Building blocks for long-term investors (CMAs, SAAs) AND why they matter to you

The Sandbox Daily (1.22.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

the building blocks for long-term investors

Let’s dig in.

Blake

Markets in review

EQUITIES: Nasdaq 100 +1.33% | S&P 500 +0.61% | Dow +0.30% | Russell 2000 -0.61%

FIXED INCOME: Barclays Agg Bond -0.21% | High Yield -0.14% | 2yr UST 4.302% | 10yr UST 4.615%

COMMODITIES: Brent Crude -0.47% to $78.92/barrel. Gold +0.23% to $2,765.6/oz.

BITCOIN: -2.42% to $104,072

US DOLLAR INDEX: +0.18% to 108.262

CBOE TOTAL PUT/CALL RATIO: 0.72

VIX: +0.27% to 15.10

Quote of the day

“The stock market is the story of cycles and of the human behavior that is responsible for overreactions in both directions.”

- Seth Klarman

What are Capital Market Assumptions?

Capital Market Assumptions (CMAs) are the building blocks for making informed investment decisions, necessary parameters for setting appropriate expectations about the future range of outcomes for both risk AND return, and become instrumental inputs for financial goal analysis.

CMAs quantity the forward-looking expectations about the future performance of various investable asset classes, including their potential returns, risks, and how they might move in relation to one other (correlations). These assumptions are based on historical data, current market conditions, and economic forecasts.

In essence, CMAs provide a roadmap for navigating the uncertainties of investing, ensuring strategies are grounded in data and aligned with an investor’s financial situation, goals, and liquidity needs. Without them, financial planning would be like embarking on a roadtrip without a map –– risky, unreliable, and more likely than not to lead us nowhere.

So, what do CMAs actually look like?

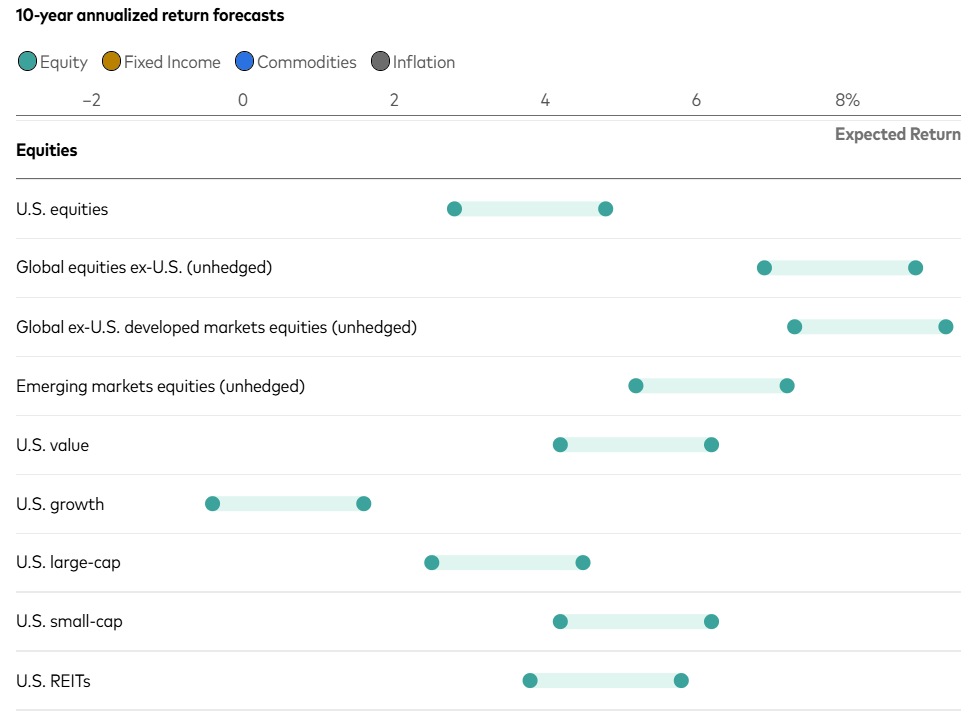

Vanguard, one of the world’s largest asset managers, makes their asset class return and volatility assumptions public. Below are the 10-year forward looking forecasts for equity returns.

As an example, Vanguard expects U.S. large-cap equities (row 7 below) to return between 2.5% and 4.5% per year over the next decade. For context, the market-cap weighted S&P 500 returned x% over the last ten years, while the equal-weighted S&P 500 (RSP) returned x% over the same time period.

Of course, these assumptions will vary by the firm producing them because their historical inputs and forward-looking estimates will differ.

CMAs are dynamic, not static

Keep in mind that markets are living, breathing organisms – constantly absorbing each new data point amidst a complex universe of competing interests.

Economic conditions evolve, key fundamental inputs like interest rates and inflation change, new political, fiscal, and monetary cycles emerge, and of course structural technology regimes shift over time. Models must adjust accordingly.

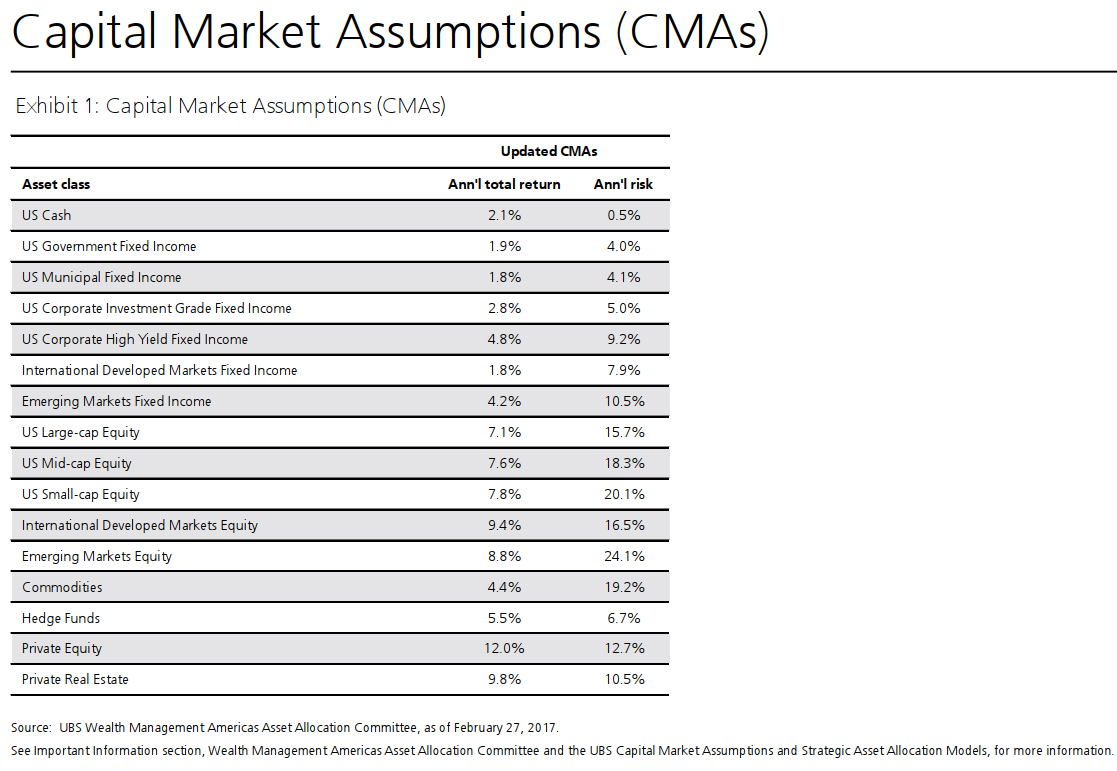

Below are the CMAs from my previous employer, UBS, which date back to February 2017.

One thing that sticks out, quite literally right off the top, are the cash assumptions. “U.S. Cash” – think money markets, certificates of deposits (CDs), short-term Treasury bills, and the like – was to earn ~2.1% annualized over the coming market cycle, per UBS.

This was somewhat intuitive based on the conditions at the time – zero interest rate policy (ZIRP) established by central banks around the world terrified to raise rates on the heels of the Global Financial Crisis (GFC).

And yet, for the last two+ years, after the largest and fastest synchronous hiking cycle in history, we have seen U.S. cash pay closer to 4-5%. So, today this table looks out of step with the current environment.

We must remind ourselves that CMAs are the average assumed return over the full market cycle (recovery, expansion, slowdown, recession). As such, the distribution of returns will almost always come in higher and lower in any given year than the actual forecast itself.

Strategic Asset Allocation

Prudent asset allocation decision-making can begin once reasonable assumptions about the risk and return prospects for a range of asset classes are formed.

Strategic Asset Allocations (SAAs) are diversified portfolios that are expected to produce a reasonable risk and return trade-off over a full economic cycle. SAAs are designed to be investable, efficient, and provide the highest expected return for a target level of risk – based on the CMA strategic return and risk assumptions.

Weighted together, the collection of the different asset classes formulate a framework for a broadly diversified multi-asset portfolio. SAAs can be customized by investor risk profile (Conservative, Moderate, Aggressive), tax status (taxable, non-taxable), and liquidity preference (liquid, non-liquid), among other customizations.

Asset allocation is the primary determinant of long-run portfolio performance. SAAs also provide a reference point for tactical shifts based on short-term considerations, and are a starting point for financial planning analysis.

Below is an example of a Strategic Asset Allocation.

CMAs, SAAs for the financial planning process

Understanding both Capital Market Assumptions (CMAs) and Strategic Asset Allocations (SAAs) are important for investors because of the following:

Setting Realistic Goals: Building the appropriate foundation can help investors understand what kind of returns they can reasonably expect over the long term. This prevents unrealistic expectations and aligns investment strategies with financial goals. It also keeps investors committed to their financial plan, or change it based on new circumstances, because the range of outcomes have been quantified and adjusted over time based on prevailing market conditions.

Portfolio Construction: By understanding how different asset classes are likely to perform and interact with one another (hello diversification!), investors can design diversified portfolios that balance risk and return in line with their risk tolerance and objectives.

Risk Management: CMAs highlight the potential volatility and downside risks of investments, allowing investors to plan for market fluctuations and avoid concentration issues, liquidity shortfalls, and overexposure to risky assets.

Goal Analysis: For goals like retirement, education funding, or major purchases, these frameworks are necessary for estimating how much to save and invest today to meet future needs along different timelines and can be adjusted based on life changes.

Sources: Goldman Sachs, Ned Davis Research, Vanguard, UBS

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures at the Sandbox Financial Partners website: