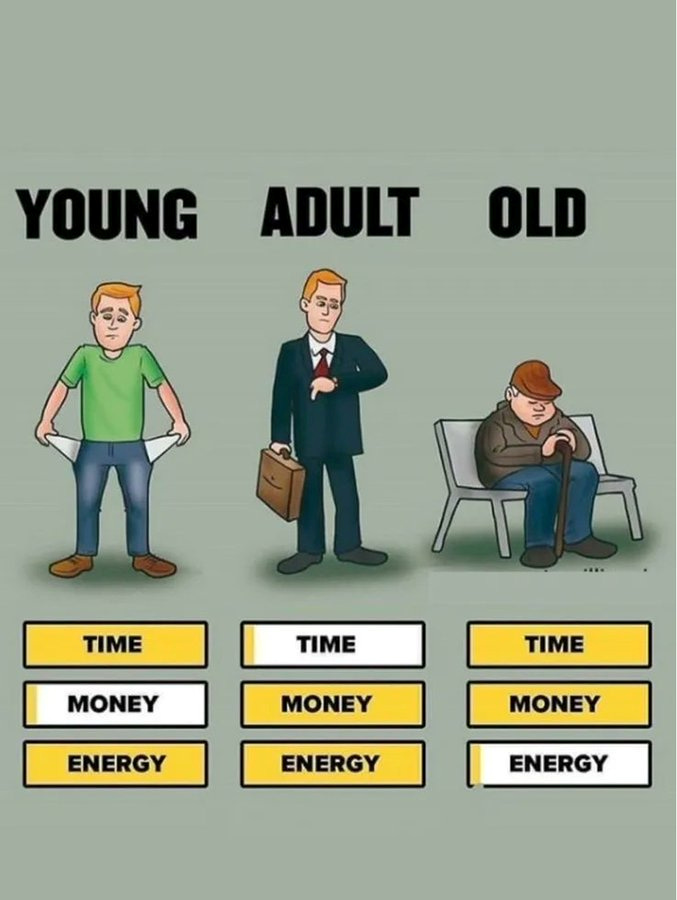

One simple graphic

Time, money, and energy – the vast majority of people will never experience all three at the same time.

Choose carefully how you allocate each.

Source: Compounding Quality

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.