Bulls outlast bears, plus frequency of market drops, climbing the wall of worry, and your priority pyramid

The Sandbox Daily (12.15.2023)

Welcome, Sandbox friends.

Today’s Daily discusses:

bulls outlast bears

frequency of market drops

markets climb the wall of worry

aligning your financial priorities

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 +0.52% | Dow +0.15% | S&P 500 -0.01% | Russell 2000 -0.77%

FIXED INCOME: Barclays Agg Bond -0.23% | High Yield -0.22% | 2yr UST 4.449% | 10yr UST 3.915%

COMMODITIES: Brent Crude +0.39% to $76.91/barrel. Gold -0.58% to $2,033.1/oz.

BITCOIN: -1.76% to $42,241

US DOLLAR INDEX: +0.63% to 102.603

CBOE EQUITY PUT/CALL RATIO: 0.55

VIX: -1.60% to 12.28

Quote of the day

“When a management with a reputation for brilliance tackles a business with a reputation for bad economics, it is the reputation of the business that remains intact.”

- Warren Buffett

Bulls outlast bears

Bull markets are greater in magnitude and longer in length than their bear market counterparts.

Since 1926, the average bull market lasts 8.9 years and has an average cumulative total return of +468%, while the average bear market lasts 1.4 years with an average cumulative loss of -41%.

This chart illustrates that profound truism, showing each bull and bear market since 1950.

Source: YCharts, Raymond James

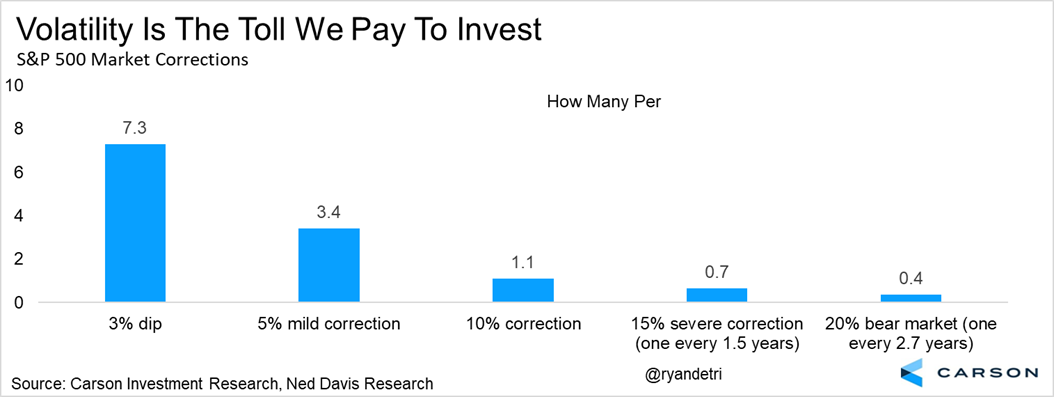

Frequency of market drops

As investors in stocks, volatility is the price we all pay to participate in the market.

Sometimes the ride isn’t always the easiest, but that patience to endure difficult markets allows investors to avoid making costly mistakes at the worst time.

Setting the right expectations when investing in public equities is critically important to your long-term success. In that vein, here is what you should expect on average from the S&P 500:

each year sees more than 7 different 3% dips

stocks correct 5% more than 3 times a year do

about once a year on average sees a 10% correction

a 15% major correction happens every year-and-a-half

20% bear markets happen about every three years

Do yourself a favor and save this chart for perpetuity. When the next market drawdown comes, you will be mentally ready for it.

Source: Carson Investment Research

Markets climb the wall of worry

Markets are always climbing the wall of worry.

This year, it was the commercial real estate meltdown fears, air coming out of the housing market, a possible government shutdown, the recession, bank runs/bank failures, geopolitical wars, and the AI robots coming for our jobs.

There is always a reason to sell.

Source: Barry Ritholtz

Aligning your financial priorities

"Make sure you're not geeking out about small-bore investment problems while giving short shrift to the game-changers."

Morningstar’s Christine Benz makes a good point.

There are so many facets to personal finance that it can be easy focusing on decisions that, at the end of the day, won't have any significant impact, while simultaneously overlooking topics that carry much more weight.

That's why it’s important to review a pyramid such as the one below that illustrates the order of priorities, with the foundation being the most substantial.

Perhaps your financial pyramid assumes a different order and that’s ok – prioritize what works best for you because every household and situation is different.

Source: Morningstar

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.