Buffett stock valuation indicator, plus April seasonality favors stocks and 🧁 weekend sprinkles 🧁

The Sandbox Daily (3.28.2024)

Welcome, Sandbox friends.

Today’s Daily discusses:

Buffett stock market valuation indicator hits 2-year high

seasonality favors stocks in April

weekend sprinkles

Let’s dig in.

Markets in review

EQUITIES: Russell 2000 +0.48% | Dow +0.12% | S&P 500 +0.11% | Nasdaq 100 -0.14%

FIXED INCOME: Barclays Agg Bond -0.12% | High Yield -0.22% | 2yr UST 4.628% | 10yr UST 4.206%

COMMODITIES: Brent Crude +1.61% to $87.50/barrel. Gold +1.90% to $2,254.8/oz.

BITCOIN: +2.74% to $70,789

US DOLLAR INDEX: +0.18% to 104.531

CBOE EQUITY PUT/CALL RATIO: 0.67

VIX: +1.80% to 13.01

Quote of the day

“The first rule of compounding is to never interrupt it unnecessarily.”

- Charlie Munger, Berkshire Hathaway

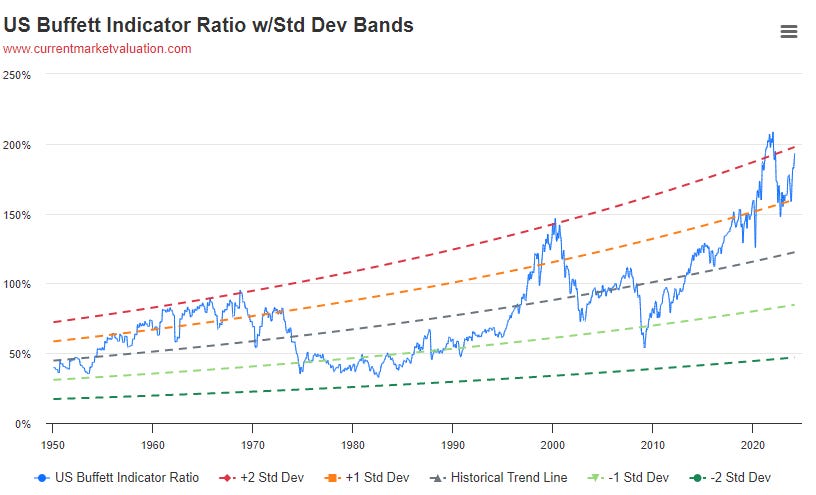

Buffett Indicator hits 2-year high

Warren Buffett's preferred metric for assessing valuation suggests that stocks are overstretched.

The Buffett Indicator, a key measure he often references, has reached 193% and is hitting 2-year highs, driven by investor optimism regarding artificial intelligence (AI), interest rate reductions, and the prospect of a gentle economic slowdown. The current measure is roughly two standard deviations above “normal.”

Total stock market capitalization to Gross Domestic Product (GDP) – the ratio of all publicly traded corporate equities to our country’s output of goods and services – is a long-term valuation indicator of the U.S. stock market that has come to colloquially be called the “Warren Buffett Indicator” due to comments made to Fortune Magazine back in 2001 when Uncle Warren said it was “the best single measure of where valuations stand at any given moment.”

At 193%, the indicator is below the peak of the equity markets from November 2021 (201%) but firmly higher than the pre-COVID highs (155%), pre-GFC highs (106%), pre-DotCom bubble (140%), and the average going back to 1995 (109%).

The Buffett Indicator, while not flawless nor predictive in nature, has been an accurate measure historically of how expensive or cheap the stock market is relative to economic output. The assumption is that markets and the economy will eventually converge.

Source: Yahoo Finance, Current Market Valuation

Seasonality favors stocks in April

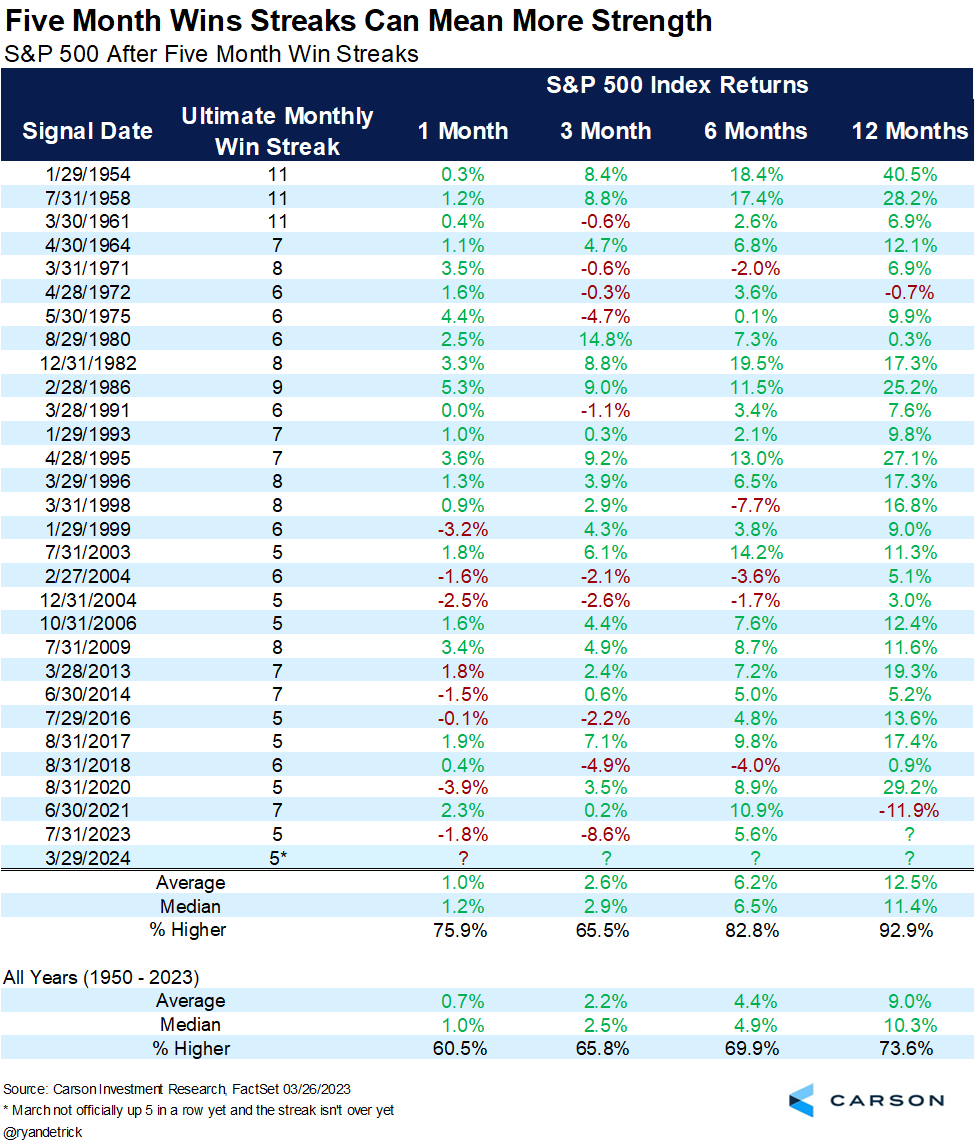

After a 5-month win streak for the S&P 500 and we turn the clocks forward to April, what can investors expect over the near-term?

Hopefully, more good things – at least according to history.

April is the 2nd best month of the year for the stock market since 1950 (yellow bars below); only November is better.

But, let’s revisit that 5-month win streak for a minute.

Since 1950, the S&P 500 index has experienced 5-month win streaks on 28 separate occasions.

The market has been higher 12 months later in 26 of those instances, with a median forward return of +11.4% – just above the +10.3% median return for all years since 1950.

The bottom line? Strength begets more strength.

Source: Ryan Detrick, CMT (Carson Group)

Weekend sprinkles

Here are some ideas that caught my attention this week – perfect for quiet time reading over the weekend.

Discipline Funds – My top 10 peeves (Cullen Roche)

Bps and Pieces – The Paper Trail: Apples and Oranges (Phil Huber)

The Verge – How the House quietly revived the TikTok ban before most of us noticed (Lauren Feiner)

The Joint Account – A conversation with Tightwads and Spendthrifts author Scott Rick (Doug Boneparth)

And here is the fun stuff that got me to the finish line.

The Place Beyond The Pines – feat. Ryan Gosling, Bradley Cooper, Ray Liotta, and Eva Mendes (IMDB)

The Art of War – Sun Tzu (Amazon)

Justin Timberlake – No Angels (Spotify, Apple Music)

Zach Bryan – Something in the Orange (Spotify, Apple Music)

Grand National – Talk Amongst Yourselves (Spotify, Apple Music)

Pusha T feat. Kanye West – Dreamin’ of the Past (Spotify, Apple Music)

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.