Cash in 2024, plus Gallup poll on inflation, credit spreads, and key Fed lending survey

The Sandbox Daily (5.6.2024)

Welcome, Sandbox friends.

Today’s Daily discusses:

what to make of cash in 2024

Gallup poll shows inflation still the #1 problem

credit fears remain subdued

lending conditions remain restricted

Let’s dig in.

Markets in review

EQUITIES: Russell 2000 +1.23% | Nasdaq 100 +1.13% | S&P 500 +1.03% | Dow +0.46%

FIXED INCOME: Barclays Agg Bond +0.07% | High Yield +0.12% | 2yr UST 4.833% | 10yr UST 4.487%

COMMODITIES: Brent Crude +0.69% to $83.53/barrel. Gold +1.10% to $2,334.1/oz.

BITCOIN: -1.03% to $63,562

US DOLLAR INDEX: +0.06% to 105.091

CBOE EQUITY PUT/CALL RATIO: 0.60

VIX: 0.00% to 13.49

Quote of the day

“The maturation of every investor starts with absorbing almost everything and ends with filtering almost everything.”

- Ian Cassel

What to make of cash in 2024

In times of market uncertainty, investors often seek the safety of cash – and, more specifically, the U.S. dollar. This has been no truer than the past several years as markets have swung wildly from the COVID-19 pandemic, geopolitical events, synchronized rate hikes from central banks around the world, inflation, gridlock in Washington, and more. More recently, the possibility of worse-than-expected inflation and a delay of the 1st Fed rate cut have led to renewed investor concerns. At the same time, interest rates on cash are at their highest levels in decades, making these “risk-free” returns quite attractive – especially for savers and retirees.

After over a decade of historically low interest rates, higher cash yields are a welcome development for many investors. Interest rates are higher across all cash instruments including many savings accounts, certificates of deposit, and money market funds, to name a few.

These dynamics have led many investors to hold more cash than in the past. Money market funds, for instance, have attracted inflows with total assets reaching new all-time highs of $6 trillion+. This is more than double the assets held in money market funds prior to the pandemic when interest rates were near zero for the better part of a decade. As the chart below shows, money market fund assets have typically grown in times of economic distress or when interest rates have been high.

Cash is an essential part of any financial and investment plan. From a financial planning perspective, cash provides the liquidity needed to cover expenses and important life events. Similarly, it's critically important to have enough cash to serve as an emergency fund in case of unexpected personal events such as job loss or injury or broader macro events like an economic downturn. From an investment standpoint, cash can also serve important roles including reducing overall portfolio risk and by allowing investors to take advantage of attractive market prices.

Source: Clearnomics

Americans label “inflation” as top financial problem

For the 3rd year in a row, the share of Americans naming inflation or the high cost of living as the most important financial problem facing their family has reached a new high.

The 41% affirming inflation this year is up slightly from 35% a year ago and 32% in 2022. Before 2022, the highest percentage mentioning inflation was 18% in 2008.

Source: Gallup

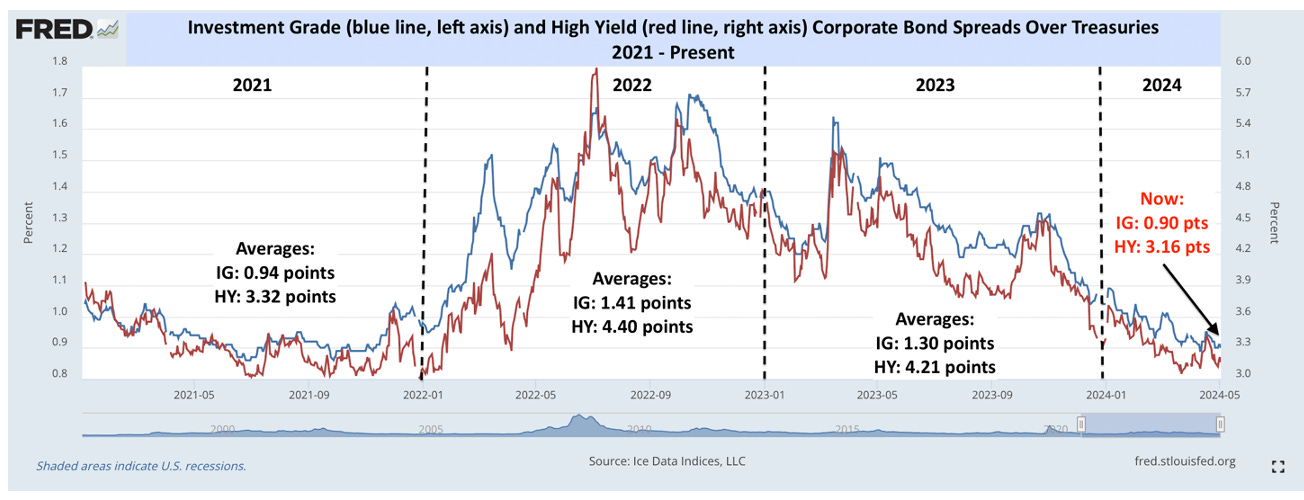

Credit fears remain subdued

The bond market had itself a very productive week.

Treasury yields posted their 1st weekly decline in over a month, while spreads were rangebound-to-lower – consistent with recent cyclical trends, see below – following less hawkish-than-expected remarks from Fed Chair Powell and a softer-than-expected April nonfarm payrolls report.

We also learned the Fed balance sheet runoff caps were reduced for U.S. Treasuries from $60B per month down to $25B, which is incrementally positive for liquidity.

The quarterly refunding announcement from the Treasury Department – typically a mundane statement of how the government plans to finance itself but has gained attention in the last year due to the rapid run-up in interest rates – came largely in line with expectations. This week’s refunding auctions present bearish risks and it will be tough for yields to follow through lower unless April inflation data validates this more dovish implied Fed policy path.

Despite choppy equity markets over the last couple months, U.S. corporate bond spreads (Investment Grade and High Yield) are very close to 15 years lows. On one hand, that’s comforting – no recession or perceived credit event around the corner. On the other hand, it’s also a bit concerning – excessive confidence in the status quo and rising risk of complacency.

As a reminder, the difference between risk-free Treasury yields and those for any other bond is called a “spread”. In the case of corporate bonds, when spreads rise/fall it signals growing/lessening concern about future economic growth.

Source: Brown Technical Insights, St. Louis Fed, DataTrek Research

Lending standards remain restricted

The Fed’s Senior Loan Officer Opinion Survey (SLOOS) on bank lending practices from Q1 showed that banks reported tighter standards amid weaker demand for commercial and industrial (C&I) loans as well as for all commercial real estate (CRE) loan categories. But we’re past peak tightening, as shares of banks tightening standards fell from the prior survey, which should be good for markets and the economy.

SLOOS is an important report because it addresses changes in the standards and terms on, and demand for, bank loans to businesses and households.

Additionally, banks reported tighter standards, tougher terms, and weaker demand for consumer loans, including credit cards and autos.

“A significant net share of banks reported increasing minimum credit score requirements for credit card loans, while moderate net shares of banks reported doing so for auto loans and other consumer loans,” the Fed said.

Source: Federal Reserve, Ned Davis Research

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.