Bubble talk is everywhere. So let’s talk about it.

The Sandbox Daily (10.28.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

lots of bubble talk out there

Let’s dig in.

Blake

Markets in review

EQUITIES: Nasdaq 100 +0.74% | Dow +0.34% | S&P 500 +0.23% | Russell 2000 -0.55%

FIXED INCOME: Barclays Agg Bond +0.06% | High Yield -0.10% | 2yr UST 3.491% | 10yr UST 3.978%

COMMODITIES: Brent Crude -1.81% to $64.43/barrel. Gold -1.21% to $3,969.8/oz.

BITCOIN: -1.68% to $112,785

US DOLLAR INDEX: -0.07% to 98.716

CBOE TOTAL PUT/CALL RATIO: 0.79

VIX: +3.99% to 16.42

Quote of the day

“Our lives are defined by opportunities, even the ones we miss.”

- Eric Roth

Lots of bubble talk out there

Today on Charles Payne I was asked to share my thoughts around the theoretical bubble developing across the stock market.

Specifically, are we there yet?

Bottom line up top: I don’t know.

In fact, no one knows. And, by the time we do know, it’s almost always too late.

Sure, there will be warning signs.

Extreme optimism. Margin excess. The blazing trail of IPOs and M&A activity. A spike in unemployment. A hyperscaler finally saying “no thank you” to Nvidia’s Blackwell chips. Runaway valuations. Deteriorating market breadth. Many others.

Yes, one day the party will end and it will be the same painful unwind we’ve all experienced before.

Escalator up, elevator down.

As someone who manages money professionally, I can tell you bear markets are about the worst thing in my universe. Losing my money is one thing; losing money on behalf of someone else, entirely different.

At some point this cycle, there will come a time to manage downside risk and, in doing so, the regime shift will necessitate different strategies and tools, no matter how you manage capital: momentum trader, set-it-and-forget-it, indexer, long-short, core + satellite, etc. It could be next week, next month, or next year, or in the next decade (2030s).

The good news? As of today, most of these traditional warning signs/markers outlined above do not flash imminent danger.

In fact, there are a myriad of reasons to support why this secular bull market can persist for many quarters, if not years, to come.

In short, the Fed is 1) easing financial conditions 2) into a cyclical reacceleration 3) as the AI capex train rolls down the tracks 4) while fiscal stimulus from the One Big Beautiful Bill Act ramps up.

Jeff deGraaf of RenMac once noted: “In this business, predictions are over-rated, but the mismatch between expectations and probable outcomes are underrated.”

In other words, this bubble talk is another risk in a long line of them designed to scare you out of your positions and keep you from reaching your financial goals.

For now, investors have been, and continue to be, rewarded by aligning themselves with the primary trend underlying this market which has been firmly in place since the bear market bottom in October 2022.

And yet, many investors have been marching to the beat of a different drum, fighting the tape because of the latest risk-du-jour or taking comfort in cash because it feels safe.

I was always taught that when you’re in a bull market, it’s absolutely necessary for investors to ride it – at least until it’s clear that a recession is underway or the bubble is bursting.

Right now, I’m not seeing either.

The goal of investing is to make money. Full stop. Enjoy it while the offense remains on the field.

Having said all that, here are three charts I came across today that definitely raise my risk-management antenna. I flag these dynamics into the yellow “worth monitoring” category.

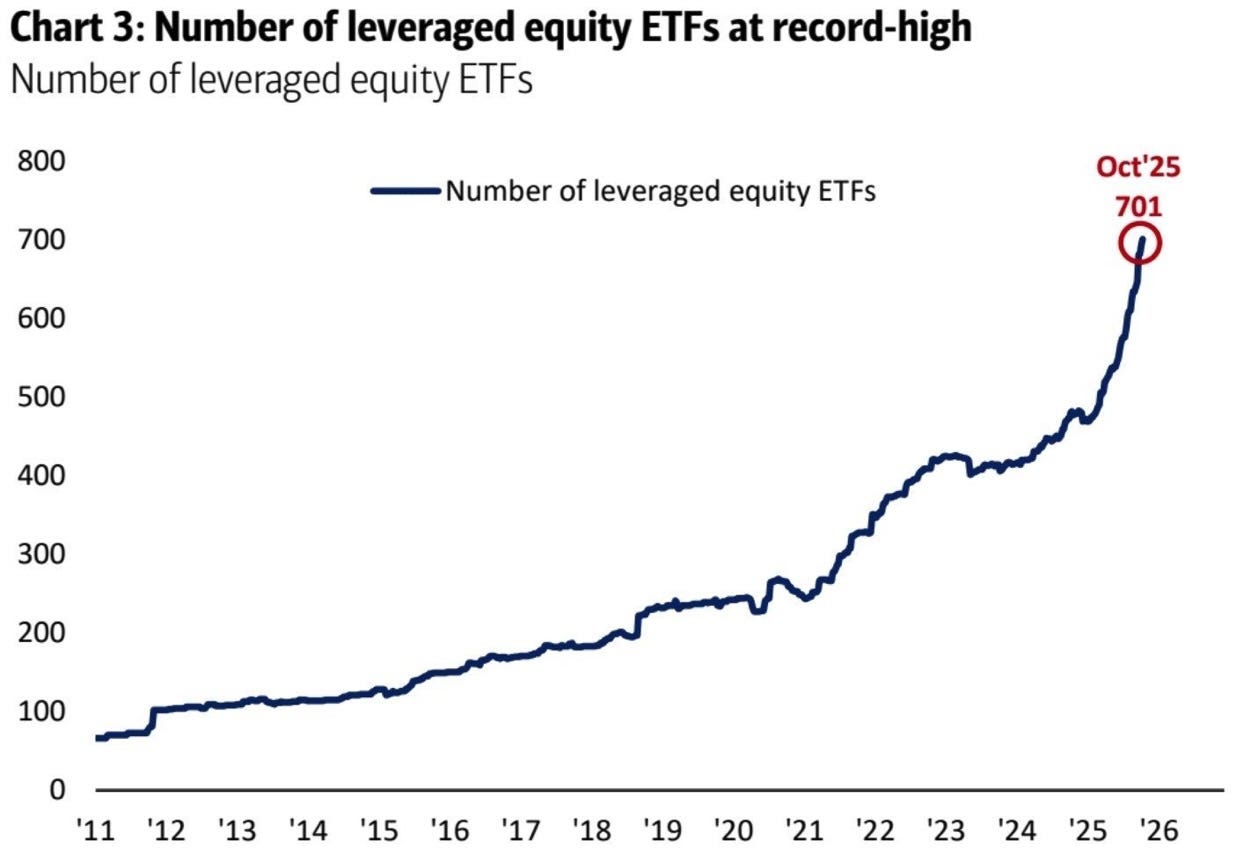

Callum Thomas: “Leveraging Up: Another angle on it is the surge in leveraged equity ETFs — I previously shared a chart showing a record surge in the annual net change in the number of all ETFs… and a big part of that has been the rise of leveraged equity ETFs (including single-stock ultra-leveraged products). And yes, if I had to guess; this is probably just meeting the demand of retail speculators.”

Bloomberg: “Everywhere you look these days, it’s hard to miss signs of individual retail traders cementing themselves as a dominant force in markets. And while they’re often cited as reliable buyers of dips who keep prices buoyant, their tendency to crowd into whatever appears to be the next big thing has a way of causing pain for anyone late to the momentum chase.

One proxy for retail involvement in the market is the volume of stocks executed by off-exchange venues such as those run by equity wholesalers serving clients like Robinhood Markets Inc. Those trades are poised to make up 50% of the total this year for the first time ever.”

Goldman Sachs: “And it’s not just plain vanilla investing or trading, leverage is a huge part of this story — especially the scramble to speculate. The stimulus fueled frenzy of 2020/21 opened minds to what’s possible and opened the floodgates of greed. We see this in the rise of “zero-day options” trading volume (options that expire within 24 hours — whose sole purpose is to speculate on very short-term market movements, and typically resulting in significant effective leverage).”

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)