Build your cars in the U.S. or pay up !

The Sandbox Daily (4.1.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

auto tariffs

Let’s dig in.

Blake

Markets in review

EQUITIES: Nasdaq 100 +0.82% | S&P 500 +0.38% | Russell 2000 +0.02% | Dow -0.03%

FIXED INCOME: Barclays Agg Bond +0.37% | High Yield +0.23% | 2yr UST 3.875% | 10yr UST 4.161%

COMMODITIES: Brent Crude -0.45% to $74.43/barrel. Gold +0.06% to $3,152.3/oz.

BITCOIN: +3.49% to $85,247

US DOLLAR INDEX: +0.02% to 104.229

CBOE TOTAL PUT/CALL RATIO: 0.97

VIX: -2.29%to 21.77

Quote of the day

“It is only with the heart that one can see rightly; what is essential is invisible to the eye.”

- Antoine de Saint-Exupéry

Build your cars in the United States, or pay up

Last week, President Donald Trump announced a 25% tariff on all cars manufactured outside the United States, set to take effect this week alongside his broader “reciprocal tariff” plan. The same tariff rate will then be imposed on key auto parts – engines, transmissions, powertrain, and electrical components – no later than May 3.

A 25% levy on ~$400 billion in annual U.S. sales of cars and auto parts not made in the United States will raise $100 billion in tax revenue, all else equal.

The leading sources for these imports are Mexico, Japan, South Korea, and Canada.

An estimated 46% of U.S. light-vehicle sales will be directly impacted by these tariffs, which economists and industry officials warn will be borne by manufacturers and U.S. consumers alike.

What’s more, these tariffs will carry a heavier burden on those households in the lower income brackets because it’s the smaller vehicles which are made mostly outside of the United States.

As an example, take the Chevrolet Equinox, a crossover SUV, with an average current list price of $23,580. Under the newly-announced auto tariffs, that price could rise to ~$28,300, adding roughly $5,000 to an affordable design. Higher end cars could see $10-$15k sticker price increases, or much more.

As a result of these measures, Wall Street firms are slashing sales and revenue estimates, while simultaneously cutting price targets for the auto manufacturers.

JPMorgan auto analyst Ryan Brinkman labeled the announcement “draconian.” Wedbush Securities Dan Ives said it’s an “untenable, head-scratching number for the U.S. consumer.” MAI Capital Management’s chief market strategist Chris Grisanti on the announcement: “moving from a free trade world to a protectionist world.”

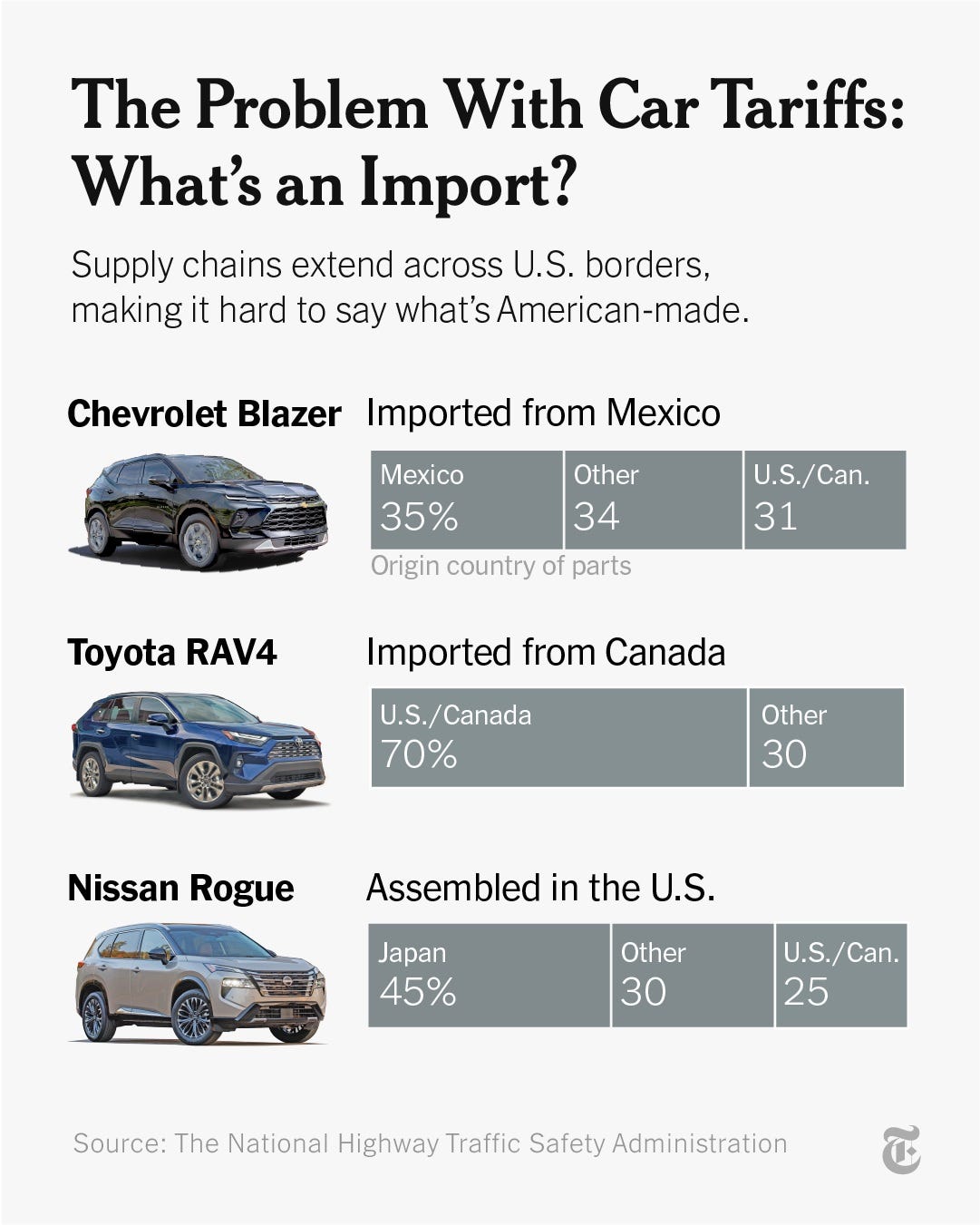

While the White House is publicly stating these duties would foster domestic manufacturing over the long run, ultimately it puts an immediate squeeze on the automakers because these companies utilize global supply chains with production plants located all around the world. One engine block might move across the Mexico-Canada-U.S. border five or six times before its completed.

Furthermore, because the automotive industry is one of the most physically intensive sectors of the economy, you can’t simply uproot workers, production lines, and manufacturing equipment overnight.

This likely leads to the auto companies focusing on a fewer number of models for sale in the United States, while also moving foreign manufactured cars and parts to other foreign markets.

As you can see below, this effects nearly all auto manufacturers in a material way.

With domestic inventories drawn down from the pandemic surge – many are estimated to be sitting on a two- or three-month supply of new cars – sticker prices on both new and used car prices will likely see meaningful price moves higher in the near-term.

President Trump strongly believes this new policy will Make America Great Again.

He might be the only one.

Sources: Associated Press, New York Times, Edmunds, Cox Automotive, Axios, Yahoo Finance

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures at the Sandbox Financial Partners website: