Car prices could offload inflationary pressures, plus cash and 🧁 weekend sprinkles 🧁

The Sandbox Daily (6.21.2024)

Welcome, Sandbox friends.

Happy Summer Friday !!!

Today’s Daily discusses:

car prices could help offload inflationary pressures

cash isn’t always king

🧁 weekend sprinkles 🧁

Let’s dig in.

Markets in review

EQUITIES: Russell 2000 +0.23% | Dow +0.04% | S&P 500 -0.16% | Nasdaq 100 -0.26%

FIXED INCOME: Barclays Agg Bond +0.01% | High Yield +0.12% | 2yr UST 4.732% | 10yr UST 4.255%

COMMODITIES: Brent Crude -0.68% to $85.13/barrel. Gold -1.44% to $2,334.8/oz.

BITCOIN: -1.09% to $64,282

US DOLLAR INDEX: +0.20% to 105.798

CBOE EQUITY PUT/CALL RATIO: 0.62

VIX: -0.60% to 13.20

Quote of the day

“When you have tremendous conviction on a trade, you have to go for the jugular. It takes courage to be a pig.”

- Stanley Druckenmiller, Duquesne Capital

Car prices could help offload inflationary pressures

Fundstrat estimates that auto-related components (cars, insurance, etc.) is 17% of the core inflation basket, or “Core CPI.”

Perhaps more startling, autos represent 31% of all core inflation since 2019.

As investors continue looking for incremental developments on inflation and how that impacts the Federal Reserve and forward guidance on monetary policy, autos are a good place to start.

New car inventory has surged back to pre-pandemic levels as auto production has improved and consumer demand has softened. In fact, as recent reporting highlights, Ford now has 100 days’ supply of cars – which is a lot for any manufacturer.

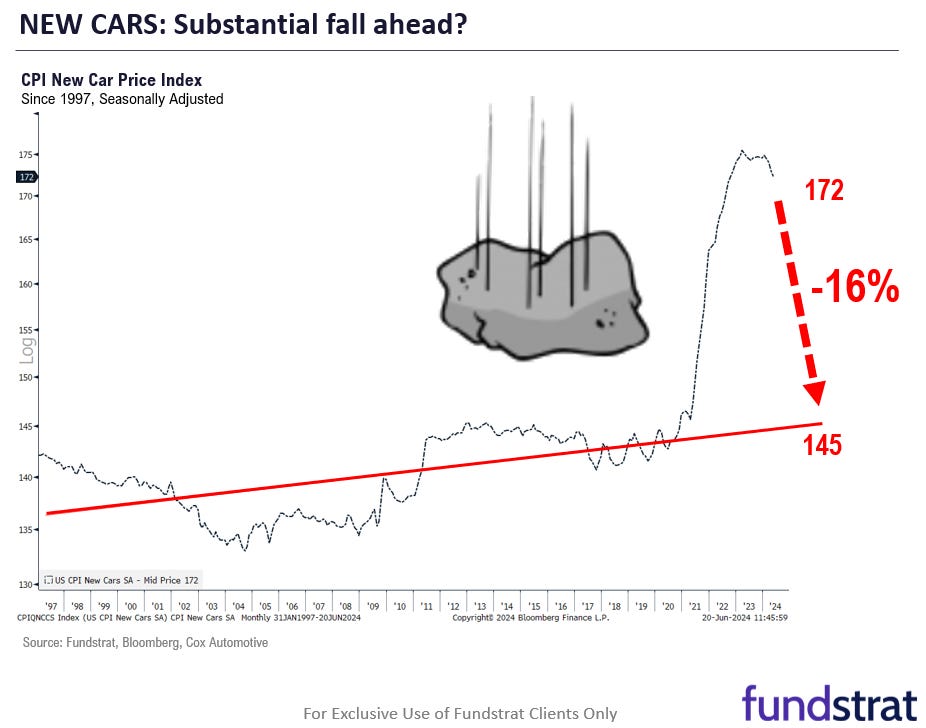

New car prices surged 20% from 2021 to 2023 after stagnating from the mid-1990s to the pandemic, but these recent developments – higher inventories, stalling consumer demand, skyrocketing insurance impacting affordability – should help relieve pressure on new car prices.

If new car prices fall back to its 50-year trend, the decline in prices could be significant. See below.

And it’s not just new cars.

Used car prices are already down ~10% from their peak in 2023, with more room to go before catching down to its long-term trend.

This suggests that the 2nd largest CPI component (autos) is set to see substantial deflation ahead.

Source: Fundstrat Macro Minute, Car Dealership Guy

Cash has an opportunity cost

Cash isn’t always king and there may be better opportunities, depending of course on circumstances, risk tolerance, and time horizon.

In 2022, the Federal Reserve began raising interest rates more aggressively than at any point in decades. As a results, for the 1st time in many years, cash appears to be a worthwhile “investment.” After all, who doesn’t love earning 5% on their cash?

We also acknowledge how critical having cash on hand for day-to-day expenses as well as an emergency fund, in case of job loss or unexpected large-ticket expenses, is to an important part of financial well-being and peace-of-mind.

That said, it’s also important to consider the opportunity cost of holding too much cash. Throughout history, peak cash yields have not persisted and returns from other fixed income instruments and the stock market have typically outpaced the return on cash. In other words, while cash is an important part of any portfolio, excess cash should be deployed into the market.

Source: J.P. Morgan Guide to the Markets

🧁 Weekend sprinkles 🧁

Here are the ideas, sights, and sounds that caught my attention this week – perfect for quiet time over the weekend.

Blogs

Global Financial Data – 200 years of market concentration (Dr. Bryan Taylor)

Money Visuals – What drives portfolio returns vs. what investors focus on (Ashby Daniels)

Yahoo! Finance – Why the Fed might need to ‘get on with it’ (Josh Schafer)

Wall Street Journal – More Munger (Jazon Zweig)

Federal Reserve – A faster convergence of shelter prices and market rent (Chris Cotton)

Podcasts

New Hampshire Public Radio – Bear Brook: A True Crime Story (Spotify, Apple Podcasts)

Trends with Friends feat. Ryan Detrick – Asset Allocation, Momentum Trading, and Resilient Portfolios (Spotify, Apple Podcasts, YouTube)

RenMac Off-Script – The Fed Needs To Get On With It (Spotify, Apple Podcasts)

Movies

The Debt – Helen Mirren, Sam Worthington, Jessica Chastain, Marton Csokas, Tom Wilkinson (IMDB, YouTube)

Den of Thieves – Gerard Butler, Pablo Schreiber, O’Shea Jackson Jr, 50 Cent (IMDB, YouTube)

Music

311 – Love Song (Spotify, Apple Music)

The Expendables – Bowl for Two (Spotify, Apple Music)

Cold War Kids – Lost That Easy (Spotify, Apple Music)

daydreamers – Beach House (Spotify, Apple Music)

Pop Culture

I’m looking for a man in finance (TikTok)

Kobe Bryant on tearing his Achilles tendon and the Mamba mentality (Bleacher Report)

Books

Kyla Scanlon – In This Economy? (Amazon)

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.