Bullish signals are everywhere, plus improving economic data, small caps, and 2020s tech vs. 2000s tech

The Sandbox Daily (10.2.2024)

Welcome, Sandbox friends.

Today’s Daily discusses:

bullish signals everywhere

better than we thought

one lever for small caps

comparing 2020s tech to 2000s tech

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 +0.15% | Dow +0.09% | S&P 500 +0.01% | Russell 2000 -0.09%

FIXED INCOME: Barclays Agg Bond -0.21% | High Yield +0.01% | 2yr UST 3.641% | 10yr UST 3.783%

COMMODITIES: Brent Crude +1.59% to $74.72/barrel. Gold -0.35% to $2,681.1/oz.

BITCOIN: +0.11% to $60,787

US DOLLAR INDEX: +0.42% to 101.617

CBOE EQUITY PUT/CALL RATIO: 0.55

VIX: -1.87% to 18.90

Quote of the day

“Wisdom begins in wonder.”

- Socrates

Open your eyes: bullish signals are everywhere

One question I often hear is: does the market have legs to continue higher from here?

As is often the case, let’s look to history as a guide.

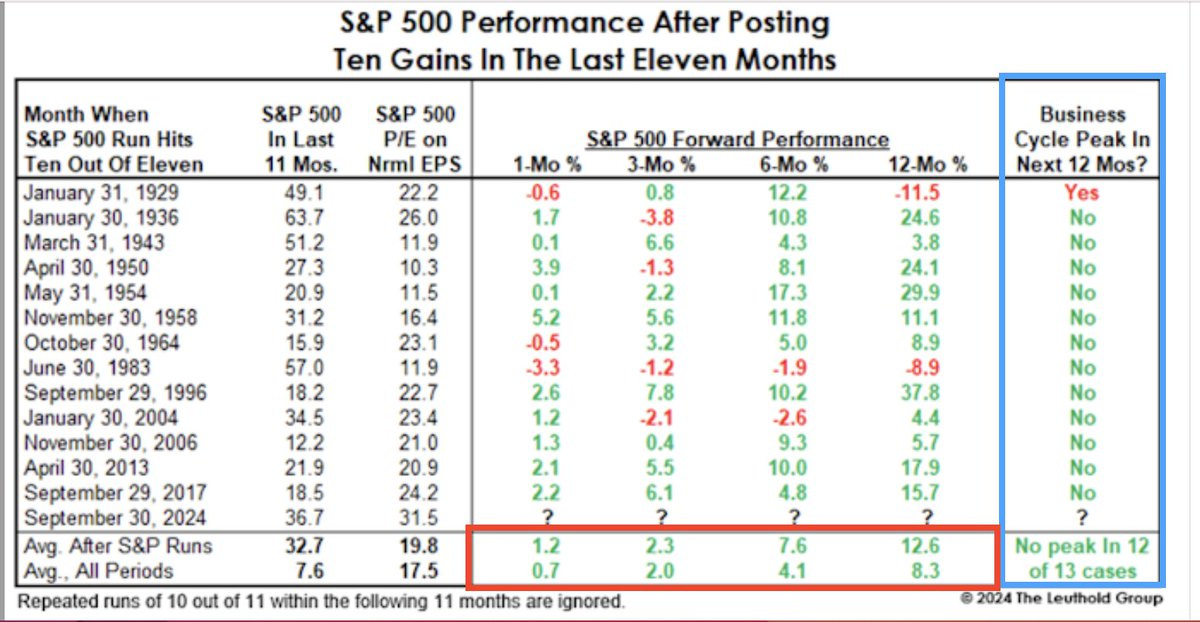

The S&P 500 has posted a positive return in 10 of the last 11 months. That’s only the 14th time over the last century.

The market was higher twelve months later 11 of 13 times for an average gain of +12.6%, better than the average of +8.3.

What’s more? 1929 was the last – and only – time a recession began within 12 months after a stock market run like this.

The market is awash in bullish signals as the post-covid economy continues to defy its greatest skeptics.

Source: Seth Golden

Better than we thought

The Citigroup Economic Surprise Index – a widely followed indicator that provides a quick-and-dirty snapshot of how the economy is faring against expectations – has just nosed above the zero line and crossed back into positive territory.

Surprise indexes show how economic data compares with consensus analyst expectations. Higher numbers mean data has been better than expected; lower numbers, worse.

Recently, this index has reversed course and started turning higher after a year-long string of net misses on aggregate that dated back to late July 2023.

This tells me the U.S. economy is stronger than forecasts and working its way through short-term periods of intense growth scares, like the episodes in both early August and early September.

Source: Kevin Gordon

One lever for small caps

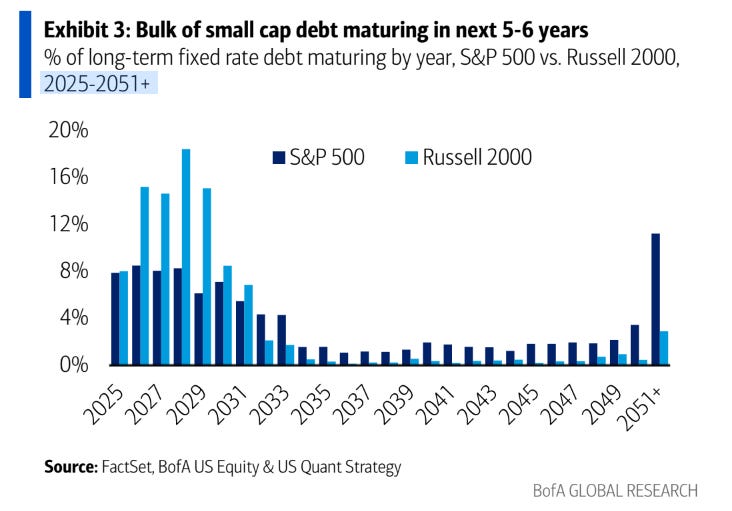

Falling rates and healthy credit environments are robust positive tailwinds for small cap companies needing to refinance.

Small cap liabilities tend to be front-end loaded to maturities happening over the next five years, versus large cap companies who are able to spread their liabilities out over much, much longer time frames.

Source: Mike Zaccardi, CFA, CMT

Comparing 2020s tech to 2000s tech

Could the current AI-fueled tech environment face the same demise of the 2000s tech bubble?

Maybe, maybe not.

Only time will tell.

However, this overly simplified graphic from Visual Capitalist quickly tells me two things: the Mag 7 tech stocks are much better businesses, with 1) nearly double the profit margins (28% vs. 16%), while 2) their valuations are half as rich (23.9x vs. 52.0x).

Not to mention these are diversified businesses, category leaders, household names (my 5-year-old daughter knows her iPad is made by Apple and Cybertrucks come from a place called Tesla), subscription-based revenue models, hoard billions of dollars of cash on their balance sheets, et al.

Source: Visual Capitalist

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures at the Sandbox Financial Partners website:

once again, a brief yet jam-packed post detailing info i wasn't privy to, many thx