Bullish engulfing pattern, plus Coca-Cola, tech arms race, market broadens, and the week in review

The Sandbox Daily (3.3.2023)

Welcome, Sandbox friends.

Today’s Daily discusses:

bullish engulfing pattern for the S&P 500

Coca-Cola’s secret sauce

U.S.-China relations and a new study on the technology arms race

broadening of the market creates more opportunities for stock selection

a brief recap to snapshot the week in markets

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 +2.04% | S&P 500 +1.61% | Russell 2000 +1.35% | Dow +1.17%

FIXED INCOME: Barclays Agg Bond +0.79% | High Yield +1.03% | 2yr UST 4.861% | 10yr UST 3.958%

COMMODITIES: Brent Crude +1.44% to $85.97/barrel. Gold +1.14% to $1,861.4/oz.

BITCOIN: -5.25% to $22,251

US DOLLAR INDEX: -0.45% to 104.553

CBOE EQUITY PUT/CALL RATIO: 0.81

VIX: -5.62% to 18.49

Quote of the day

“The reason that capital markets are, have always been, and will always be inefficient is not because of a shortage of timely information, the lack of analytical tools, or inadequate capital. The internet will not make the market efficient, even though it makes far more information available at everyone's fingertips, faster than ever before. Markets are inefficient because of human nature – innate, deep-rooted, and permanent. People do not consciously choose to invest according to their emotions – they simply cannot help it.”

- Seth Klarman, The Baupost Group

Bullish engulfing pattern

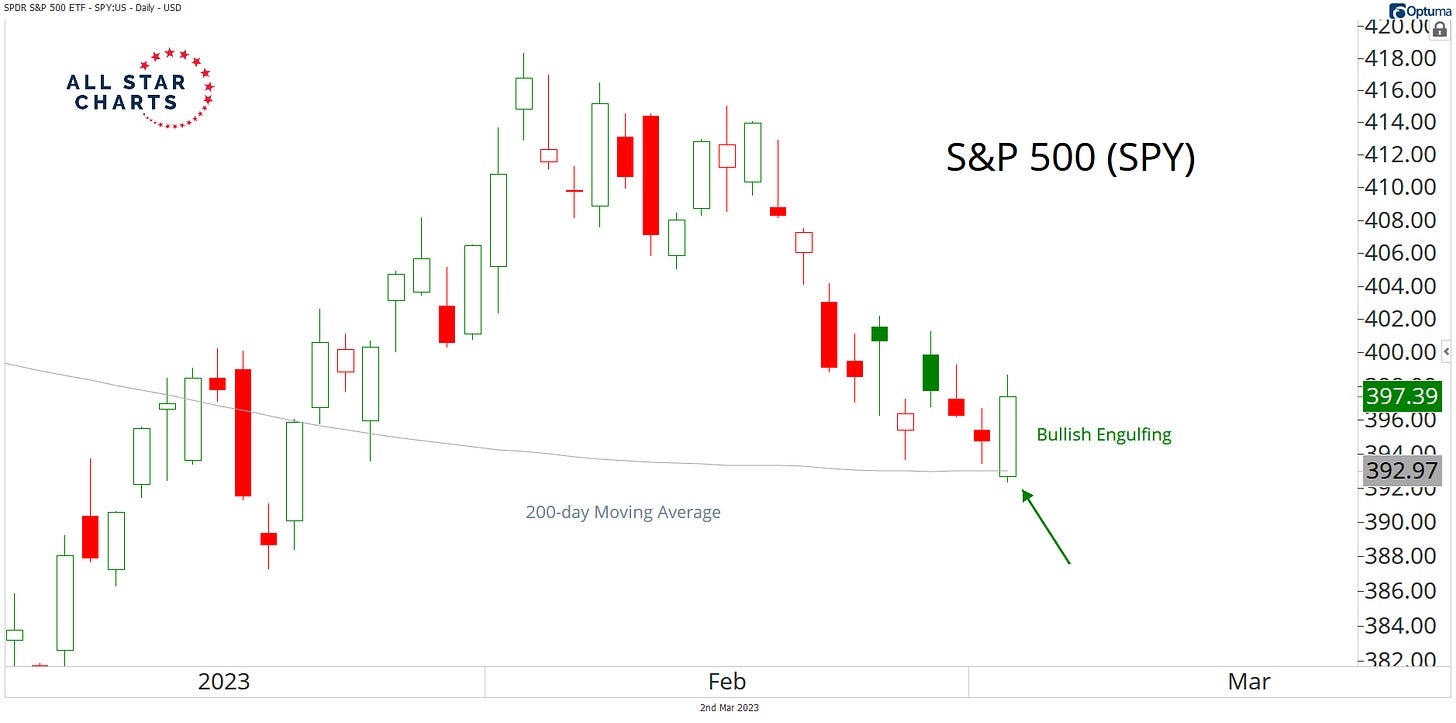

A bullish engulfing pattern occurs when the trading range for a given session completely engulfs that of the prior session, with price closing higher.

It means price made new lows on the day, but recovered to make new highs, closing above both the prior day’s opening and closing price. Here’s what it looks like, using yesterday’s daily candlestick chart in the S&P 500 as an example:

For a bullish engulfing candlestick pattern to fully complete, there needs to be upside follow-through in the subsequent session, or another green candlestick today – which is precisely what the market delivered today.

This could provide solid evidence that a tradeable low is in for stocks following the corrective action we witnessed in February. It could make sense for the recent selloff to halt and for a new leg higher to kick off at the 200-day moving average.

Source: All Star Charts

Coca-Cola’s secret sauce

Coca-Cola (KO) has been one of the better performing large-cap consumer staple companies across decades.

It’s dividend durability – KO is a dividend aristocrat as evidenced by its 60 consecutive years of dividend growth – is one reason why famed investor Warren Buffett loves the stock.

In Berkshire Hathaway’s recently published annual shareholder letter, Warren discusses the history, background, and investment thesis of many companies and investments across their vast portfolio, including Coca-Cola.

The durability of Coca-Cola’s moat – efficient scale, cost advantages, network effects, intangible assets, branding, and of course its highly-coveted secret sauce patent – provides a competitive advantage in the beverage industry that few other companies can ever hope to achieve in their respective industry. This has generated tremendous free cash flow which Coca-Cola has generously returned to its shareholders over the years.

Warren once quipped about the brand, “If you gave me $100 billion and said take away the soft drink leadership of Coca-Cola in the world, I'd give it back to you and say it can't be done.”

In August 1994, Berkshire completed a seven-year purchase of the 400 million shares it still owns today. Here is what Warren’s quick recount on Coca-Cola and its dividend:

The cash dividend we received from Coke in 1994 was $75 million. By 2022, the dividend had increased to $704 million. Growth occurred every year, just as certain as birthdays. All Charlie and I were required to do was cash Coke’s quarterly dividend checks. We expect that those checks are highly likely to grow.

That is the power of patience, discipline, and compounding over the course of 28 years!

Source: Genuine Impact

U.S.-China relations

As tensions continue to flare up between policymakers of the United States government and the People’s Republic of China, investors and business leaders have growing concerns about geopolitical tensions that could result in major economic ramifications.

Now this: a recent study by the Australian Strategic Policy Institute showed that China has a stunning lead in 37 of 44 critical and emerging technologies.

The Chinese Academy of Sciences, a government research body, ranked first or second in most of the 44 technologies tracked, which spanned defense, space, robotics, energy, the environment, biotechnology, artificial intelligence (AI), advanced materials, and quantum technology.

China first overtook the United States in annual patent filings in 2011, and in 2021 its count was well over twice the U.S.’s, at 1.58 million, according to the World Intellectual Property Organization, a United Nations agency.

The report notes that no other nation is close to China and the United States in the research race.

“In the long term, China’s leading research position means that it has set itself up to excel not just in current technological development in almost all sectors, but in future technologies that don’t yet exist,” ASPI concludes.

Source: Goldman Sachs, Australian Strategic Policy Institute (ASPI), Wall Street Journal

A broadening market creates wider opportunities for stock selection

Stocks were hit hard in last year’s downturn, and as investors reprice valuation based on higher interest rates and a less favorable macro backdrop, the changing contours of the market mean we can capture a broader array of recovery candidates while incurring less benchmark risk.

New leaders will emerge in the next bull market so increased selectivity is essential to identify those businesses with robust long-term growth prospects in an environment of structurally higher inflation and interest rates.

As Alliance Bernstein states: “portfolios seeking to capture future market leadership don’t have to rely on yesterday’s champions to drive tomorrow’s returns.”

Source: Alliance Bernstein

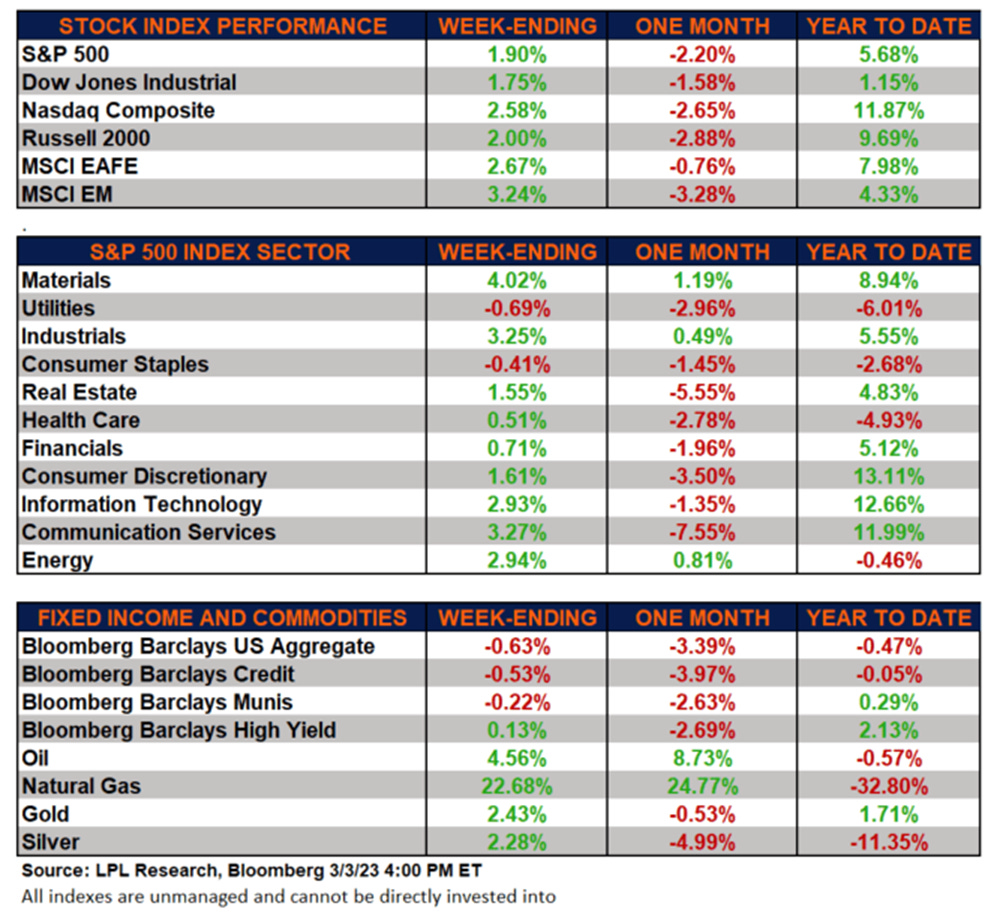

The week in review

Talk of the tape: The recent narrative seems to indicate the path of least resistance is to tilt lower for stocks on the meaningful rate repricing seen over the last month or so – driven by a hotter labor market, consumption, and inflation data. Bears are focused on earnings/margin risk, valuation, and geopolitical risk, along with negative flow and liquidity dynamics.

Several narratives continue to underpin softer landing scenarios, including the market moving back in line towards the Fed on policy expectations, corporate commentary not signaling a recession, and a tight labor market.

Stocks: Stocks ended the week higher, reversing three-straight consecutive weekly declines. Amid concerns over global price pressures and hawkish central bank monetary policy, investors added risk to portfolios. For the week ending March 1, the American Association of Individual Investors showed bearish sentiment increased to 44.8% from 38.6% in the prior week, marking the highest bearish percent reading since late 2022 and above the 31% historical average for the 61st time in the past 66 weeks.

Bonds: The Bloomberg Aggregate Bond Index finished the week in the red as yields increased for the fourth straight week. Bonds have been directly influenced by concerns over the general inflationary landscape as some traders believe the Federal Reserve will maintain its higher-for-longer policy. Treasury yields rose and the curve flattened as January Personal Consumption Expenditure (PCE) deflator data came in notably hotter-than-expected. The 2-year Treasury yield followed Fed terminal rate pricing higher, rising 0.20% to 4.81%.

Commodities: Energy prices finished higher this week even as traders grew concerned that the Fed will not pivot on monetary policy given the recent inflation data. The major precious metals, gold and silver, also ended the week higher after facing concerns over future economic growth.

Source: Dwyer Strategy, LPL Research

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.